The UXLink hack was a multisignature wallet breach that allowed an attacker to mint almost 10 trillion UXLINK tokens and convert a small portion to ETH, producing estimated losses of about $30 million. UXLink says exchanges froze a large portion of funds and will implement a token swap and fixed-supply contract.

-

Multisig breach enabled mass minting of UXLINK tokens

-

Attacker minted nearly 10 trillion UXLINK and swapped 9.95 trillion for ~16 ETH (~$67,000).

-

UXLink reports most stolen funds were frozen with exchange cooperation; a token swap and fixed-supply contract are planned.

UXLink hack: Multisig wallet breach led to 10 trillion UXLINK mint and ~$30M loss; exchanges froze funds. Read updates and token-swap guidance.

What happened in the UXLink multisig wallet breach?

The UXLink hack was a multisignature wallet compromise that allowed unauthorized minting of UXLINK tokens and the illicit transfer of assets. UXLink reported the incident, engaged exchanges to freeze suspicious deposits, and is coordinating with law enforcement and security partners to contain the impact.

How did the attacker mint nearly 10 trillion UXLINK tokens?

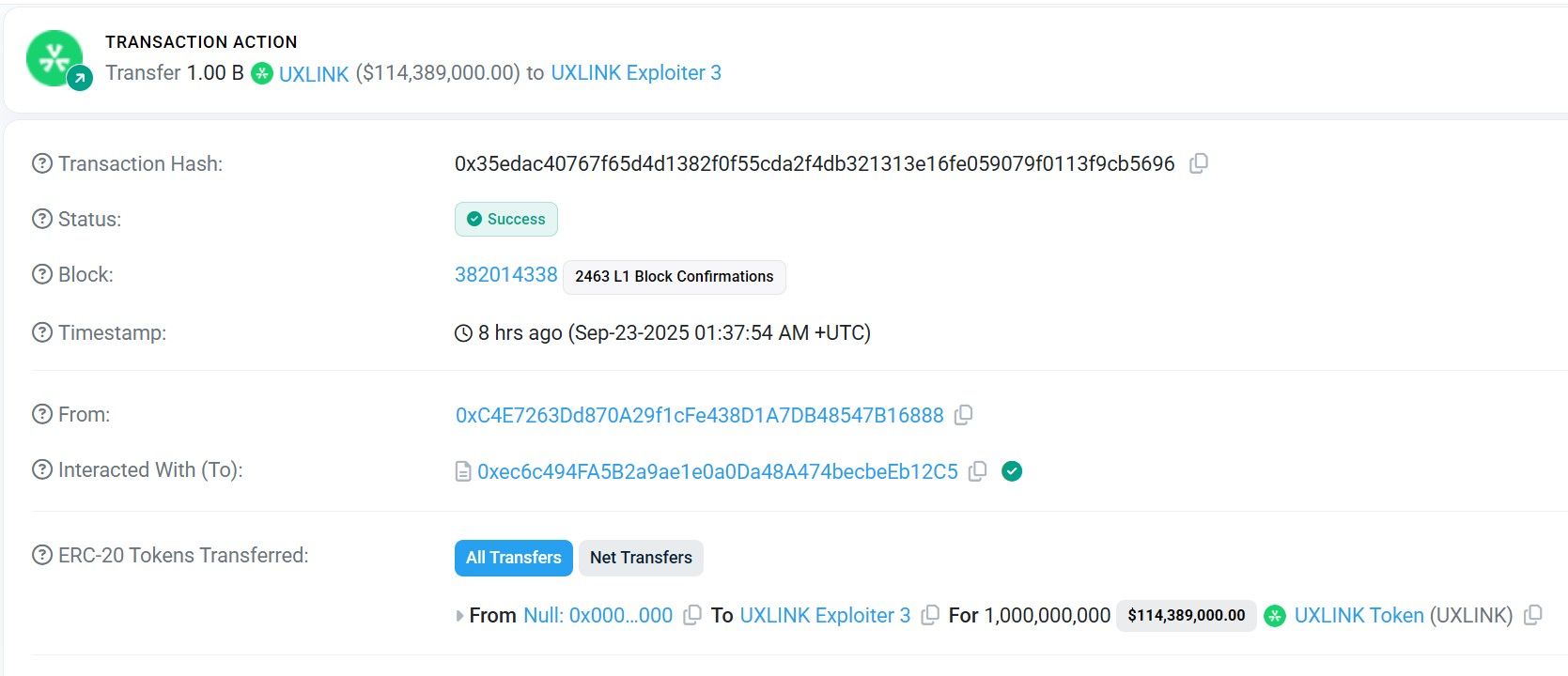

After gaining control of a multisig signing process, the attacker executed repeated mint transactions that produced billions and then trillions of UXLINK tokens. Blockchain security firms reported an initial 1 billion mint followed by continued minting, with on-chain analysis estimating almost 10 trillion tokens created in total.

Onchain investigators reported the attacker swapped 9.95 trillion UXLINK for roughly 16 ETH (about $67,000), while overall estimated losses exceed $30 million. Security observers named in on-chain reports include PeckShield, Hacken and Lookonchain (referenced as plain text sources).

Hacker mints 1 billion UXLINK tokens. Source: Etherscan

Why did UXLINK’s price crash and how severe was the market impact?

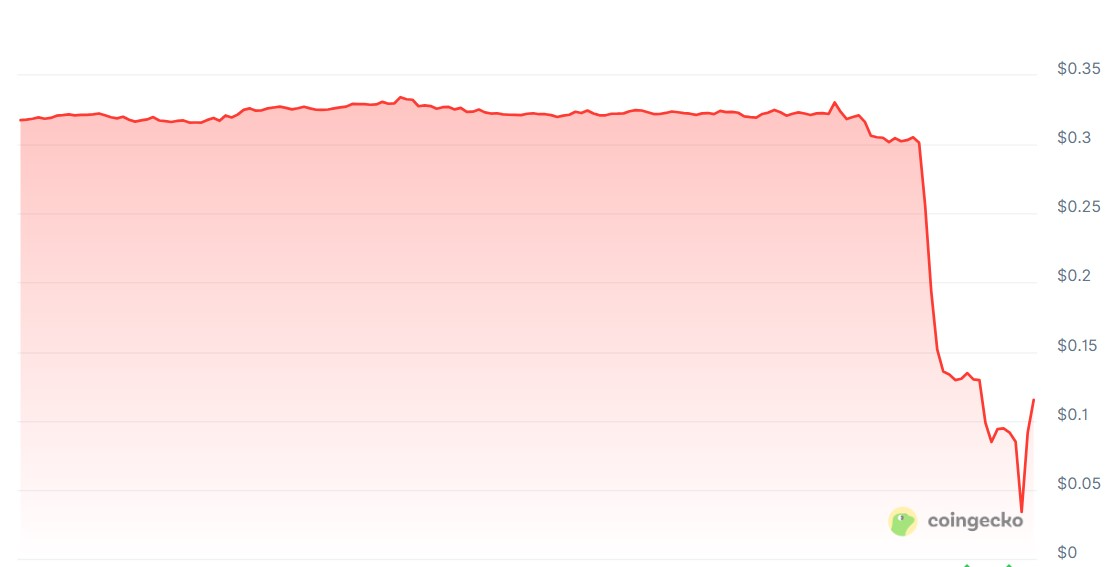

Price action reacted immediately: the UXLINK token plunged over 90%, falling from $0.33 to $0.033 before partially recovering to $0.11 at the time of reporting. Market participants were advised to avoid interacting with suspicious token contracts while exchanges investigated suspicious deposits.

On-chain analytics flagged an unusual phishing loss during the incident: while minting, the attacker reportedly lost more than 500 billion UXLINK through a separate phishing scam, adding an unexpected twist to the attack timeline.

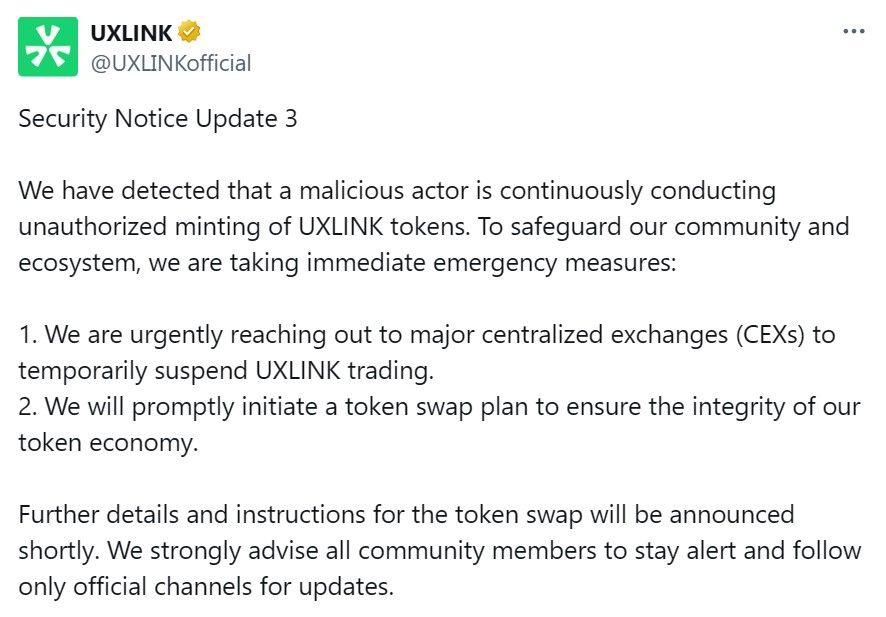

Source: UXLINK

How is UXLink responding to the breach?

UXLink has publicly communicated multiple containment steps. The project reached out to centralized exchanges to request temporary suspension of trading and reported the incident to law enforcement.

UXLink confirmed collaboration with exchanges led to freezing a large portion of the stolen assets. The team also announced plans for a token swap and has submitted a new smart contract for a security audit to enforce a fixed supply so no further tokens can be minted.

UXLINK seven-day price chart. Source: CoinGecko

How should users respond after a token contract breach?

Act quickly and follow official project channels for instructions. UXLink has advised users that individual wallets showed no signs of compromise and to only trust official communications.

- Verify official announcements from the project’s verified channels.

- Do not interact with suspicious UXLINK contracts or airdrop claims.

- Monitor on-chain activity and consult security advisories from recognized blockchain security firms (PeckShield, Hacken, Lookonchain are referenced as plain text).

- Follow exchange instructions if you hold affected tokens on a centralized platform.

Frequently Asked Questions

What triggered the sudden token minting in the UXLink incident?

The attacker exploited access to the multisignature wallet signing process to call mint functions repeatedly, generating unauthorized UXLINK tokens and moving them on-chain. Security firms tracked the minting sequence and alerted traders to avoid the asset.

How quickly did exchanges respond to freeze funds?

UXLink reports that exchanges cooperated to freeze a large portion of suspicious deposits shortly after the incident was reported. The project continues to coordinate with exchanges and law enforcement on asset recovery and investigation.

Key Takeaways

- Multisig compromise: Access to a multisignature wallet allowed mass unauthorized minting of UXLINK tokens.

- Material losses: On-chain analysis estimates about $30 million in losses despite the attacker converting a small portion to ETH.

- Containment & recovery: Exchanges froze funds, UXLink will implement a token swap and a fixed-supply audited contract; users should follow official project communications.

Conclusion

The UXLink multisig breach highlights persistent operational and smart-contract risks in Web3 ecosystems. UXLink’s coordination with exchanges, pending token swap plan and move to a fixed-supply audited contract are immediate steps to restore trust. Users should monitor official UXLink updates and follow security best practices while investigations continue.

Published: 2025-09-23 • Updated: 2025-09-23 • Author: COINOTAG