Date: Mon, Sept 29, 2025 | 11:34 AM GMT

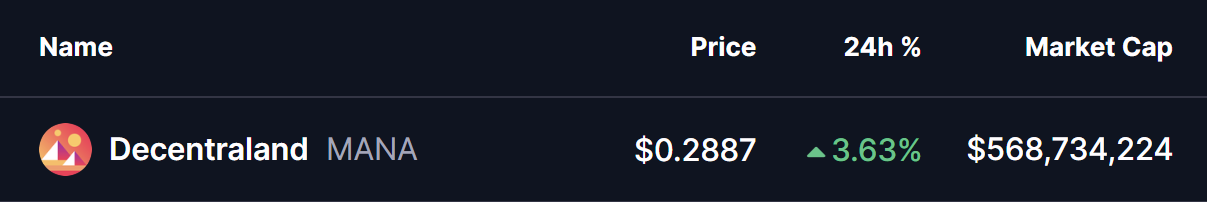

The cryptocurrency market is recovering from last week’s turbulence that pushed Ethereum (ETH) to a low of $3,839 before bouncing back above $4,100. With both Bitcoin (BTC) and ETH gaining more than 2% today, overall market sentiment has turned positive, providing a lift to major altcoins including Decentraland (MANA).

MANA is back in the green with modest gains, but the real focus is on the chart structure, where a potential bullish reversal setup may be taking shape.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Triangle Pattern in Play

On the daily chart, as highlighted by crypto analyst Jonathan, MANA has been consolidating within a symmetrical triangle — a neutral formation that often precedes a sharp breakout, either upward or downward.

The latest correction dragged the token down to the triangle’s lower boundary near $0.2723, which has been acting as a strong support zone in recent trading sessions. Currently, MANA is trading at $0.2893, hovering just below the 100-day moving average (MA) at $0.2930, a level that has served as an important barrier for bulls.

Decentraland (MANA) 2D Chart./ Credits: @JohncyCrypto (X)

Decentraland (MANA) 2D Chart./ Credits: @JohncyCrypto (X)

Reclaiming this MA could be the first signal of renewed momentum, potentially setting the stage for a stronger rebound.

What’s Next for MANA?

If MANA manages to defend the ascending support trendline and secure a close above the 100-day MA, the next logical target would be the triangle’s descending resistance trendline. A confirmed breakout above that level could unlock further upside potential, with price targets seen at $0.46, $0.57, and $0.76 in the medium term.

On the other hand, if MANA fails to break higher and faces rejection near resistance, the token may revisit the support trendline before bulls attempt another push upward.

For now, the setup suggests that MANA is at a critical juncture — either preparing for a bullish breakout or heading for one last test of its lower support levels.