TOWNS experiences a 61.58% increase in 24 hours during turbulent short-term market movements

- TOWNS surged 61.58% in 24 hours to $0.819, contrasting a 1,215.05% weekly and 4,079.71% annual decline. - Analysts attribute the rebound to speculative trading amid oversold conditions, not fundamental improvements. - A backtesting strategy tests if technical indicators (RSI, volume) validate the bounce as a potential reversal signal. - Traders debate sustainability of the rally, with $0.90 identified as a key resistance level for trend confirmation.

On September 27, 2025,

Market experts have observed that this dramatic one-day rebound sharply contrasts with the token’s overall downward trajectory. Although the daily gain is notable, the price remains well below its former highs. Technical analysis points to speculation as the main driver behind the move, with traders taking advantage of the oversold market conditions that resulted from the extended slump.

During the latest trading session, several important technical levels were reached or tested, including major support and resistance points. The quick rebound has sparked debate over whether this is merely a brief rally or the beginning of a more significant trend reversal. Experts believe the next major resistance is above $0.90, and a breakout above this could indicate a wider shift in momentum. Still, without consistent trading volume or follow-through, the price action may remain limited to short-term swings.

TOWNS’s recent price movement has caught the eye of both individual and algorithmic traders, especially after the sharp daily increase. The token continues to be among the most volatile in its category, and this latest surge has fueled ongoing discussions about whether the recovery can last. While some see the bounce as a chance to buy, others are wary due to the token’s weak long-term outlook.

Backtest Hypothesis

A suggested backtesting approach examines if TOWNS’s recent daily spike fits a predictive framework that uses key technical signals like RSI, moving averages, and volume patterns. The model proposes that a rebound after a lengthy decline is more likely to hold if multiple technical indicators align. The hypothesis tests whether a simulated trade, entered at the start of the 24-hour rally, would have produced a positive outcome under these conditions.

The backtest uses specific entry and exit rules based on set criteria, such as RSI divergence, moving average crossovers, and sudden increases in volume. If the model had flagged the recent daily move as a potential rebound, it would have issued a buy alert. The outcome of this hypothetical trade could offer valuable insights into how the token behaves in similar scenarios and assist traders in refining their strategies for short-term price swings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

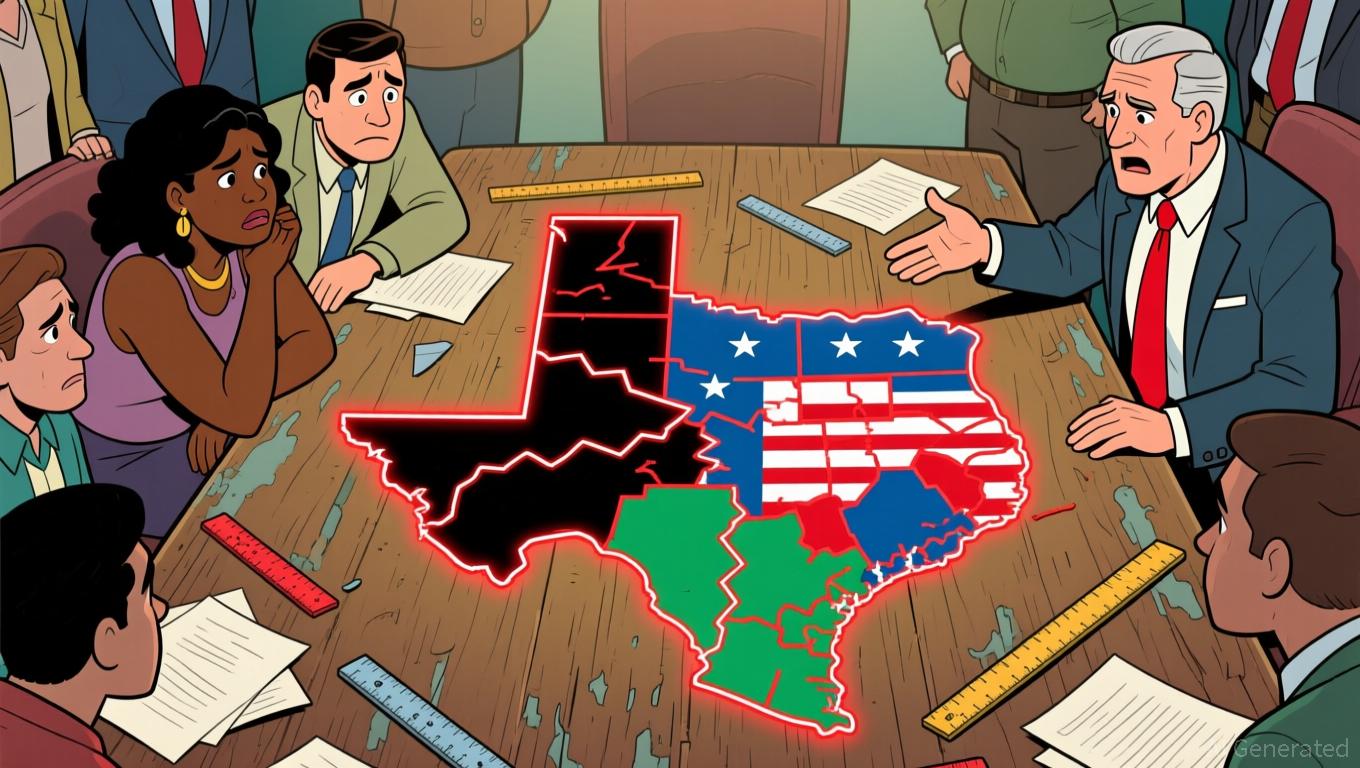

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov