Bitcoin derivatives, especially options and futures, are reducing BTC volatility and attracting institutional capital; increased options open interest and covered-call strategies point to deeper liquidity and could support Bitcoin’s market capitalization expansion toward multi‑trillion-dollar levels.

-

Derivatives expand institutional participation

-

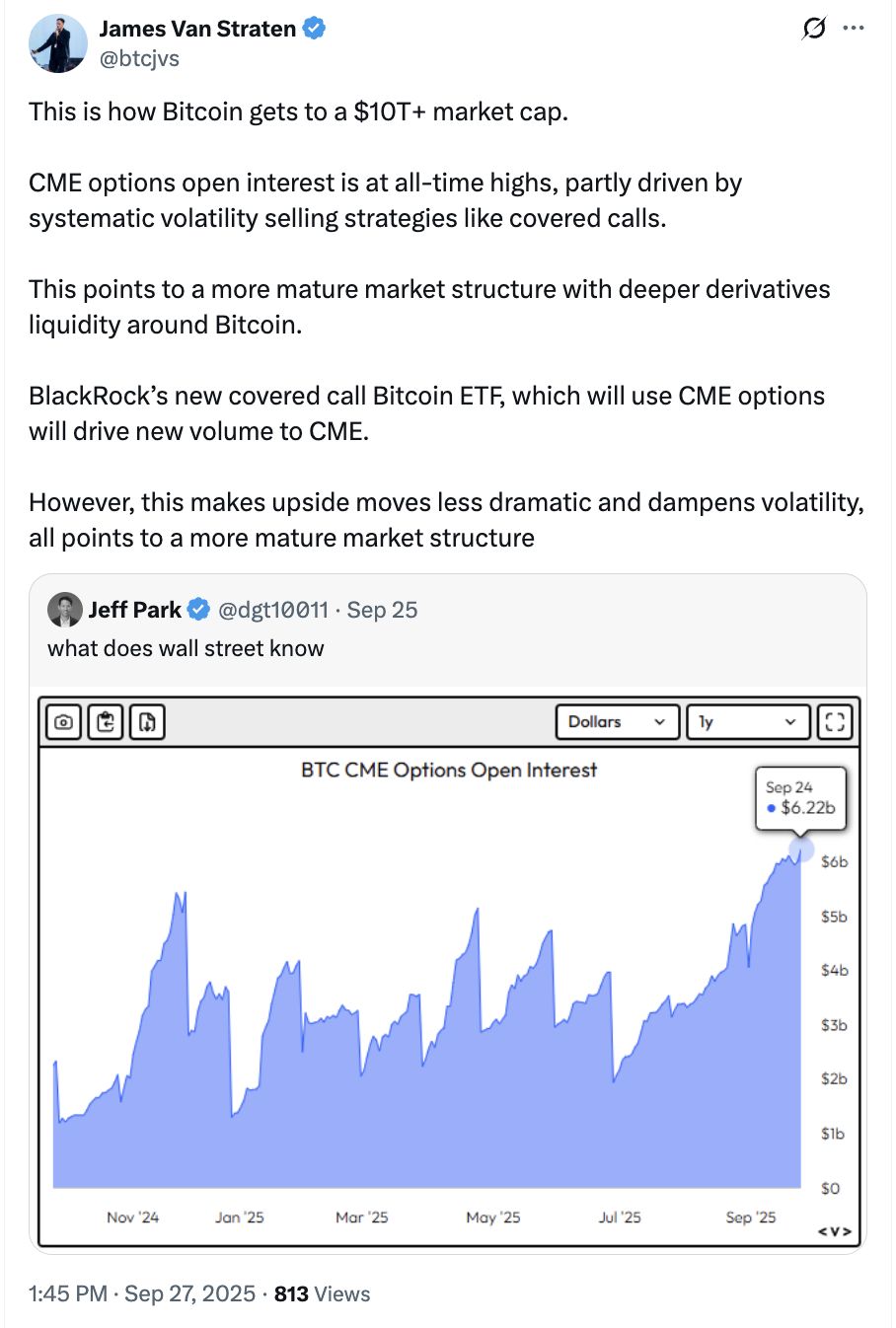

Options open interest and CME futures metrics show growing risk-management activity that cushions price swings.

-

Systematic strategies like covered calls are cited by analysts as evidence of a maturing Bitcoin market.

Bitcoin derivatives reduce volatility, attract institutions, and deepen liquidity — read how options and futures may push BTC toward a multi‑trillion market cap. Learn more.

How are Bitcoin derivatives driving market maturation?

Bitcoin derivatives — notably options and futures — provide instruments for hedging and yield strategies that reduce headline volatility and encourage institutional allocations. Growing options open interest on regulated venues and advanced strategies like covered calls indicate deeper liquidity and a more resilient market structure.

What evidence shows institutions are using derivatives to manage Bitcoin risk?

On regulated exchanges, futures and options open interest has expanded, reflecting institutional appetite for structured exposure. Analysts point to rising activity in the Chicago Mercantile Exchange (CME) and systematic volatility-selling strategies as signs institutions are using derivatives to hedge positions and generate yield.

Source: James Van Straten

Derivatives can dampen extreme moves by enabling market participants to offset directional risk. That reduces the frequency of crushing drawdowns but also tempers parabolic rallies. This tradeoff reflects maturation: lower tail risk and steadier liquidity may support higher long-term market capitalization, even if short-term returns moderate.

Is the four-year Bitcoin market cycle still relevant?

Many analysts argue the classic four‑year cycle is not dead. Human psychology, macro events, and news remain drivers. Institutional participation may smooth the amplitude of cycles but market sentiment and liquidity shocks can still produce distinct bull and bear phases.

How do experts view the future interplay of derivatives and investor behavior?

Market commentators diverge. Some say derivatives signal structural maturity that supports sustained inflows. Others maintain that investor psychology remains the dominant force — citing past collapses tied to institutional failures as reminders that institutions can also amplify risk when misallocated or leveraged.

Frequently Asked Questions

Will derivatives make Bitcoin less volatile long-term?

Derivatives are likely to reduce short-term volatility by enabling hedging and yield-generation, but they will not eliminate market cycles driven by macro shocks and sentiment. Expect lower amplitude swings over time, not zero volatility.

Can derivatives push Bitcoin to a $10 trillion market cap?

Derivatives alone cannot guarantee a $10 trillion valuation, but by improving liquidity and institutional access, they can remove barriers to large capital inflows that are necessary for such growth.

How should investors interpret rising options open interest?

Rising options open interest signals greater participation and more sophisticated hedging. It can indicate both increased demand for protection and greater capacity for market makers to provide liquidity.

Key Takeaways

- Derivatives deepen liquidity: Options and futures expand market capacity and support institutional participation.

- Volatility management: Hedging strategies reduce extreme drawdowns but can moderate rapid upside moves.

- Cycle persistence: Institutional tools alter amplitude, not the existence, of market cycles; sentiment remains influential.

Conclusion

As Bitcoin derivatives markets grow, they provide measurable proof of structural maturation — deeper liquidity, improved risk management, and clearer pathways for institutional capital. While derivatives can help pave the way toward multi‑trillion market capitalization, investor psychology and macro forces will continue to shape cycle dynamics. Monitor derivatives metrics alongside sentiment and macro indicators to evaluate long‑term trends.