Why Bitcoin’s hashrate explosion could squeeze public miners next

On Sep. 23, Bitcoin’s hashrate set a new all-time high of 1,073 EH/s. Over the last month, raw compute rose about 21%.

Over the last quarter, roughly 70%. Over the last year, the curve went vertical, up around 675%.

Hashrate used to be a chart for miners and protocol nerds. Now it reads like a capital expenditure scoreboard for an industry you can trade.

Let’s answer the basic question quickly: What is hashrate, and why should anyone outside a mining warehouse care?

Hashrate is the total computational effort pointed at Bitcoin’s proof-of-work: i.e., how hard it would be to outvote the network and rewrite the ledger. More hashrate makes an attack more expensive and less practical. But the more interesting angle isn’t just “safety”; it’s what this says about the scale of the industry behind it.

You don’t get a zetahash without years of setting up facilities, installing transformers, hauling in container loads of machines, and locking in energy contracts big enough to power entire towns. Every uptick on this line is money and engineering showing up in the real world.

Mechanically, the protocol keeps block cadence steady by raising or lowering difficulty every 2016 blocks, like a treadmill that speeds up when the runners get stronger. When hashrate jumps like it did into September, the treadmill kicks faster on the next epoch or two, and margin gets tighter.

That feedback loop drives the business: machines come online, blocks arrive too quickly, difficulty adjusts, and unit economics compress until only the most efficient operators keep their edge. The protocol is agnostic; it doesn’t negotiate. Miners either hit their power price and fleet-efficiency targets or they get pushed to the back of the line.

The latest daily print set a fresh high around 1,073 EH/s. The past 30 days added roughly 184 EH/s at the peak of the run-up, an absolute jump big enough to have counted as the entire network not long ago.

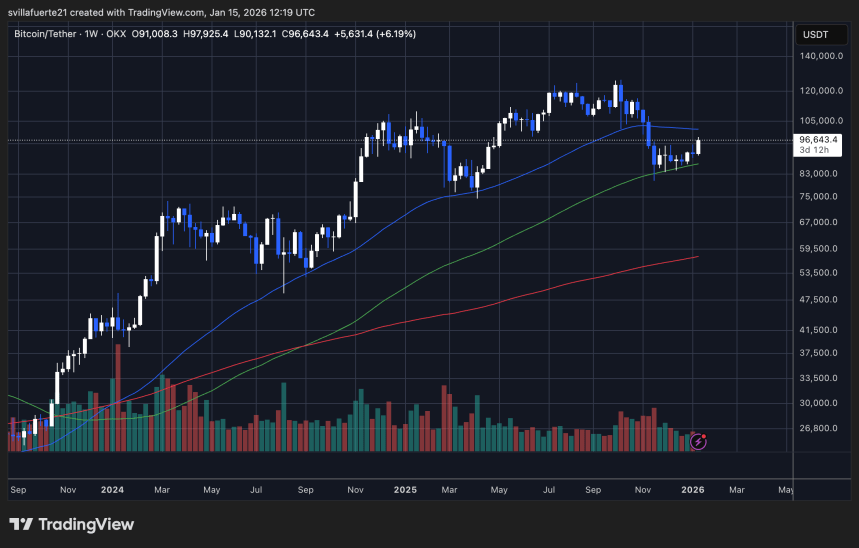

Graph showing Bitcoin’s hash rate from Sep. 26, 2024, to Sep. 25, 2025 (Source:

Graph showing Bitcoin’s hash rate from Sep. 26, 2024, to Sep. 25, 2025 (Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Oil prices extend losses as chance of US strike on Iran recedes

Survey says slowing economy is the No. 1 worry for US businesses in China, not trade friction

Bitcoin Bull Score Hits Level Seen Only 7 Times In 6 Years – A Rare Historical Signal

India Seizes Assets in Crypto and Land Fraud