BNB Chain Bull Market Fueled by Ultra-Low Fees and On-Chain Activity

BNB Chain’s ultra-low fees and record trading volume signal strong fundamentals. With bullish momentum, traders eye potential new ATHs.

The crypto market is heating up daily, and the most talked-about name right now is BNB Chain — an ecosystem that has just slashed gas fees to “ultra-low” levels while recording an all-time high on-chain perpetuals trading volume surpassing $51 billion.

With technical indicators and on-chain data pointing in the same direction, the big question is: could this be the “golden time” for BNB to break through to new highs?

Impressive Performance

The BNB Chain ecosystem has recently seen a series of technical upgrades and market-shaping announcements. Validators have proposed lowering the minimum gas price to 0.05 Gwei and reducing the block interval to 450 ms, aiming to expand network capacity and lower transaction costs. At the same time, Binance’s former CEO, CZ, called for another 50% cut in fees to accelerate transaction flow and attract liquidity, following a wave of fee reductions in recent updates.

“Let’s reduce fees by another 50% on #BNB Chain?” CZ urged.

Previously, in a post on X, when BNB surpassed the $1,000 mark, CZ also revealed that gas fees could already be reduced by 10x. This has positioned BNB Chain as one of the lowest-cost blockchains in the market.

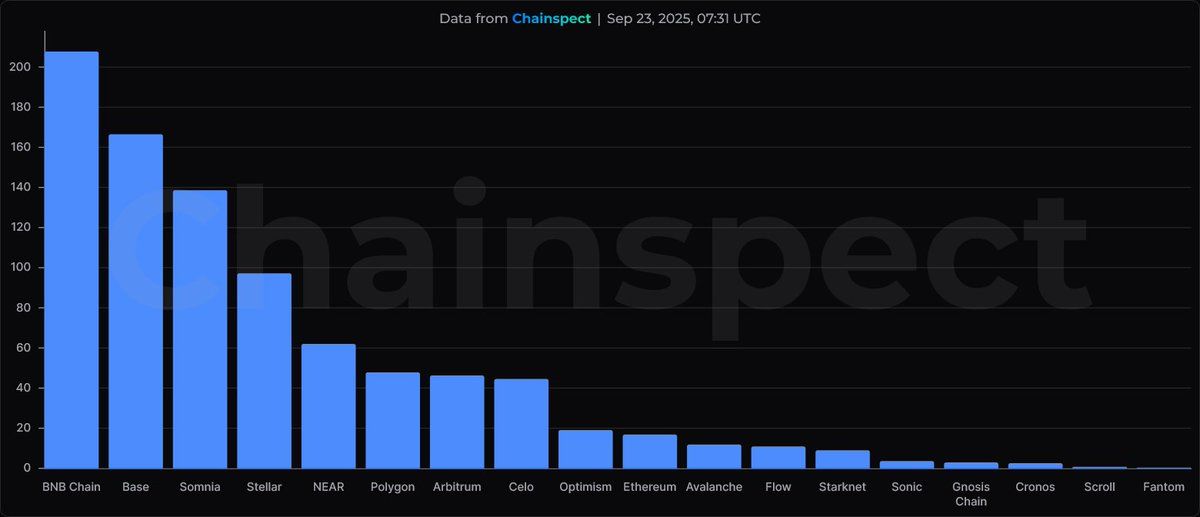

Not stopping there, observations from community members on X highlighted that BNB Chain currently outpaces all Layer-1 and Layer-2 networks with over 200 real-time transactions per second (TPS). This strengthens its competitive edge for DeFi applications, DEXs, and on-chain derivatives markets, where low costs are critical to attracting high trading volume.

BNB Chain’s TPS. Source:

BNB Chain’s TPS. Source:

“At ATH activity, the chain proves its stress-tested scalability,” one X user noted.

However, ultra-low fees may also pose risks such as transaction spam or reduced revenue for validators. The market will need time to assess whether the BNB Chain can strike a sustainable balance between technical efficiency and economic incentives.

Positive On-Chain Activity

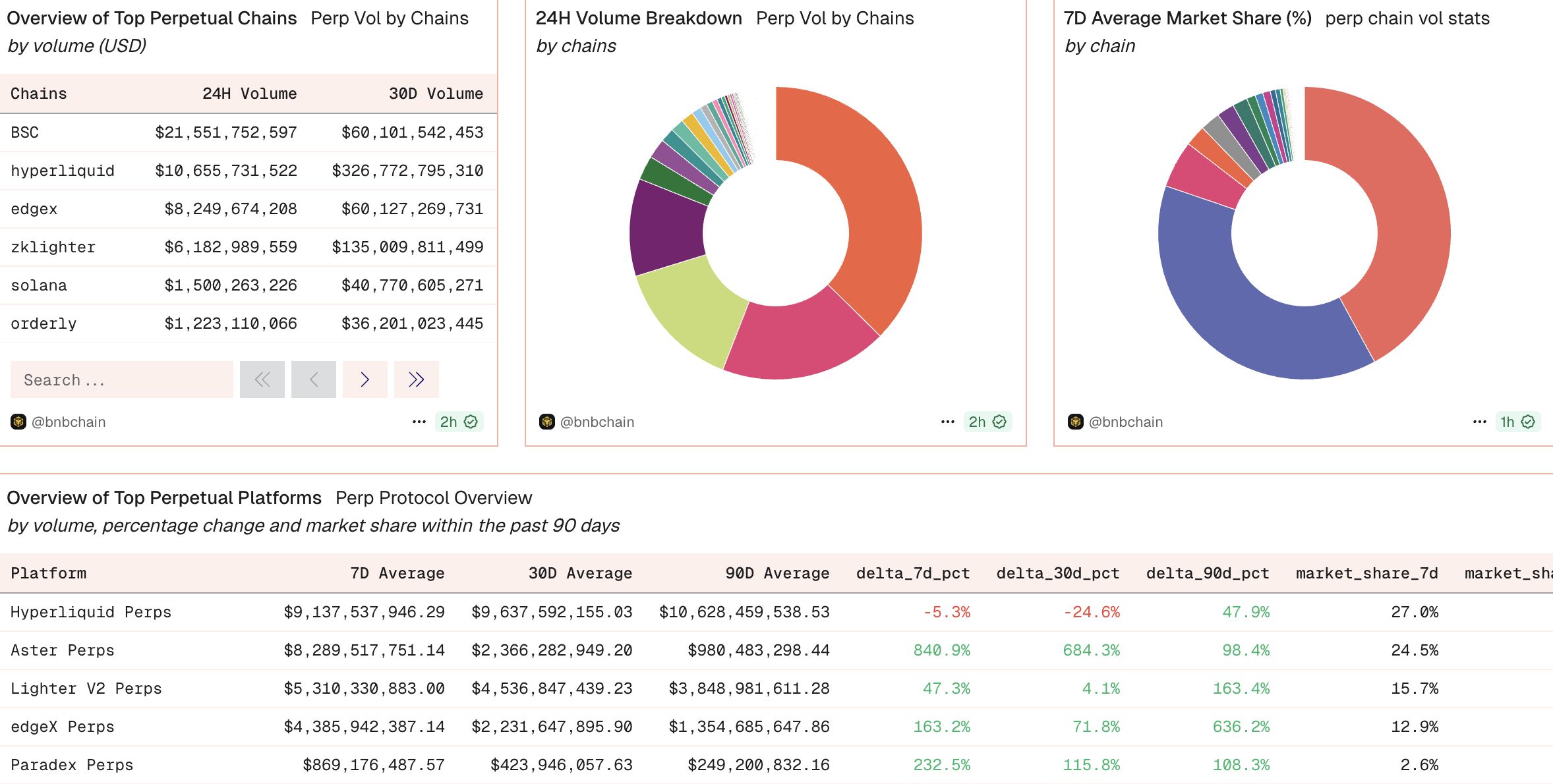

On-chain data also shows strong momentum for the BNB Chain. According to Dune, total perpetual trading volume hit a record $51.3 billion, with BNB Chain alone contributing around $21.5 billion. The recent surge in activity on Aster perp DEX is likely a key driver behind this liquidity inflow. This indicates a significant shift of derivative liquidity onto the BNB Chain, creating real demand for its native token BNB.

Perp trading volume. Source:

Dune

Perp trading volume. Source:

Dune

Beyond the surge in perpetuals, Santiment data shows that BNB Chain has been leading in development activity over the past 30 days. Meanwhile, short-term stablecoin flows have largely shifted through Binance’s rails, highlighting BNB Chain’s role as a central hub for stablecoin transactions and fast settlement. These on-chain fundamentals provide a more solid basis for price expectations than pure sentiment or FOMO.

Regarding price action, after breaking the $1,000 threshold, BNB is now pulling back to retest its former resistance line, supported by the 20-day EMA. This suggests the uptrend remains intact as long as the support holds.

BNB/USDT 1D chart. Source:

Lark Davis

BNB/USDT 1D chart. Source:

Lark Davis

Many traders and analysts remain bullish, with some even predicting new ATHs if the current on-chain drivers (lower fees, derivative liquidity, development activity) strengthen.

“New ATHs are on the horizon. Or maybe we haven’t even hit the real bull market yet? In a true bull market, BNB will be unstoppable,” one X user commented.

At the time of writing, BNB is trading at $1,025, 5% lower than its ATH recorded on September 21.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing CSCOUSDT, PEPUSDT, ACNUSDT STOCK Index perpetual futures

Stock Futures Rush: Trade popular stock futures and share $250,000 in equivalent TSLA tokenized shares. Each user can get up to $8,000 TSLA.

Bitget margin trading to support BGB cross margin trading and loans

Bitget margin trading to support BGB cross margin trading and loans