Greeks.live Researcher: ETH needs to hold the $4,000 level, or the options market may start pricing in a bear market

ChainCatcher news, Greeks.live macro researcher Adam posted on X, stating that ETH once fell below $4,000 during a sharp decline, breaking through multiple technical support levels.

After the plunge, the implied volatility of major contracts remained the same as before, but the skew was significantly tilted towards put options, with put contract prices noticeably higher than call options, indicating a sharp increase in market concerns about downside risks. There was no significant increase in options trading volume, and market makers' positions entered the gamma amplification range, with some market makers having already bought put options to hedge risks. Adam pointed out that if the $4,000 level is lost, the options market may face a bearish repricing; BTC's trend is relatively more stable, but ETH's technical indicators are more critical.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

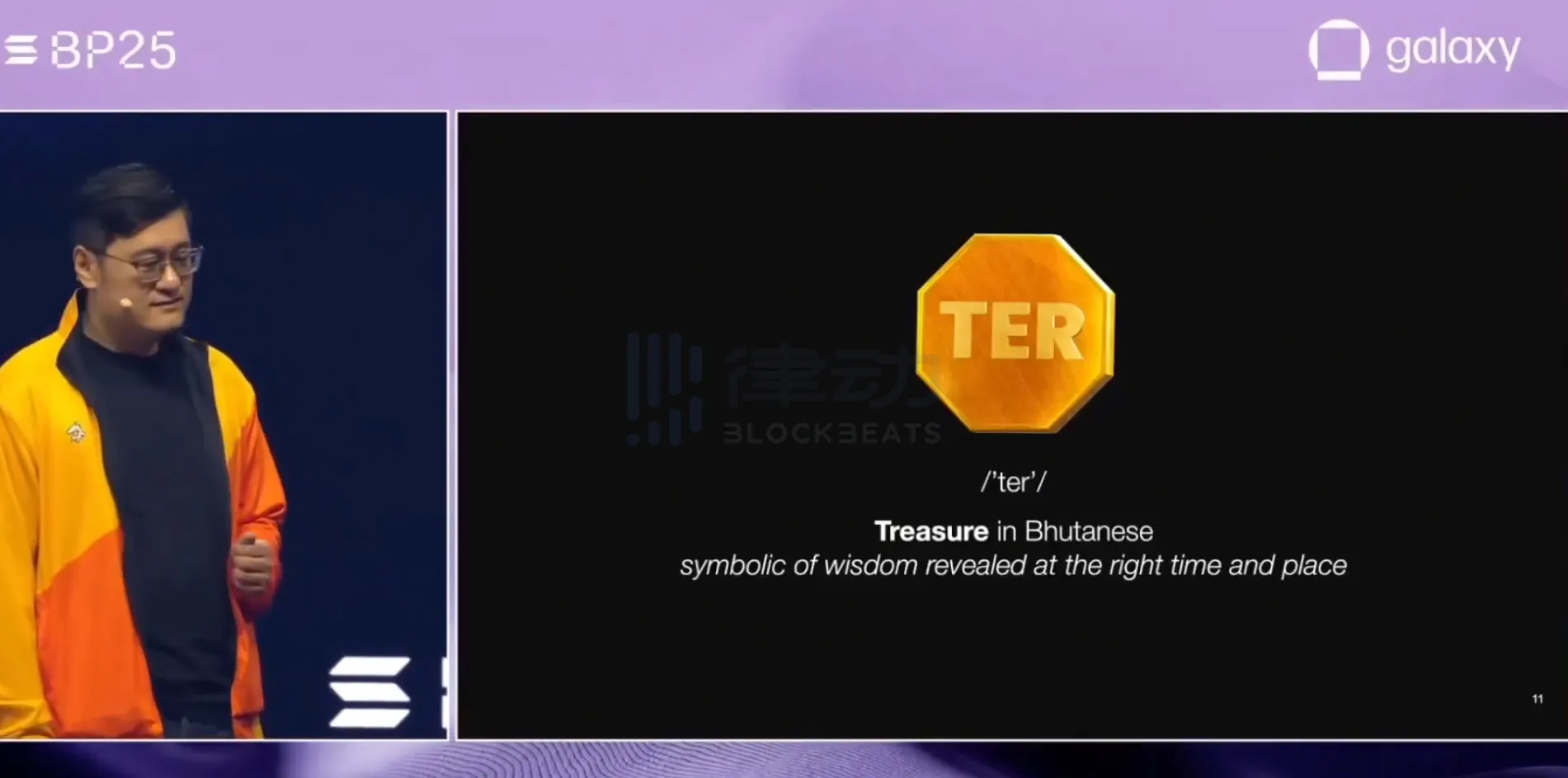

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network