Moody’s Releases Cryptocurrency Report: Issues Warning

Credit rating agency Moody's announced in its report that cryptocurrency adoption in developing countries could put monetary policy sovereignty and financial resilience at risk.

The report noted that this risk increases as cryptocurrencies go beyond being just an investment tool and are now being used for savings and money transfers.

Moody's argued that the proliferation of dollar-denominated stablecoins, in particular, and the increasing use of pricing and payments in currencies other than local currencies could weaken the monetary policy transmission mechanism. This, it added, could reduce transparency and regulatory visibility, creating pressures for “cryptocurrency”—akin to unofficial dollarization.

The report also noted that cryptocurrencies provide new channels for capital flight through anonymous wallets and offshore exchanges, which could undermine exchange rate stability. Moody's noted that the heaviest adoption of crypto assets has been seen in Southeast Asia, Africa, and parts of Latin America, driven by factors such as high inflation, currency depreciation, and limited banking services.

In contrast, crypto adoption in developed economies is reportedly advancing largely due to institutional consolidation and regulatory clarity. According to the report, approximately 562 million people worldwide will be using cryptocurrencies by 2024, representing a 33% annual increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: BitMine's Ethereum Acquisition Echoes MicroStrategy's Bitcoin Strategy, Targets $3,600 Surge

- Ethereum fluctuates between $2,600–$3,000 as analysts monitor $2,800 support level for recovery signals. - BitMine Immersion Technologies accumulates 3% of Ethereum supply (3.63M ETH, $11.2B value), mirroring MicroStrategy's Bitcoin strategy. - Spot ETF inflows ($230.9M) and institutional demand, coupled with Apparent Demand metric hitting 26-month highs, suggest potential $3,600 rally if $2,800 support holds. - BitMine's $7.4B market cap and 51.5 current ratio highlight its unique financial position, wi

Bitcoin Updates: The Cryptocurrency’s Eco-Friendly Transformation—How Artificial Intelligence, Cloud Technology, and Renewable Energy Drive Responsible Expansion

- Crypto market shifts toward sustainability via AI, cloud, and blockchain, with Alibaba and Bybit leading green tech integration. - Bitcoin miners like CleanSpark leverage renewable energy and low-cost remote locations, while BI DeFi's $180M XRP inflows highlight institutional eco-friendly interest. - CoinShares pivots to diversified crypto ETFs amid regulatory scrutiny, mirroring industry trends toward high-margin sustainable products. - Crypto donations exceed $3M for Hong Kong fire relief, showcasing a

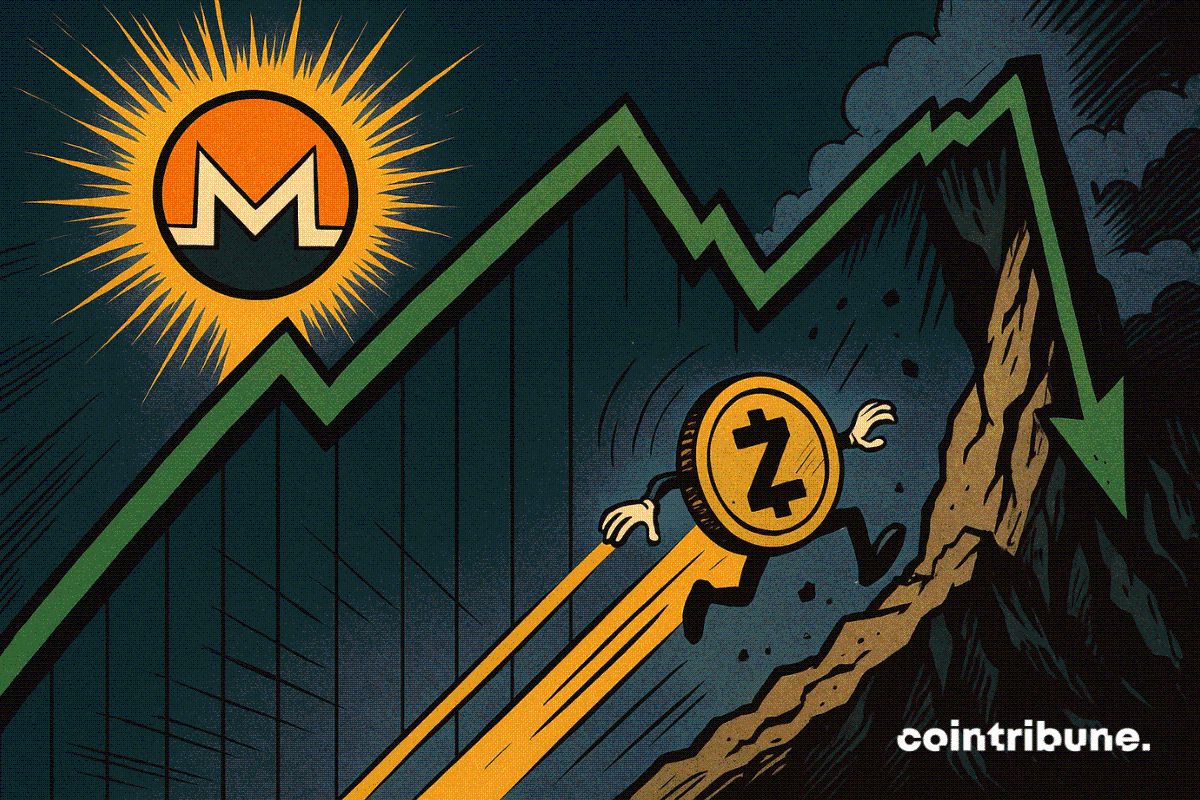

Monero Gains, Zcash Struggles In Privacy Coin Shake-up

Is Pump.fun (PUMP) Poised for a Bullish Move? This Fractal Setup Suggest So!