REX-Osprey unveils first Ethereum staking ETF amid cooling investor appetite

REX-Osprey has launched the first US exchange-traded fund designed to pair spot Ethereum exposure with staking rewards.

Announced on Sept. 25, the new product trades under the ticker ESK and is registered as a 1940 Act ETF, giving investors access to Ethereum through a familiar regulatory framework.

The ESK fund blends spot ETH holdings with a staking component, distributing rewards from Ethereum’s proof-of-stake system to shareholders on a monthly basis.

Unlike many staking products offered through private agreements or custodians, REX-Osprey emphasized that it does not keep a share of the rewards. Instead, the full proceeds from staking are passed on to investors.

Greg King, chief executive of REX Financial, said:

“With ESK, we’re giving investors access to Ethereum plus staking rewards in the most broad-based US ETF format. This continues our work of introducing crypto staking through the ETF structure.”

This rollout builds on the company’s July launch of the first Solana Staking ETF in the US. That product broke new ground as the first Solana ETF and the first domestic crypto ETF to include staking-related distributions.

Since then, the fund has grown beyond $300 million in assets under management and shifted into a Regulated Investment Company (RIC) structure to provide tax efficiency while preserving its combined spot-and-staking strategy.

Ethereum ETFs’ inflows cool

The arrival of ESK comes at a time when investor appetite for spot Ethereum ETFs has slowed considerably.

Data from SoSo Value shows that September has brought just $110 million in net inflows across nine US Ethereum spot products, compared with $3.8 billion in August and $5 billion in July. Notably, inflows have occurred on only seven trading days, while outflows have happened in 10 trading sessions this month.

Still, the cumulative flows into the products stand at $13.62 billion, with the funds managing $27.42 billion.

These numbers will significantly improve if the US Securities and Exchange Commission (SEC) allows the funds to integrate staking into their products. The financial regulator recently extended the review period for this approval.

The post REX-Osprey unveils first Ethereum staking ETF amid cooling investor appetite appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chevron Gives Green Light to Expand Leviathan Gas Project in the Eastern Mediterranean

Bitcoin Momentum Recovery: The Critical Juncture That Could Spark a Dramatic Rally

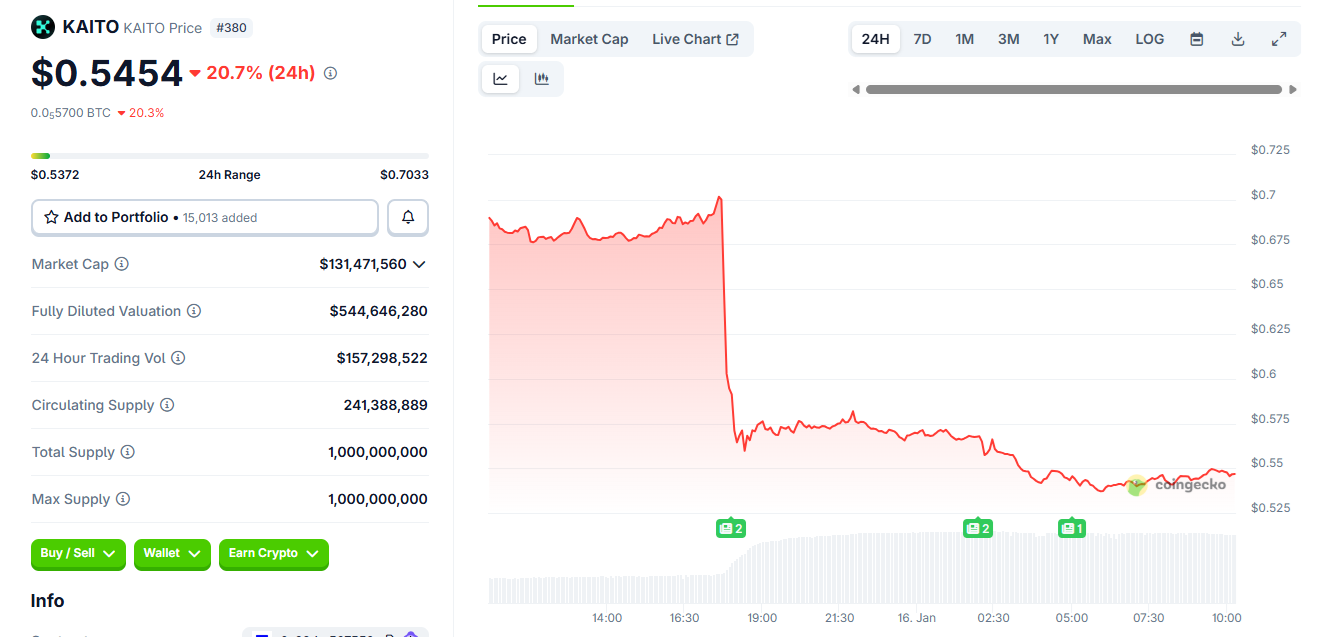

Kaito retires Yaps as token falls near all-time lows

The US Treasury market is experiencing a level of stagnation that is approaching record highs