Leverage Comes at a Price: Trader Drops $45 Million Amid 40 Days of Crypto Market Swings

- A high-profile trader lost $45M in 40 days on Hyperliquid via leveraged ETH, BTC, and HYPE positions amid volatile crypto markets. - Over $35M was lost on ETH alone as prices fell below $4,000, with 9,152 ETH liquidation pushing total losses beyond $45M. - Hyperliquid's team showed no intervention despite $100M+ in leveraged liquidations, maintaining non-intervention governance norms. - Analysts warned against shorting Bitcoin in bull markets, citing risks of amplified losses from high leverage and margi

A prominent trader on the Hyperliquid decentralized exchange has reportedly incurred a staggering $45 million loss, highlighting the inherent dangers of using leverage in the unpredictable cryptocurrency market. Known by the

The substantial losses resulted from both high leverage and unfavorable price shifts. The trader lost over $35 million on

This episode demonstrates how leveraged positions become especially vulnerable during times of market turmoil. More than $100 million in leveraged trades were liquidated during Asian trading hours in late September 2025, with bullish bets accounting for over $90 million of that total. This indicates that many traders were betting on price increases, leaving them exposed when the market turned downward Bitcoin Whale Loses $45M on Hyperliquid: Lessons for Meme … [ 3 ].

Hyperliquid’s development team has

This dramatic loss has prompted commentary from crypto analysts, who warn about the perils of shorting Bitcoin during a bull run. “Shorting Bitcoin in a bull market is always dangerous,” one analyst posted, highlighting the risks of betting against rising prices Hyperliquid Whale Suffers $45M Loss In Leveraged Trades [ 1 ]. The incident has also been compared to previous major losses, such as those seen in the Luna and FTX collapses, though in this case, the losses are attributed to personal trading choices rather than systemic issues Bitcoin Whale Loses $45M on Hyperliquid: Lessons for Meme … [ 3 ].

Observers in the market have pointed out the broader lessons for those using leverage. The trader’s account, which reached a $152 million position with 28.69x leverage, exemplifies the risks associated with aggressive, high-leverage strategies. Margin utilization of 114.74% and full commitment to short positions further intensified the impact of adverse price moves Whale 0xa523 Tops James Wynn With $40M Hyperliquid Loss [ 4 ].

This event has also renewed conversations around risk management in crypto trading circles. Experts emphasize the necessity of stop-loss mechanisms, portfolio diversification, and resisting impulsive trading. “Leverage can magnify gains but also wipe out your account—only risk what you can afford to lose,” one blockchain expert advised Bitcoin Whale Loses $45M on Hyperliquid: Lessons for Meme … [ 3 ].

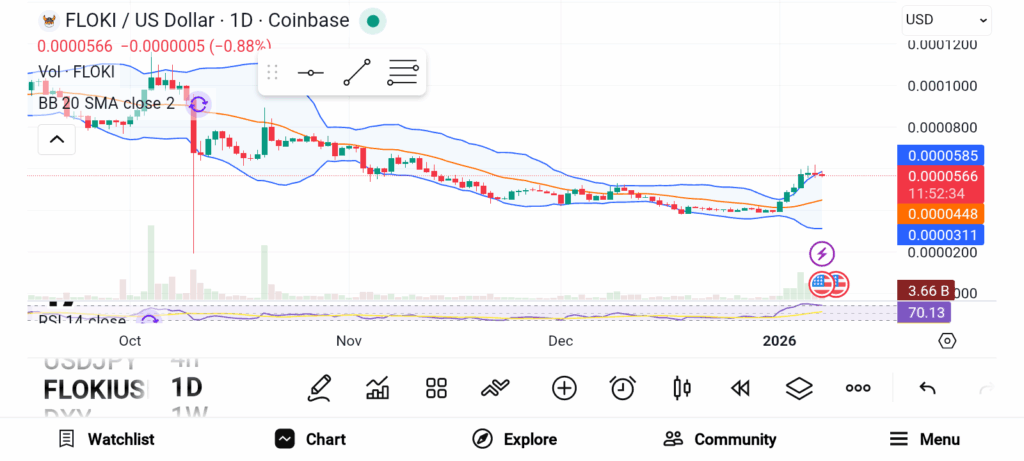

By late August 2025, both Ethereum and Bitcoin were rallying due to ETF inflows, with Ethereum’s price climbing from $1,519 in April to $4,739. However, the trader’s massive losses occurred during a temporary downturn, illustrating the difficulty of timing leveraged trades in fast-moving markets Tracking ETF Inflows Against ETH and BTC Price Moves [ 5 ].

The trader’s identity remains undisclosed, and no regulatory response has been reported. This case stands as a warning for those trading on decentralized exchanges, where high leverage can quickly turn profitable positions into devastating losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Next Big Crypto: Morgan Stanley Pivot to Digital Wallets and DeepSnitch AI 100X Launch Potential

Investors Are Watching These 3 Undervalued Altcoins Under $0.40

Germany Plans to Propose Arctic NATO Operation to Mend Greenland Dispute