Strive’s $675 million purchase of 5,816 BTC and its all-stock merger with Semler Scientific creates a combined treasury of ~10,900 BTC, making the merged Strive–Semler entity one of the top 15 public corporate Bitcoin holders and a major player in the digital-asset treasury space.

-

Strive bought 5,816 BTC for ~$675 million, raising its holdings to 5,886 BTC

-

Semler contributes ~5,040 BTC via its treasury, producing a combined total of ~10,900 BTC.

-

Combined company ranks among the 12th-largest public Bitcoin holders; industry data and Standard Chartered analysis cited.

Strive Bitcoin treasury: Strive’s $675M BTC buy and Semler merger create a ~10,900 BTC treasury — read the details and implications for crypto treasuries.

Strive’s $675 million Bitcoin purchase plus its all-stock merger with Semler Scientific yields roughly 10,900 BTC, positioning the combined firm among the largest corporate Bitcoin holders.

What is the Strive–Semler merger and how much Bitcoin does the combined company hold?

The Strive–Semler merger is an all-stock transaction in which Strive Inc. acquires Semler Scientific, and the combined company now controls approximately 10,900 BTC. Strive disclosed a purchase of 5,816 BTC for about $675 million, increasing its total to 5,886 BTC before adding Semler’s holdings.

Strive, led by Vivek Ramaswamy, executed an all-stock exchange that grants each Semler share 21.05 shares of Strive Class A stock — a roughly 210% premium to Semler’s pre-deal price.

Source: Strive

Source: Strive

How did Strive build its Bitcoin treasury and what changed after the purchase?

Strive outlined its Bitcoin treasury strategy publicly in May during its reverse-merger process. The latest purchase of 5,816 BTC for ~$675 million boosted Strive from 70 BTC to 5,886 BTC, before folding in Semler’s existing holdings to reach roughly 10,900 BTC.

Why does the deal matter for the crypto treasury industry?

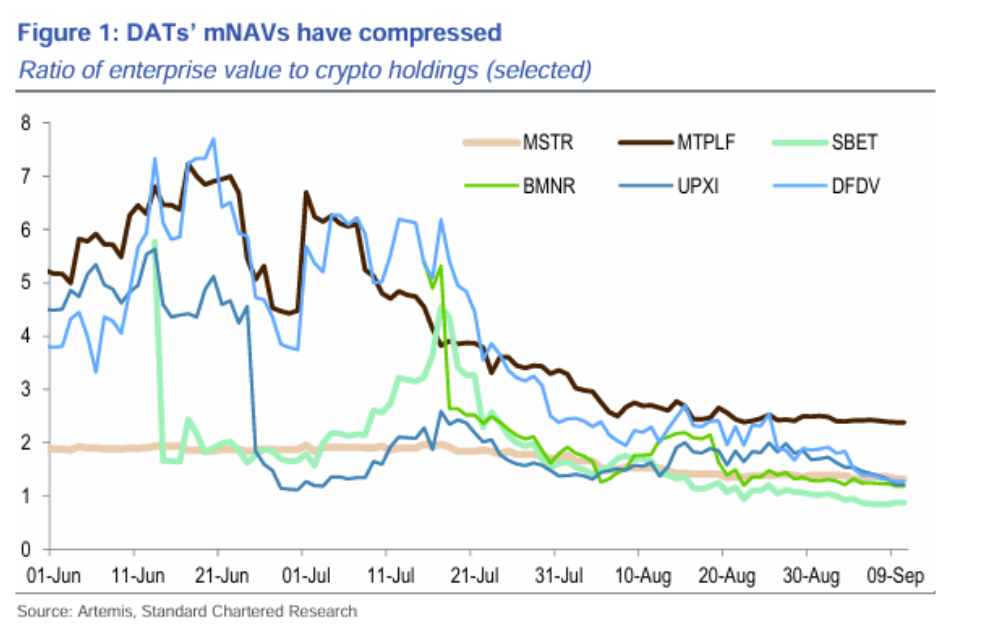

The merger highlights consolidation within digital-asset treasury companies at a time when market net asset values (mNAVs) have compressed. Standard Chartered has noted that compressed mNAVs make expansion harder and can increase financial risk for companies funding growth with leverage.

The mNAV of digital asset treasury companies has compressed since June: Standard Chartered

The mNAV of digital asset treasury companies has compressed since June: Standard Chartered

Under compressed mNAVs, larger, more liquid firms are better positioned to acquire smaller or weaker competitors. Industry voices emphasize that sustainable treasury management — not simply asset accumulation — will determine which firms survive.

HashKey Capital CEO Deng Chao warned that only crypto treasury companies with long-term strategies will “survive any market,” adding that “digital assets themselves are not inherently unsustainable; it is how they are managed that makes the difference.”

Frequently Asked Questions

How many BTC did Strive buy and at what cost?

Strive purchased 5,816 BTC for approximately $675 million, raising its total BTC holdings to 5,886 before combining with Semler’s reserves to reach ~10,900 BTC.

What does Semler bring to the combined company?

Semler Scientific had established Bitcoin as its primary treasury reserve and added several purchases to its balance. Its recent financials show a 43% year-over-year revenue decline but a net income of $66.9 million.

Key Takeaways

- Major BTC purchase: Strive bought 5,816 BTC (~$675M), increasing its reserves sharply.

- Merged treasury scale: Combined Strive–Semler controls about 10,900 BTC, ranking it among the largest public holders.

- Industry implication: Compressed mNAVs may drive consolidation; only firms with long-term strategies are likely to endure.

Conclusion

The Strive purchase and Semler merger create a sizable Bitcoin treasury company holding approximately 10,900 BTC, with implications for consolidation among digital-asset treasurers. Market net asset value compression and capital access will shape future M&A; stakeholders should watch liquidity and governance as indicators of long-term viability. For ongoing coverage and data, COINOTAG will monitor filings and official company disclosures.