Major Pullback After Rate Cut: Is the Crypto Bull Market Over? | Trader's Observation

Powell speaks again one week after the interest rate cut. What will happen to the market next?

On September 24, just a week after the Federal Reserve's first rate cut in 2025, Chairman Powell spoke publicly again, delivering a complex and subtle message. He warned that the U.S. labor market is showing signs of weakness, the economic outlook is under pressure, and inflation remains above 2%. This "two-way risk" leaves policymakers in a dilemma, and he stated that "there is no risk-free path."

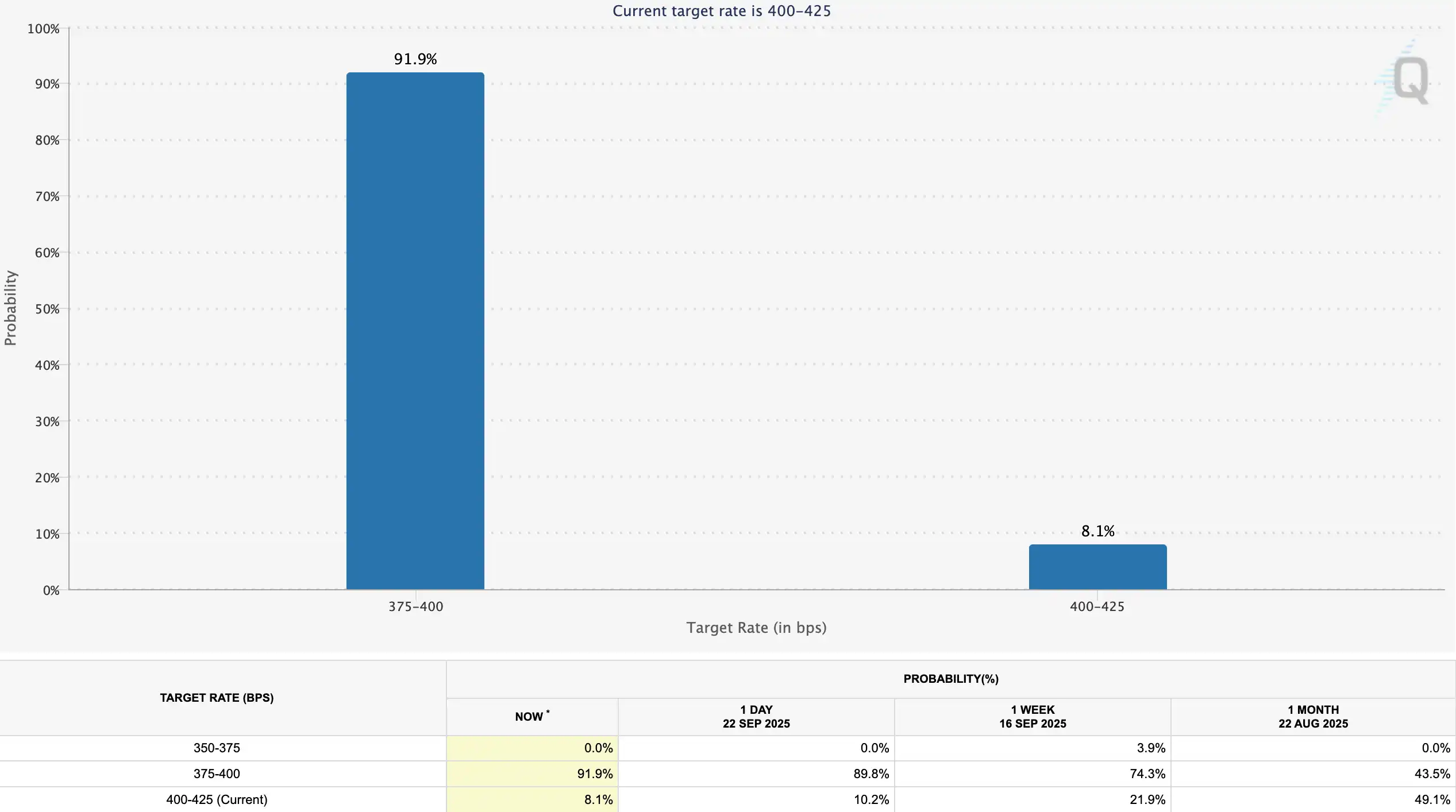

Powell also commented that stock market valuations are quite high, but emphasized that this is "not a period of rising financial risk." Regarding the October rate-setting meeting, Powell said there is no preset policy path. The market interpreted this speech as "dovish": after the speech, the probability of a rate cut in October rose from 89.8% to 91.9%, and the market has basically bet on three rate cuts this year.

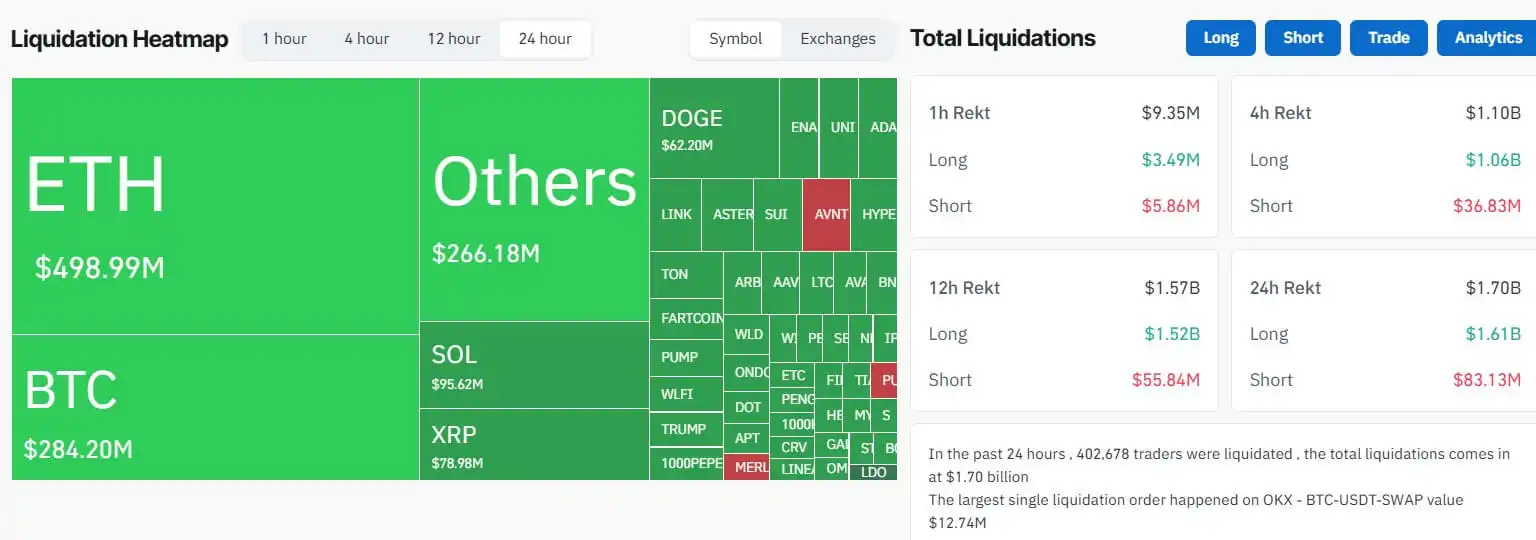

Driven by expectations of easing, U.S. stocks have repeatedly hit new highs, while the crypto market presents a completely different picture. On September 22, the crypto market saw liquidations totaling as much as $1.7 billion in a single day, marking the largest liquidation since December 2024. Below, BlockBeats has compiled traders' views on the upcoming market situation to provide some directional reference for your trading this week.

@0xENAS

Trader Dove believes that various signs indicate the crypto market is gradually weakening.

When I re-entered the market after a two-week break, I happened to catch the largest liquidation correction of the year. As a result, those "liquidation buy orders" that historically have brought rebounds 80% of the time continued to fall this time—this dislocation is a very clear danger signal. The 20% of failed cases often mean: there are no longer enough marginal buyers in the market, and no one is willing to take the baton for a rebound.

I suspect that we will increasingly decouple from the linkage logic of U.S. stocks and other "risk assets" and begin to lose several key support levels. My observation points are: BTC breaking the $100,000 structure, ETH falling below $3,400, and SOL falling below $160.

@MetricsVentures

We believe the global asset bubble cycle has most likely entered the incubation phase, and it seems only a matter of time before it starts. This bubble cycle is occurring against the backdrop of unemployment and social division caused by the impact of AI, supported by a global fiscal-led economic cycle and political-economic ecology, and accelerated by the two major powers' shared desire to export inflation to resolve internal contradictions as the world becomes increasingly polarized. It is expected to enter the public discussion in the coming months.

Looking ahead, in addition to the digital currency market—which has seen almost no major fluctuations for nearly a year and is a potential big winner—global cyclical minerals and the AI derivative investment chain will continue to generate excess returns. In terms of crypto stocks, the success of ETH crypto stocks will lead to a series of copycats, and the combination of strong large-cap coins and strong stocks is expected to become the most eye-catching segment in the coming months.

As countries with competitive advantages begin to consider setting up investment accounts for newborns, further relaxing pension investment restrictions, and elevating capital markets—historically used as financing channels—to new heights, the bubble in financial assets has become a high-probability event.

We are also pleased to see the U.S. dollar market beginning to welcome the native volatility of digital currencies and providing ample liquidity pricing for it. This was unimaginable two years ago, just as the success of MSTR was a kind of financial magic we could not have predicted two years ago.

In short, we are clearly optimistic about the digital currency market over the next six months, the global mining and pro-cyclical markets and the AI derivative industry chain over the next 1-2 years. At this moment, economic data is no longer so important. As many in the crypto community joke, "economic data is always good news." In the face of the roaring train of history, embracing the bubble in line with the trend may have become the most important lesson for our generation.

@Murphychen888

According to the "three-line convergence" trend, after October 30 this year, MVRV will enter a long-term downward oscillation trend, which is completely aligned with BTC's historical four-year cycle.

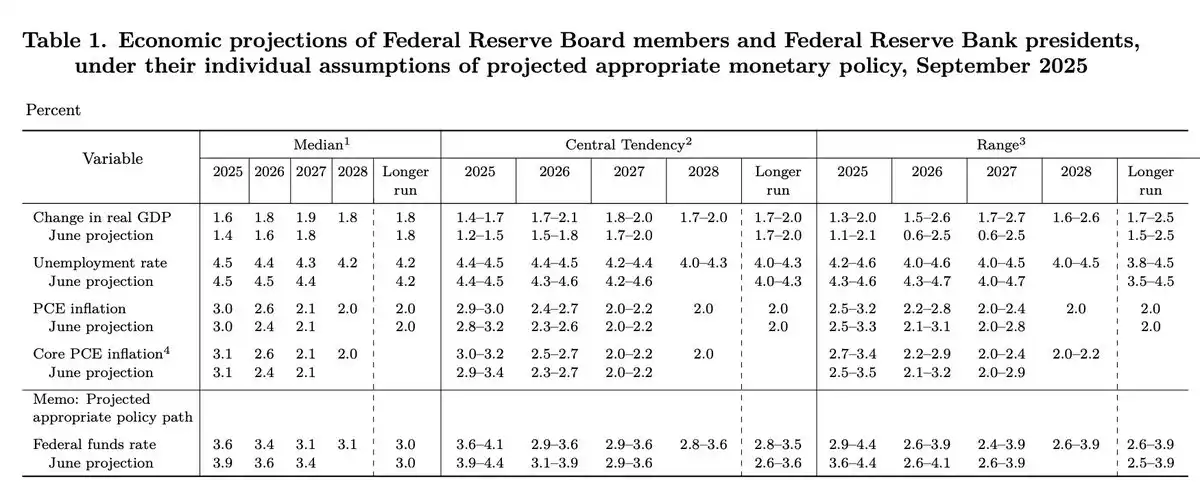

However, according to this macro expectation data, the overall signal conveyed is "soft landing + inflation falling back + monetary policy gradually easing."

Although the future is always unknown, if this is indeed the case, then the four-year cycle theory may really be broken, and bitcoin may enter an "eternal bull market."

@qinbafrank

The logic behind U.S. stocks outperforming crypto in a large-scale wide-range oscillation is that the market as a whole is still vaguely worried about the future trend of inflation. U.S. stocks are strong because of strong fundamentals and AI acceleration, allowing U.S. stocks to withstand concerns about inflation and continue to soar. The problem with crypto is that it relies on capital and expectations, and macro concerns will affect the flow of external funds.

At present, the deep structure of the crypto market is that traditional funds entering via ETFs and listed company purchases act as buyers, while ancient whales and trend investors taking profits in waves act as sellers. Most of the market's price fluctuations and volatility come from the game between these two forces. In the short term, economic strength, inflation trends, and interest rate expectations will all affect the speed of inflow of buying funds. Good expectations accelerate the flow, poor expectations stop or even reverse the inflow.

Now that the Fed is returning to rate cuts, but inflation is still slowly rising, the market naturally worries that future Fed rate cuts will be interrupted again by inflation. In this case, the inflow of buying funds will be affected, as can be seen from changes in ETF net inflows. Meanwhile, the core theme of U.S. stocks—AI penetration rate—is about to reach 10%. Once it crosses this threshold, it will enter a golden period of rapid penetration, as has always been said: AI is accelerating its own acceleration. From this perspective, the strength and weakness are naturally reflected.

The future market trend needs to refer to macroeconomic data:

1) Best case: The pace and magnitude of inflation rising is lower than expected, which is good for both crypto and U.S. stocks.

2) Moderate case: The pace of inflation matches expectations, which is more favorable for U.S. stocks because their fundamentals are stronger. Crypto will be relatively good but likely in a large-scale wide-range oscillation.

3) Worst case: If there is a major inflation surprise in the future, both U.S. stocks and crypto will correct. U.S. stocks may see a small correction, while crypto could see a medium-sized one.

@WeissCrypto

The impact of the Fed's rate cuts on liquidity will not be injected into the crypto market until mid-December. Their model shows that sideways volatility may last for 30 to 60 days, with a significant bottom possibly appearing on October 17. Notably, Weiss Crypto recently predicted a peak around September 20.

@joao_wedson

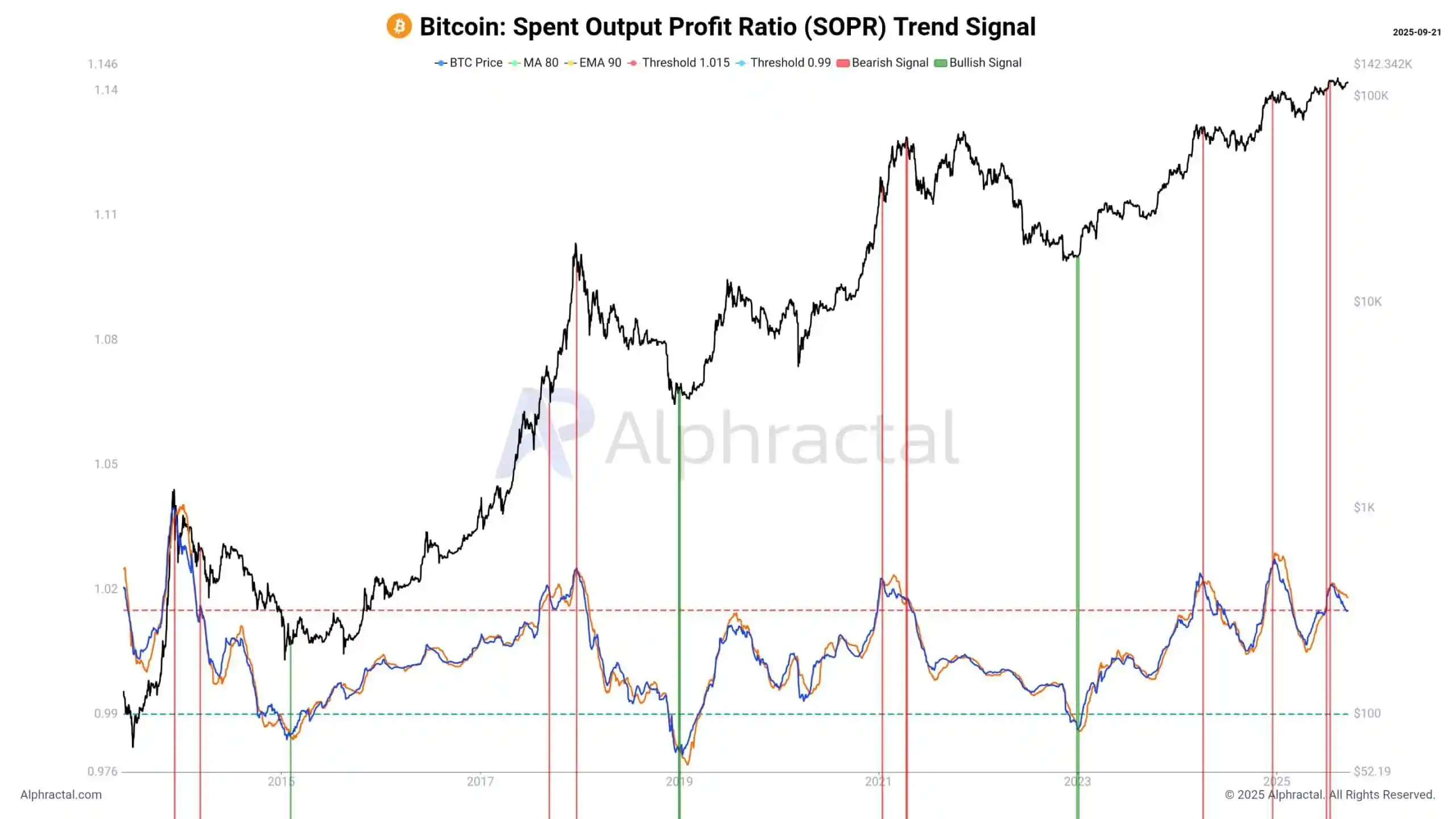

Joao Wedson, founder of blockchain analytics platform Alphractal, said that bitcoin is showing clear signs of cyclical exhaustion. He pointed out that the SOPR trend signal, which tracks on-chain realized profitability, indicates that investors are buying at historical highs while profit margins are shrinking. The actual price for short-term bitcoin holders is currently $111,400, and institutional investors should have reached this level earlier. He also noted that compared to 2024, bitcoin's Sharpe ratio—a measure of risk-adjusted returns—has weakened.

He suggested, "Those who bought BTC at the end of 2022 are satisfied with +600% returns, but those accumulating in 2025 should reconsider their strategy," and that market makers tend to sell BTC and buy altcoins, which are expected to perform better in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.