A common pattern always emerges in the final stages of every bull market: a spike in Bitcoin (BTC) prices, followed by capital rotation to low-cap tokens, signaling the start of a new altseason. As such, Dogecoin experts have identified a list of top altcoins to buy, expected to excel in the coming months.

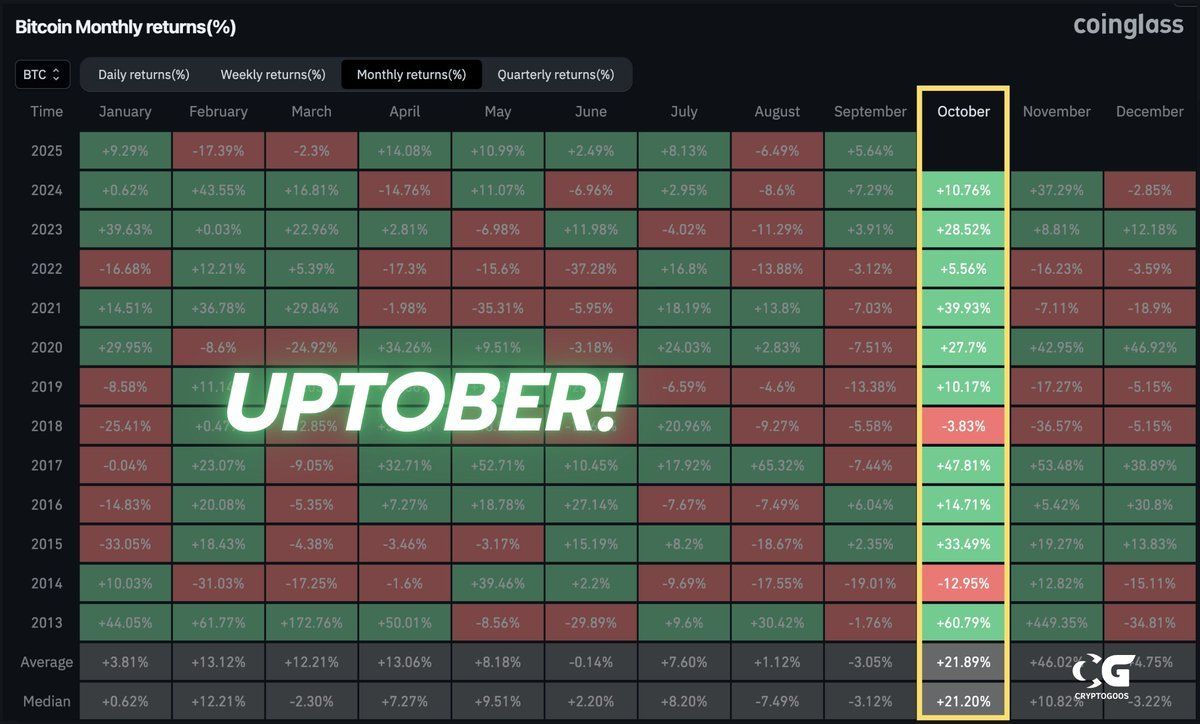

Crypto Market Patterns Point To 'Uptober' Surge

Despite Dogecoin's current 20% decline on a weekly basis, industry experts are now hopeful about what they refer to as "Uptober"—the anticipated market upswing that usually kicks off in October and the remainder of the year.

As seen in the image below, there have been notable increases during these next three months for crypto prices. On average, the Bitcoin price has increased by 21% in October of the previous bull markets, with impressive gains of 46% and 44% in November and December, respectively.

Dogecoin expert OxPhilantrop compared the current state of the market to the previous bullish cycle back in 2021, a year in which altcoin prices experienced extraordinary surges, with some of them exploding by as much as 481x.

Top Altcoins To Buy On The Radar

-

Ondo Foundation (ONDO): ONDO presents an interesting opportunity by providing on-chain software designed specifically for managing tokenized real-world assets (RWA). OxPhilantrop expects a jump in demand and accompanying price growth for the token, which is now priced at $1 and has a market capitalization of $3 billion.

-

The Ionet Protocol (IO): Positioned as the world's premier decentralized computing network, allowing machine learning engineers to gain access to scalable distributed clusters for a fraction of the cost of competing projects, is another one holding significant growth potential.

-

The PayDax protocol (PDP) : The last on the list, this rising protocol rewrites the norms of traditional banking by introducing a fully decentralized peer-to-peer (P2P) financial system, dubbed by experts as "the people's DeFi bank."

Dogecoin Expert Endorses PayDax As The Prime Altcoin

Key to PayDax's demand, visibility, and adoption across more than 20 countries, with a community of more than 10,000 users, are collaborations with auction house giants Brinks, Sotheby's, and courier Onfido, highlighting the platform's security and authenticity.

PayDax is committed to leading industry advancements with top-tier technologies, as evidenced by its collaborations and future partnerships with DeFi Oracles like Chainlink (LINK).

Exploring The PayDax Protocol (PDP) Features

APY Rewards:

Protocol staking → up to 6% annual percentage yield (APY)

P2P lending → up to 15.2% APY

Redemption Pool (insurance) → up to 20% APY

Yield farming (leveraged 5x) → up to 41.25% APY

Key Pillars

-

Security and Transparency: PayDax has been distinguished in the expert community given its focus on ongoing smart contract audits by Assure DeFi, global regulatory compliance, which counter the risks associated with projects in presale stages, characterized by scams, rug pulls, and poor transparency.

-

Community Engagement: Regular interaction through ask me anything (AMAs), podcasts, and video updates reinforces the protocol's transparency and accountability, led by a fully disclosed executive team, which include its CEO John Richardson, CTO Callum Waterstone, and CMO Matej Petrik.