Key Notes

- Solana price holds above $200 despite weakened volume, supported by Wrapped Bitcoin inflows and ETF speculation.

- WBTC supply on Solana surpasses $1 billion, marking five straight months of growth.

- Cyber Hornet files an ETF that blends Solana futures with S&P 500 stocks, signaling Wall Street’s gradual integration of crypto.

Solana (SOL) price managed to avoid a close below the $200 despite a significant decline in trading volume. A $1 billion inflow of Wrapped Bitcoin minted on Solana and another vital ETF filing from US firm Cyber Hornet, were among key events that boosted Solana’s resilient showing over the weekend.

On Friday, Solana news aggregator SolanaFloor alerted the community to wrapped Bitcoin (WBTC) supply on Solana crossing the $1 billion milestone. According to the Dune chart shared in the post, Solana’s WBTC supply has recorded five consecutive month-on-month growth spurts since May 2025.

🚨NEW: Wrapped Bitcoin supply on @Solana has hit an all-time high of 9,270 $BTC , surpassing $1.03B market cap onchain for the first time. pic.twitter.com/nkjxEHTt7D

— SolanaFloor (@SolanaFloor) September 26, 2025

This signals that recent innovative network upgrades have seen Solana emerge as a top destination for investors seeking passive income on their BTC holdings as the market consolidates. If this positive impact from the active inflows from BTC holders trend has been pivotal to the Solana price, it has avoided major downswings below $200.

Cyber Hornet ETF Filling Could Trigger Delayed SOL Price Reaction

Solana’s inclusion in Cyber Hornet ETF Filing is another key event that may not have been fully priced in before the market closed official markets on Friday. Cyber Hornet Trust disclosed plans to launch three ETFs that integrate S&P 500 equities with crypto futures exposure.

Cyber Hornet files FORM N-1A launch three ETFs combining S&P 500 stocks with Ether, Solana, and XRP futures | Source: SEC.gov

According to the SEC filing dated Sept 26, one proposed vehicle will allocate 75% of assets to large-cap U.S. equities while dedicating 25% to Solana futures. The fund provides indirect crypto exposure via CME-listed contracts and regulated exchanges .

If approved, the ETF will trade on Nasdaq, giving traditional investors another diversified and regulated exposure to the Solana ecosystem.

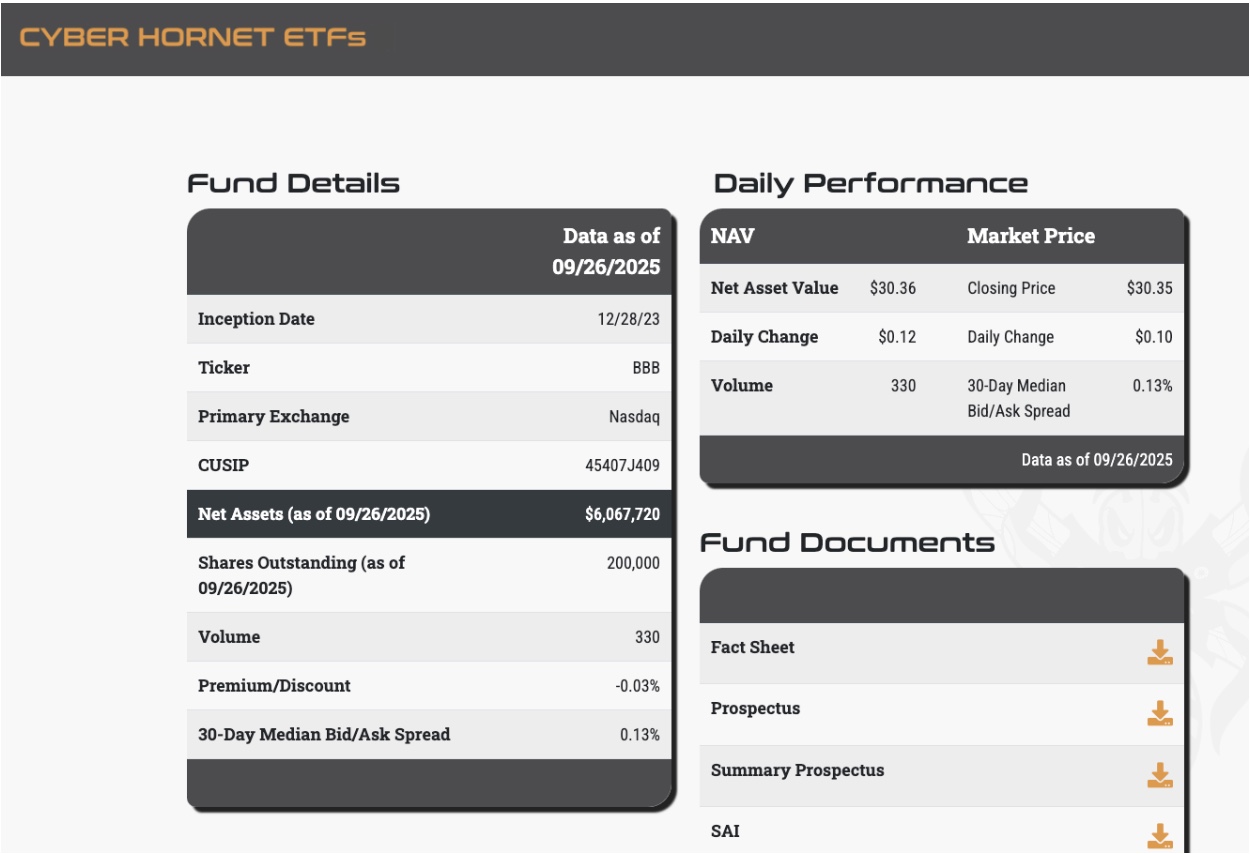

Cyber Hornet Trust S&P 500 and Bitcoin 75/25 Strategy ETF (BBB) Performance as of Sept 28, 2025 | Source: cyberhornetetfs.com

Notably, Cyber Hornet Trust currently manages a similar ETF product, the S&P 500 and Bitcoin 75/25 Strategy ETF ( BBB ), which as of September 26, has attracted net assets worth $6 million.

The latest filing complements Cyber Hornet’s existing Bitcoin 75/25 ETF, signaling an intent to expand coverage into major altcoins. S

Subject to approval, Solana’s inclusion in Cyber Hornet’s latest filing further emphasizes its preference among corporate investors, especially those seeking additional upside from yield income.

Solana Price Forecast: Is $250 Rebound in Play for the Week Ahead?

Solana price consolidated near $203 at press time, after defending the $200 floor. However, technical indicators on the SOLUSD daily price chart reveal mixed signals.

The Keltner Channel places immediate resistance near $216.98, aligning with the midline. A breakout above this level could spark momentum toward the upper channel at $239.24. Conversely, the lower channel at $194.72 remains the key downside marker, with failure to hold potentially exposing further declines.

Solana (SOL) Technical Price Forecast | Source: TradingView

The Volatility Stop (VStop) indicator sits near $215.24, suggesting bulls must reclaim this level to neutralize ongoing bearish momentum. The Relative Strength Index (RSI) at 42.28 indicates that SOL remains in bearish territory but is trending upward, suggesting a possible relief rally if buying persists.

Sustained defense of the $200 support, combined with a push above $217, could unlock a rebound toward $239. If bulls remain dominant, a breakout beyond the upper Kelter channel ban would validate a $250 target, especially if WBTC inflows and ETF enthusiasm sustain institutional interest.

On the downside, failure to clear $215 resistance could see Solana price enter a prolonged correction phase toward $194.

Best Wallet (BEST)新进展:项目融资动态

Amid Solana’s recent price consolidation above $200, Best Wallet (BEST) has also emerged as a standout early-stage project. Designed as a multi-chain storage solution, it emphasizes institutional-grade security features to address vulnerabilities in current non-custodial wallets.

Best Wallet (BEST) 相关动态

Industry estimates hint that the non-custodial wallet market could be worth more than $11 billion in the coming years, offering significant upside potential for Best Wallet’s early investors.