XRP Has a Lower Dormancy Rate than Bitcoin and Ethereum: Report

A recent report from XPMarket shows that the XRP Ledger boasts incredibly high on-chain activity, featuring a lower dormancy rate than Bitcoin and Ethereum.

While the XRP price has fallen below $3 in the latest market downturn, the recent XPMarket report confirms that the XRPL continues to show signs of life. According to the report, XRP’s supply moves far more actively than Bitcoin or Ethereum, with less of it sitting idle for years.

Assessment Metrics

The study examined 7.016 million wallets using complete ledger data up to Sept. 23, 2025 (ledger 99,046,276). Importantly, the researchers excluded 35.3 billion XRP locked in escrow and reserves, focusing on the 64.7 billion circulating supply.

By comparison, analysts estimate that more than 20% of Bitcoin is dormant, while Ethereum also shows higher long-term inactivity. The sharp drop between 1 year and 2 years of inactivity suggests that XRPL wallets either become permanently inaccessible fairly quickly or continue to transact regularly.

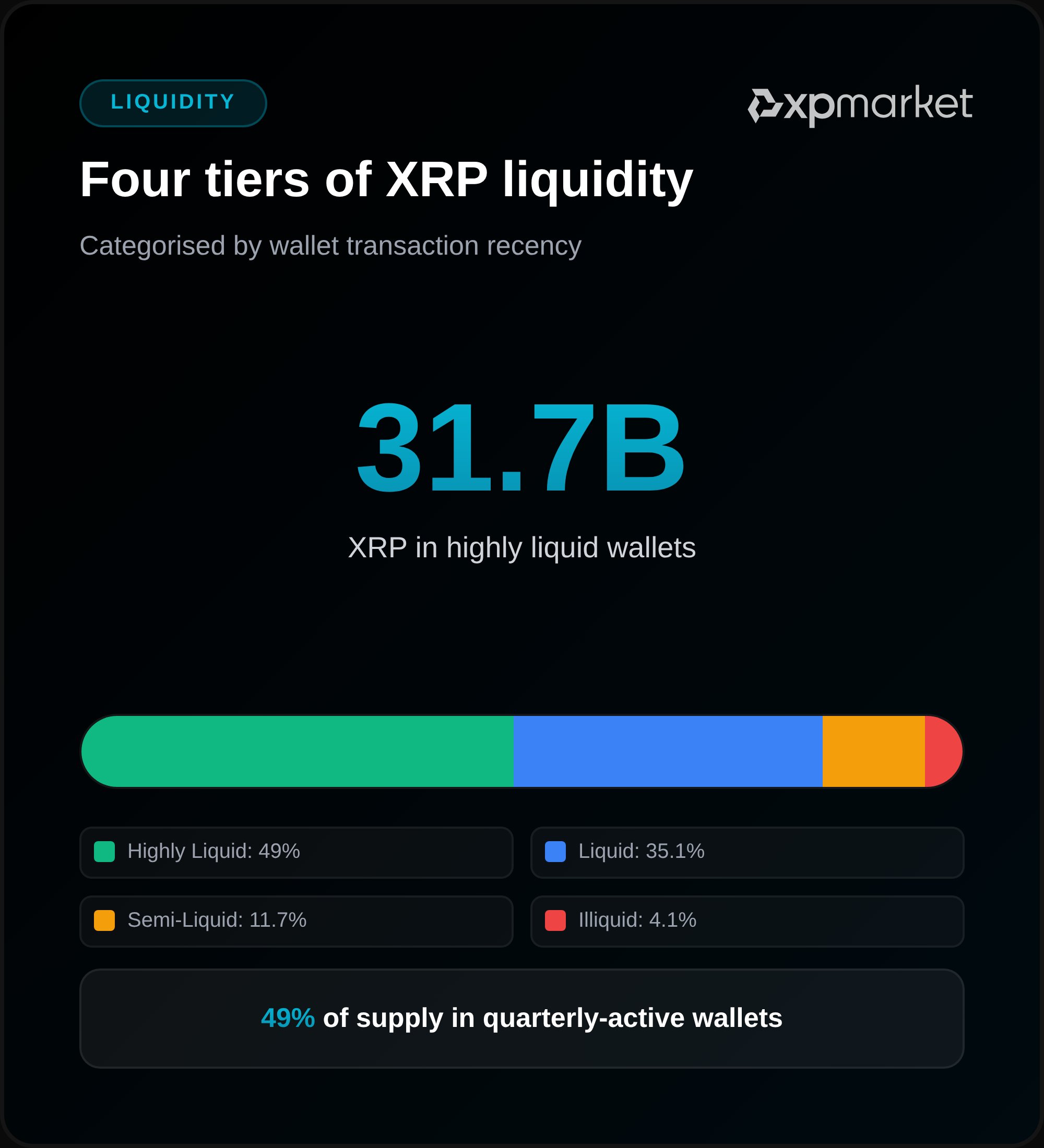

Moreover, liquidity has remained one of XRPL’s biggest strengths, according to the report. In particular, wallets active in the past year control 54.4 billion XRP, equal to 84.2% of the circulating supply. In the last 90 days, 31.7 billion XRP, or 49% of the supply, changed hands.

Meanwhile, another 22.7 billion XRP, or 35.1%, last moved between 3 months and 1 year ago, while 7.6 billion XRP, or 11.7%, shifted 1–2 years ago. Only 2.7 billion XRP, or 4.1%, has stayed dormant for longer than that. Overall, nearly half the supply circulates every quarter.

XRP Ledger Seeing Higher Wallet Activity

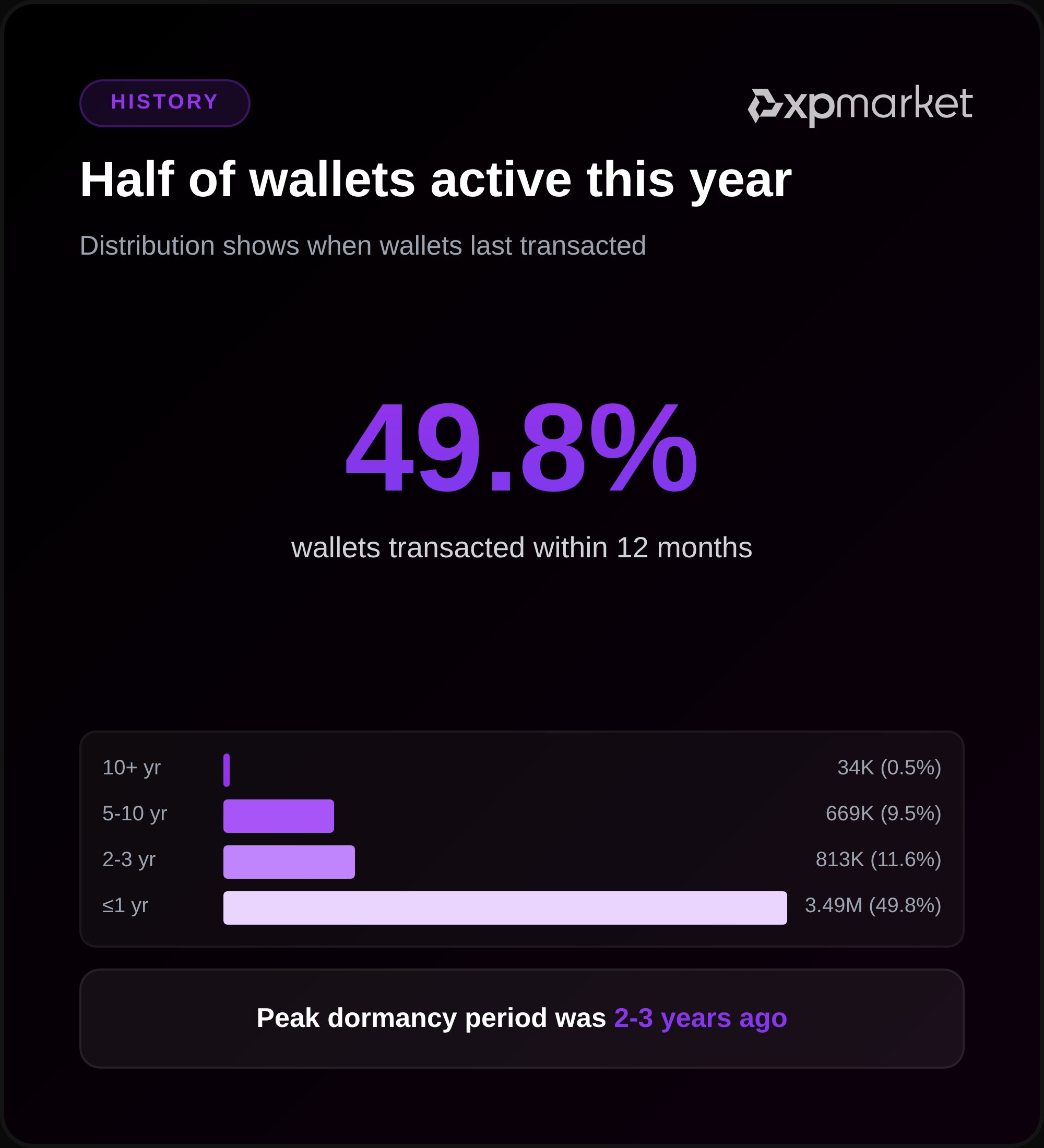

In terms of wallet activity, 49.8% of wallets transacted in the past year, and about 6.7% moved funds in the last 30 days, holding 34.8% of the supply. Another 15.1% transacted between 91 and 180 days ago, holding 30% of the supply. Also, the most recently active wallets carry larger balances, averaging 48,143 XRP for those that moved funds in the last month.

The report also examined wallets that have never sent a transaction. Specifically, XPMarket identified 308,736 such accounts, holding 2.4 billion XRP, or 3.8% of the circulating supply. Their median balance sits at 176 XRP, though large accounts raise the average. These wallets likely represent cold storage, inaccessible keys, or those with long-term holding strategies.

Whale Activity and Transaction Volume

Meanwhile, large holders show even higher engagement. XPMarket tracked 2,693 wallets with at least 1 million XRP. Together they hold 39 billion XRP, averaging 14.7 million each. Of these, 98.6% have been active within the past year, while only 37 wallets have stayed inactive for more than a year.

The network also shows depth across time. Around 11.6% of wallets last moved funds 2–3 years ago, while 0.5% date back to the genesis era and have remained active for more than 10 years.

Notably, independent data supports these findings. According to XRPScan, the XRP Ledger has averaged 23,000 daily active addresses since February 2025. Activity spiked to around 40,000 between November 2024 and January 2025, when XRP surged from $0.50 to over $3.

The network has also processed an average of 1.7 million transactions per day since April, while adding about 4,000 new accounts daily.

Speaking on the findings, XPMarket CEO Dr. Artur Kirjakulov said XRP’s low level of potentially lost supply compared to Bitcoin, along with near-universal whale participation, shows that XRPL has grown into institutional-grade infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Momentum Contrasts with Declining Network Engagement

- XRP's ETF inflows exceed $420M daily, contrasting with 50% lower on-chain payment volume and declining transaction counts. - Technical indicators show fragile bullish momentum below $2.28, while RSI rejection and EMA positioning highlight bearish pressure. - Fed's 81% rate cut probability and ETF-driven demand could push XRP toward $3, but network activity weakness raises sustainability doubts. - MACD buy signals clash with declining 50-day EMA ($2.38) and structural vulnerabilities in ETF-dependent pric

Ethereum News Update: North Korean Cybercriminals' Cross-Chain Money Laundering Reveals Vulnerabilities in Crypto Security

- North Korean hackers suspected in $36.8M Upbit breach used multi-chain laundering across Solana and Ethereum to obscure stolen assets. - Upbit froze transactions, pledged user reimbursements, and faces regulatory fines for delayed reporting amid a $10.3B merger with Naver. - Attack mirrors 2019 Lazarus tactics, exposing crypto industry vulnerabilities as stolen funds were rapidly converted into $1.6M via 185 wallets. - Market volatility surged with altcoin price spikes, while regulators intensify scrutin

Blazpay's 24-Hour Timer: AI-Powered Token Set to Dominate the 2025 Cryptocurrency Surge

- Blazpay's Phase 4 presale enters final 24 hours with $1.52M raised and 78.6% tokens sold, outpacing initial sales projections. - Analysts highlight 3.4x-5x return potential for early buyers, citing AI-powered trading tools, multichain infrastructure, and audit-backed security protocols. - Investors can purchase BLAZ tokens via USDT/ETH/BNB through the official portal, with referral incentives and gamified rewards boosting community engagement. - Project emphasizes real-world utility including automated t

Bitcoin News Update: MSCI Regulation Ignites Tension Between Bitcoin and Major Traditional Financial Institutions

- MSCI's proposed rule to exclude firms with over 50% crypto assets risks triggering $8.8B in forced Bitcoin sell-offs from index-tracking funds by 2026. - JPMorgan's analysis highlights existential threats for crypto-focused companies like Strategy (MSTR), which could face $2.8B in passive outflows alone. - Critics accuse MSCI and JPMorgan of bias, citing the bank's anti-crypto stance and the "binary cliff effect" of the 50% threshold destabilizing market eligibility. - The debate reflects a clash between