Real Finance: Infrastructure for Real Asset Tokenization

The tokenization of real assets (RWA – Real World Assets) represents one of the most promising sectors of the crypto ecosystem in 2025-2026. The integration of recognized assets on the blockchain through RWAs constitutes a significant innovation that is a central narrative of the 2024-2025 crypto season. In this dynamic context, Real Finance (REAL) positions itself as a major player by developing a complete infrastructure to facilitate the integration of real-world assets into the Web3 ecosystem.

In Brief

- Real Finance builds universal infrastructure for real asset tokenization.

- Enhanced security, decentralization, and trustless design solve the RWA trilemma.

- A network of specialized validators democratizes access to investments.

Real builds the fundamental infrastructure to integrate real-world assets and transform traditional financial markets into an open and programmable system. This innovative approach aims to solve the major challenges that currently hinder the massive adoption of tokenization.

What is Real Finance?

Fundamental Vision and Mission

Real Finance defines itself as a blockchain infrastructure platform specialized in real asset tokenization . Unlike projects focused solely on one type of asset, Real adopts a holistic approach by creating a complete ecosystem for all types of physical and financial assets.

Real’s main mission is to transform traditional financial markets into open, programmable, and accessible systems via blockchain. This vision fits perfectly with the explosive growth of the RWA sector, which could reach between 3.5 and 10 trillion dollars by 2030 according to market projections.

Innovative Technical Architecture

Real Finance relies on a dual-validator architecture built on Cosmos Tendermint, offering several distinctive advantages:

| Feature | Description | Advantage |

| Security | Dual-validator architecture + disaster recovery fund | Guaranteed protection for assets and investors |

| Decentralization | Permissionless design on Cosmos | Open tokenization for all actors |

| Trustless | Onchain mechanisms with automatic penalties | Reduced counterparty risk |

The RWA Trilemma Solved by Real

The Three Fundamental Pillars

Real Finance claims to solve what it calls the “RWA trilemma”, the difficult balance between security, decentralization, and trustless operation.

- Enhanced Security Real’s dual-validator architecture guarantees multi-layer protection of tokenized assets. The Disaster Recovery Fund (DRF) without inflation constitutes a major innovation, offering additional coverage to investors.

- Effective Decentralization Unlike current centralized solutions, Real allows anyone to tokenize assets, assess risks, or insure financial flows. This permissionless approach democratizes access to tokenization.

- Trustless Mechanisms Business validators (tokenizers, insurers, evaluators) must stake tokens and face automatic onchain penalties in case of failure, eliminating the need for blind trust.

The Business Validator Ecosystem

A Collaborative Decentralized Approach

Real Finance distinguishes itself through its network of specialized business validators, each assuming a critical role in the tokenization value chain:

Tokenization Providers

These trusted entities integrate real assets on-chain by guaranteeing:

- Verified ownership

- Legal applicability

- Complete transparency of collateral

Risk Assessment Partners

Specialized companies score tokenized assets by analyzing:

- Financial risk

- Market exposure

- Regulatory compliance data

Decentralized Insurers

Underwriters offer asset protection via:

- Capital-backed coverage

- Onchain risk data

- Protocol-enforced guarantees

Recent Developments and 2025 Roadmap

Strategic Milestones Achieved

Real Finance follows an ambitious roadmap with several key stages already completed or scheduled:

- Q4 2024 – Project Genesis Real was born from an obvious market gap: the absence of scalable and compliant infrastructure to tokenize real-world assets. This period saw the initial conceptualization of the project.

- Q2 2025 – Technical Foundations Finalized Completion of protocol architecture and basic technical documentation. Closure of a friends & family funding round to initiate product development and formation of the initial ecosystem.

Immediate Future Prospects

- Q3 2025 – Strategic Funding Completion of the complete strategic funding round to fuel:

- Product deployment

- Validator onboarding

- Regulatory alignment

- Q4 2025 – MVP Launch The launch of Real’s minimum viable version will include:

- Asset tokenization modules

- Risk validation

- Onchain insurance

- A secure and composable platform

Real Finance in the Context of the 2025 RWA Market

A Rapidly Expanding Market

The RWA sector is experiencing remarkable growth. Tokenization allows these assets to exist as tokens on a blockchain, facilitating their purchase and sale, thus creating new accessible investment models.

Market projections are particularly encouraging, with estimates oscillating between 3.5 and 10 trillion dollars in tokenized assets by 2030. This growth is explained by several factors:

- Improvement of blockchain infrastructures

- Favorable evolution of regulations

- Growing interest from institutional investors

- Democratization of fractional investment

Competitive Positioning

Real Finance differentiates itself from its competitors through its infrastructure-first approach. While many projects focus on specific niches (real estate, commodities, bonds), Real aims to create a universal platform capable of supporting all types of real assets.

This strategy presents several competitive advantages:

- Economies of scale on technical infrastructure

- Network effect between different types of assets

- Standardization of tokenization processes

- Risk pooling via the insurance ecosystem

What Real Finance Changes for Users

Investment Democratization

Real Finance revolutionizes access to assets traditionally reserved for wealthy investors:

- Fractionalization: Investment possible with reduced capital

- Liquidity: Ability to sell shares of illiquid assets

- Transparency: All information stored onchain

- Accessibility: 24/7 investment without traditional intermediaries

New Economic Models

The platform paves the way for unprecedented economic models:

- Passive income via tokenization of productive assets

- Automatic diversification via asset pools

- Decentralized insurance with risk pooling

- Programmable and automated financial services

As regulations evolve and institutional interest accelerates, Real’s infrastructure-first strategy and universal approach provide the scalability and resilience necessary for long-term adoption. With an MVP on the horizon and a clear roadmap ahead, Real Finance is shaping the foundation of the tokenized economy of tomorrow.

FAQ - Real Finance

Real offers universal infrastructure with a business validator ecosystem, unlike solutions specialized in a single asset type.

Via a dual-validator architecture, an inflation-free disaster recovery fund, and staking mechanisms with automatic onchain penalties.

The MVP is planned for Q4 2025, with basic modules for tokenization, risk assessment, and insurance.

The project is actively working on regulatory alignment as part of its strategic funding planned for Q3 2025.

The platform aims to support all types of real assets: real estate, commodities, bonds, private stocks, artworks, etc.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

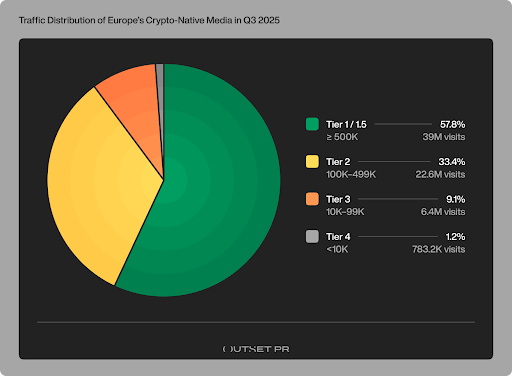

Europe’s crypto media relied almost entirely on search and direct traffic in Q3 2025

XRP Price Nightmare Scenario Over, Bollinger Bands Signal

Litecoin slips below $76, lags broader crypto market amid bearish signals