House lawmakers urge SEC to implement Trump’s crypto 401k executive order

Nine House Financial Services Committee members sent a letter to SEC Chairman Paul Atkins on Sept. 22, urging swift implementation of President Donald Trump’s Aug. 7 executive order enabling cryptocurrency investments in 401(k) retirement plans.

The bipartisan coalition expressed support for expanding access to alternative assets to help 90 million Americans secure dignified retirement outcomes.

The Sept. 22 letter, led by Committee Chairman French Hill and Subcommittee on Capital Markets Chairman Ann Wagner, applauds the executive order’s policy:

“Every American preparing for retirement should have access to funds that include investments in alternative assets when the relevant plan fiduciary determines that such access provides an appropriate opportunity to enhance the net risk-adjusted returns.”

Congressional push for regulatory clarity

The lawmakers encouraged the SEC to swiftly assist the Department of Labor and make necessary revisions to current regulations and guidance regarding alternative asset access in participant-directed defined-contribution retirement savings plans.

The letter specifically requests the SEC review of bipartisan legislation concerning accredited investors advanced in the 119th Congress.

Trump’s executive order directs the Secretary of Labor to consult with the SEC to determine necessary parallel regulatory changes.

The order also instructs the SEC to facilitate alternative asset access by revising applicable regulations and guidance, potentially including consideration of accredited investor and qualified purchaser status modifications.

As of March 31, the defined-contribution market had assets of $12.2 trillion, with $8.7 trillion in 401(k) plans. Even modest default allocations could generate substantial crypto demand through systematic payroll contributions and employer matches.

A 0.1% default allocation across 10% of plans would produce $1.22 billion in crypto investment flows. Meanwhile, broader adoption scenarios suggest potential ranges from $15.3 billion at 0.5% defaults across 25% of plans to $61 billion if 1% defaults were implemented across half the market.

Implementation mechanics

The executive order builds on the Labor Department’s May 28 rescission of its 2022 crypto compliance release, which warned fiduciaries to exercise “extreme care” regarding crypto menu design.

Distribution will likely run through target date funds and collective investment trusts, where most participant dollars flow automatically.

The signatories include Representatives Frank Lucas, Warren Davidson, Marlin Stutzman, Andrew Garbarino, Michael Lawler, Troy Downing, and Mike Haridopolos. The letter was copied to Ranking Member Maxine Waters and Subcommittee Ranking Member Brad Sherman.

Implementation now depends on agency guidance, product filings, and recordkeeper integrations before plan committees can update investment policy statements to include cryptocurrency allocations.

The post House lawmakers urge SEC to implement Trump’s crypto 401k executive order appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

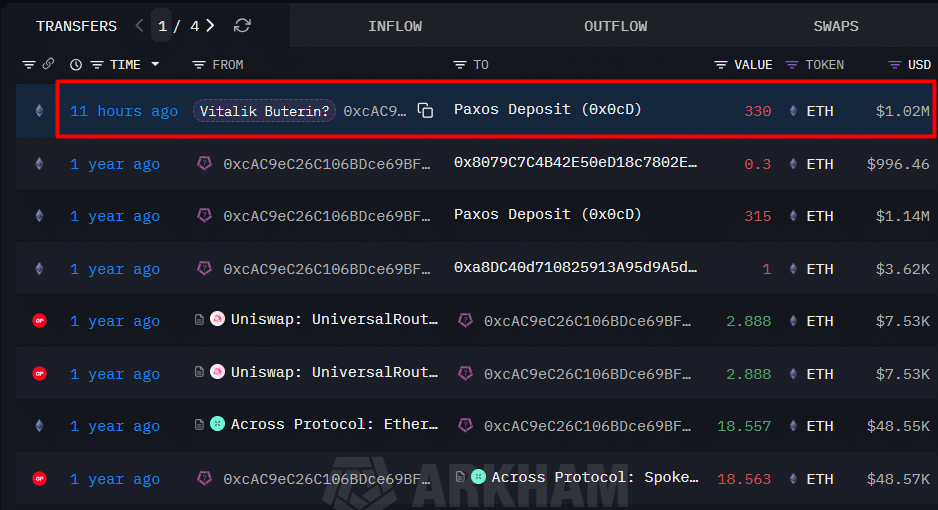

Ethereum locks 1mln as Vitalik Buterin warns of ‘corposlop’ – Identity crisis ahead?

'Shib Owes You': Shiba Inu Team Member Explains Shibarium Recovery Framework

XRP Ledger Amendments Getting Closer to Activation Timer, What's Coming?

Ripple at $40 Billion Valuation? John Deaton Says Haters Must Admit It Is Legendary