Bitcoin Price Flash Crash: Buy the Dip or Brace for More Pain?

Bitcoin price experienced a sharp flash crash, dropping below $113,000. Is this an excellent buying opportunity, or could Bitcoin fall further before rebounding?

The price of $Bitcoin experienced a sudden flash crash, dropping to $112,620 after being rejected near a resistance level. This sharp sell-off has traders debating whether BTC is setting up for a buy-the-dip opportunity or warning of further downside. In the world of cryptocurrency, such volatility is not uncommon—volatility is part of the game.

Bitcoin Price Trend: Chart Signals

The attached chart shows that Bitcoin lost the $114,417 (50-day SMA) and fell toward the support area near $112,142–111,350. The RSI has dropped to 44, indicating neutral to bearish momentum. Key observations:

- Resistance Rejection: $BTC was rejected below $118,600, marking a strong ceiling.

- Support Retest: The current price is testing the key support band between $111K–112K.

- Moving Averages: 200-day SMA sits lower at $103,615, while the psychological $100K level serves as a major long-term support.

BTC/USD 1D Chart - TradingView

Bitcoin Price Prediction: Rebound or Further Decline?

- Bullish Scenario (Rebound Buying Opportunity): If BTC holds the $111K–112K support zone, it could quickly rebound to $115K, and possibly even reach $118K. For long-term holders, these dips are often solid buying opportunities.

- Bearish Scenario (Further Downside): If the support fails, BTC could extend its decline to $105K, with the next major psychological threshold at $100K. A break below this point would confirm a deeper correction.

Bitcoin News Background: Normal Volatility in Crypto

Flash crashes are nothing new in Bitcoin news. Due to its highly liquid yet sentiment-driven market, sudden swings are part of its DNA. Historically, Bitcoin has experienced sharp pullbacks before making larger upward moves. Long-term investors typically view such corrections as healthy resets that weed out weak-handed participants.

Bitcoin Price Remains in Focus in the Coming Weeks

Although the flash crash below $113K sparked panic, from a broader perspective, Bitcoin remains within its wider trading range. The coming days will be crucial to observe whether bulls can hold the support or if bears will push the price toward $105K and lower.

For now, traders should closely watch the $111K–112K support and the $118K resistance. Whether this crash turns into a rebound or a deeper sell-off, one thing is certain: Bitcoin news and Bitcoin price volatility remain at the center of the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

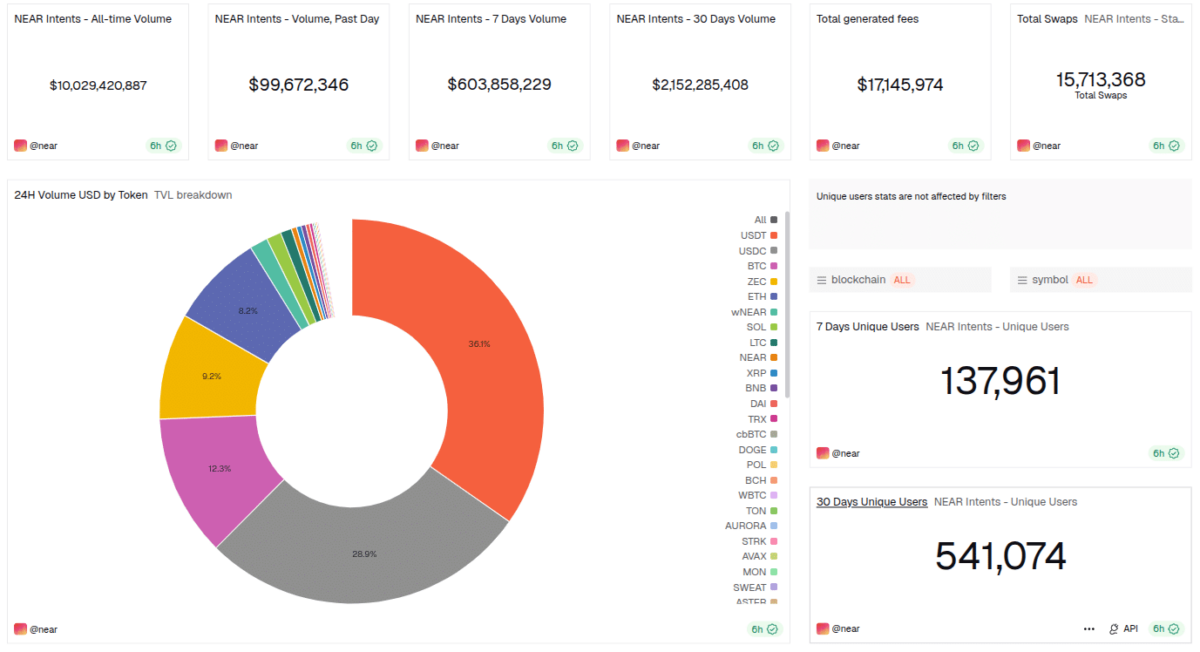

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund