Where Does Pi Coin Stand Amid The $150 Billion Crypto Market Crash?

Pi Coin avoided being the worst performer during the $150 billion crypto crash, holding $0.263. A bounce from $0.260 could fuel recovery, but risks remain.

Pi Coin has slowed its decline after last week’s crash that pushed the token to a new all-time low.

While broader market conditions remain weak following the $150 billion crash in the last 24 hours, the altcoin is showing signs of stability. Investors’ cautious optimism is critical in keeping Pi Coin from deeper losses.

Pi Coin Finds Support

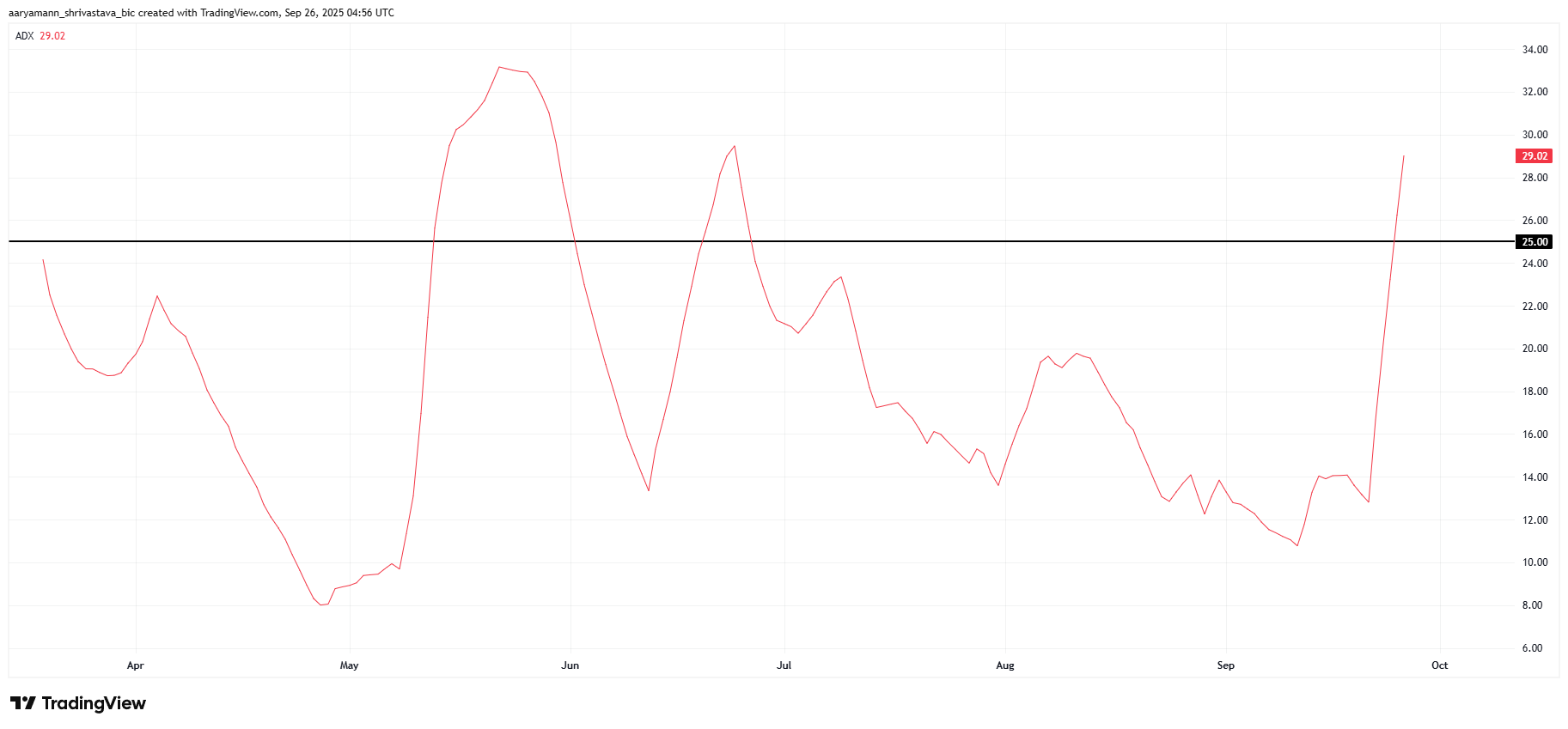

The Average Directional Index (ADX) highlights that bearish momentum is strengthening. The indicator shows Pi Coin locked in a downtrend, and its position above the 25.0 threshold confirms that momentum is gaining traction..

In Pi Coin’s case, the indicator confirms sellers are firmly in control. Unless external support arrives, the token could face difficulties in reversing this trend, leaving its price vulnerable to additional downward pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Pi Coin ADX. Source:

Pi Coin ADX. Source:

Pi Coin ADX. Source:

Pi Coin ADX. Source:

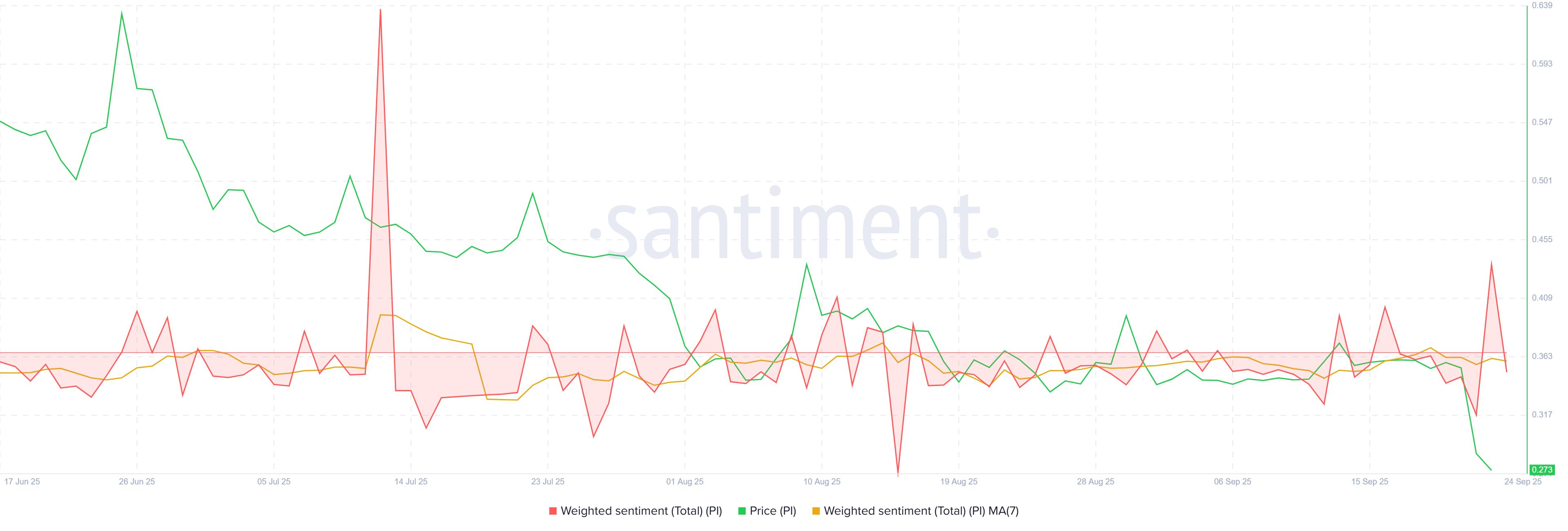

Despite the bearish signals, weighted sentiment is showing a sharp increase, reflecting investor confidence. The indicator has spiked to a two-month high, a surprising shift given Pi Coin’s recent low. This marks a rare moment where optimism is countering otherwise discouraging technical and market conditions.

The rise in sentiment suggests that investors may be preparing for a recovery. Such collective confidence is unusual after a crash, yet it shows that traders are unwilling to abandon Pi Coin. This optimism is preventing the altcoin from being labeled the “worst performer” of the day, even as losses persist.

Pi Coin Weighted Sentiment. Source:

Pi Coin Weighted Sentiment. Source:

Pi Coin Weighted Sentiment. Source:

Pi Coin Weighted Sentiment. Source:

PI Price May See Further Decline

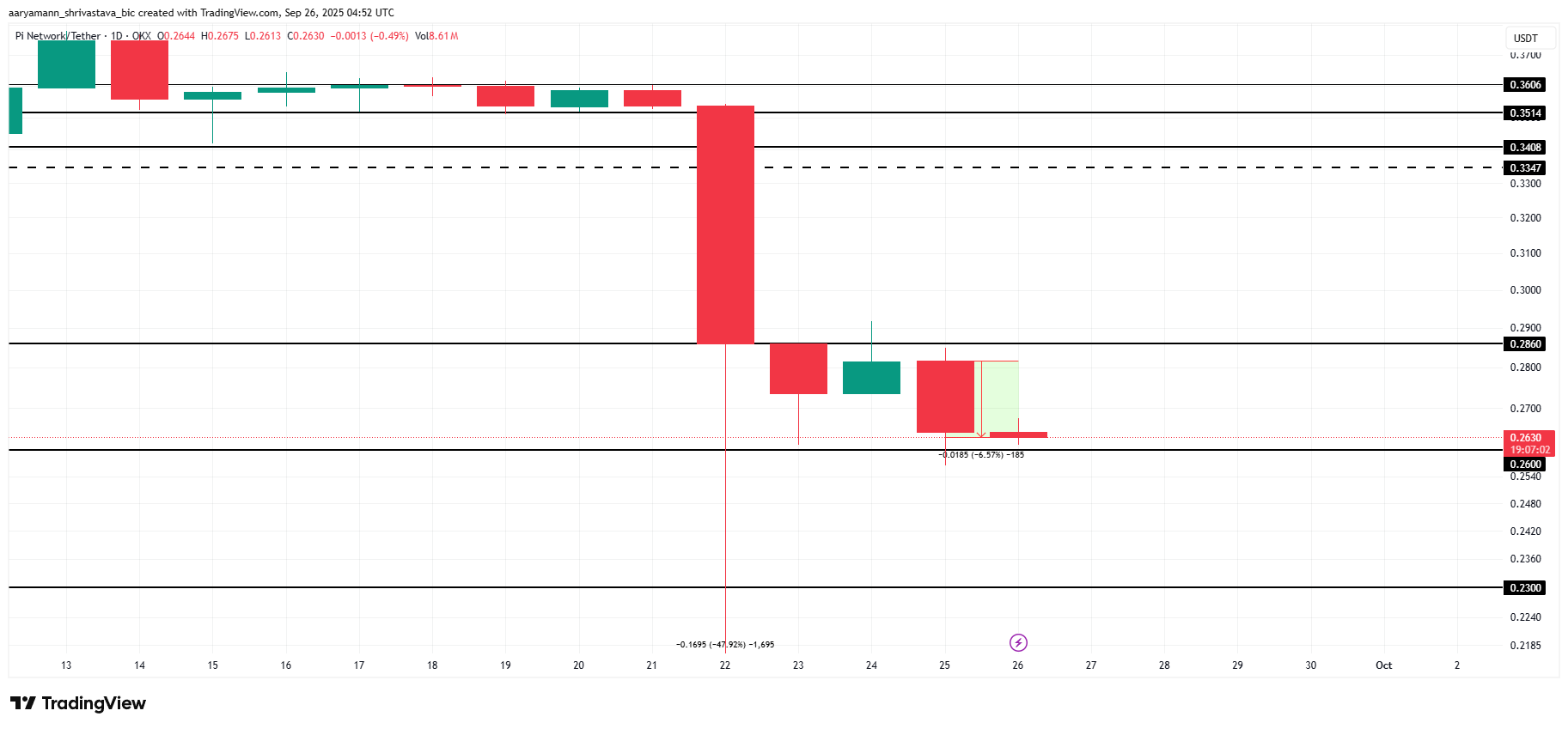

Pi Coin has been down slightly more than 6% in the past 24 hours, but it is not enough to make it one of the day’s top losers. The token is currently priced at $0.263, holding close to immediate support.

The $0.260 level is a critical threshold for traders. A break below this support could send Pi Coin toward $0.230, deepening investor concerns. The ADX momentum makes this risk more pressing in the short term.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

On the other hand, a bounce from $0.260 could provide relief. If Pi Coin reclaims $0.286 as support, it may attempt a recovery rally. Successfully breaching this level could invalidate the bearish outlook and help restore market confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.

Elon Musk at the Center of an Unprecedented Showdown with the EU

Stablecoin Payments: Stripe’s Tempo Blockchain Launches Public Testnet

Trump Launches Fed Auditions: Who Will Replace Powell?