U.S. regulators are probing public companies that adopted crypto treasuries for possible insider trading, focusing on suspicious trades made before firms announced crypto treasury plans; the probes involve FINRA and the SEC and could affect corporate crypto holdings and market transparency.

-

Regulators investigate pre-announcement trades by firms with crypto treasuries.

-

FINRA has sent inquiry letters; the SEC may pursue formal actions depending on findings.

-

$121B in corporate crypto holdings, with BTC representing the majority, could be impacted.

Meta description: Crypto treasury firms under probe for insider trading by SEC and FINRA — learn why regulators are acting, how ETFs factor in, and key market impacts. Read more.

What is driving the regulatory probe into crypto treasury firms?

Regulators are acting after evidence of suspicious trading activity that occurred before companies publicly announced crypto treasury plans. FINRA has sent letters to multiple public firms and the SEC is evaluating whether to open formal investigations into potential insider trading.

How are regulators proceeding with inquiries?

FINRA’s inquiry letters typically represent a first step in fact-gathering, according to former SEC counsel David Chase. Agencies request trade records and internal communications to establish timelines and potential misuse of nonpublic information.

Key facts: inquiries focus on trade timing, disclosure dates, and whether corporate insiders or connected parties traded ahead of public announcements.

Source: X

Will crypto ETFs kill treasury firms?

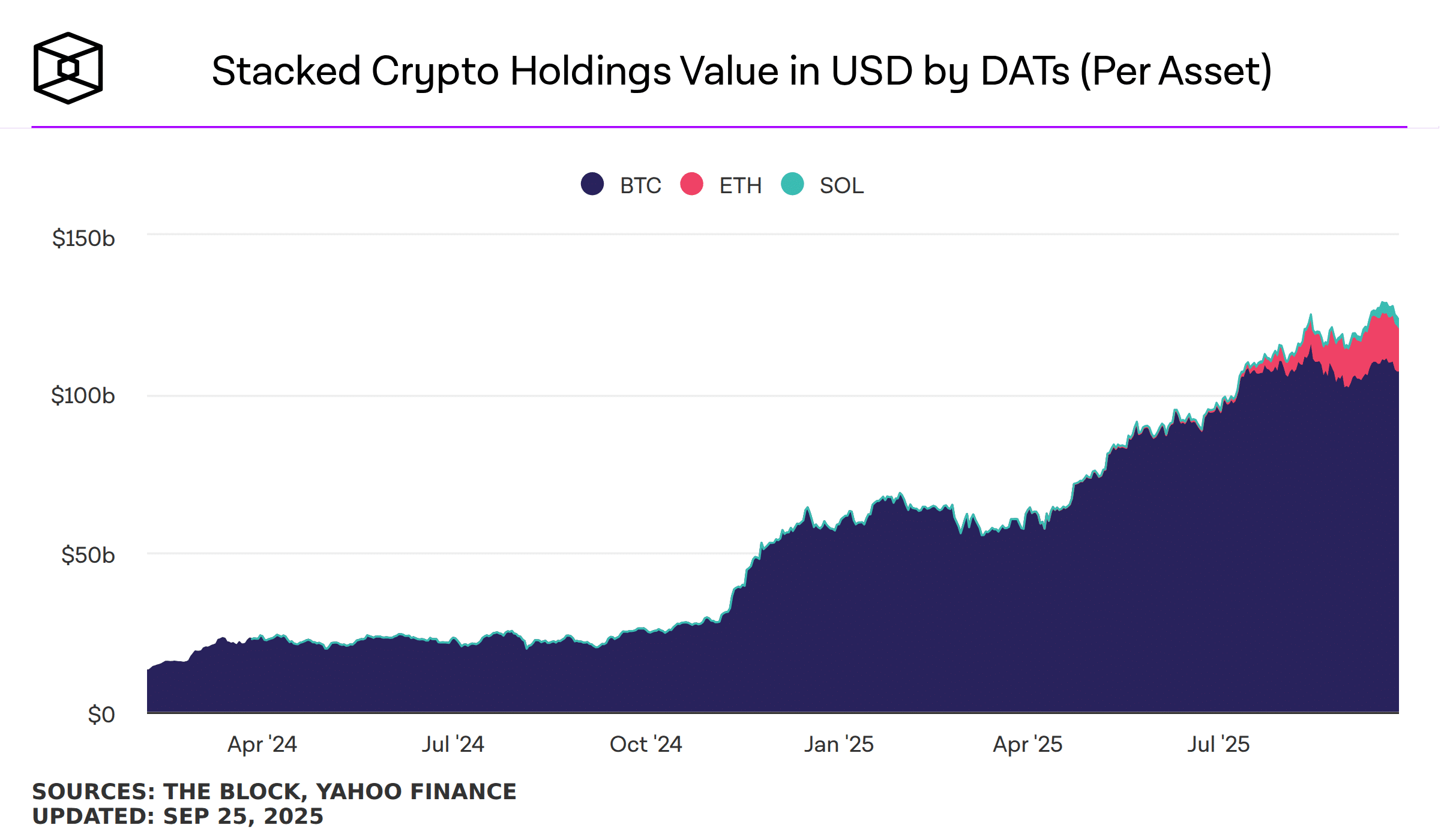

ETF approvals may reduce some demand for corporate treasuries but are unlikely to fully eliminate them. Over 200 firms reportedly plan crypto treasury programs, and analysts estimate corporate holdings around $121 billion, with Bitcoin dominating those positions.

How do analysts view the impact of ETFs?

ETF specialist Nate Geraci suggested spot ETFs and staking approvals could make treasuries less attractive for simple exposure. Bloomberg analyst James Seyffart countered that ETFs cannot easily deploy capital into DeFi or staking strategies that some treasuries use to generate yield.

Source: The Block

What could be the market impact if probes escalate?

Potential outcomes include fines, disclosure revisions, and reputational damage for implicated companies. Corporate treasuries have helped reduce selling pressure on major assets, but enforcement actions could trigger short-term volatility and prompt stricter treasury governance.

How should companies respond if contacted?

Companies should preserve records, engage experienced securities counsel, and review internal controls and disclosure practices. Prompt, transparent cooperation with regulators often mitigates enforcement outcomes.

Frequently Asked Questions

Can insider trading rules apply to corporate crypto treasuries?

Yes. If executives or connected parties trade crypto using material nonpublic information about treasury plans, traditional insider trading statutes and securities rules can apply regardless of asset type.

Will this investigation slow corporate crypto adoption?

Some firms may pause or tighten governance, but long-term adoption depends on risk controls, regulatory clarity, and corporate strategy — not solely enforcement actions.

Key Takeaways

- Regulatory focus: FINRA and the SEC are investigating suspicious pre-announcement trading tied to crypto treasury plans.

- Market scale: Public companies hold an estimated $121B in crypto, with BTC dominating corporate treasuries.

- Practical action: Firms should secure trade records, consult securities counsel, and strengthen disclosure and insider-trading controls.

Conclusion

Crypto treasury firms are under heightened scrutiny as regulators probe potential insider trading; companies and investors should monitor enforcement developments closely. Strengthened governance and clear disclosures will determine whether corporate treasuries remain a durable feature of corporate balance sheets as ETFs and other products evolve.