Wisconsin crypto bill AB471 would exempt mining, staking, node operation and certain digital-asset exchanges from state money transmitter licensing, allowing businesses and individuals to accept and custody digital assets without DFI licenses, provided transactions do not convert assets to legal tender or bank deposits.

-

Exempts mining, staking and node operation from money transmitter rules

-

Exchanges are exempt only when no conversion to legal tender or bank deposits occurs

-

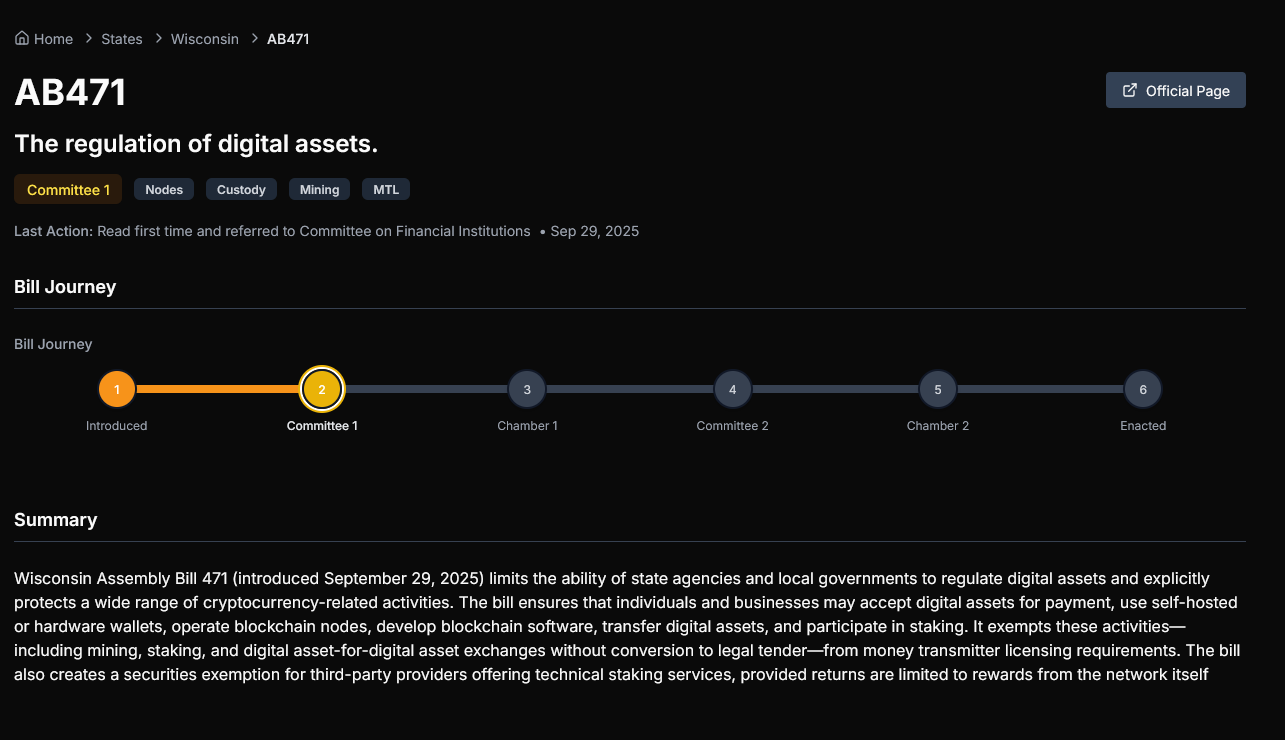

Bill progress tracked at 25% with referral to the Committee on Financial Institutions (source: Legiscan)

Wisconsin crypto bill AB471 could exempt mining, staking and exchanges from money-transmitter licensing—read how it affects businesses and developers. Learn next steps.

A new bill in Wisconsin could exempt local crypto users and businesses from money transmitter licenses, boosting mining, staking, and blockchain development.

Wisconsin lawmakers introduced Assembly Bill 471 on Monday to carve out explicit exemptions from state money transmitter licensing for a range of blockchain activities.

The bill text from the Wisconsin Legislative Reference Bureau clarifies that individuals and businesses would not need Department of Financial Institutions (DFI) money transmitter licenses for activities such as crypto mining, staking, node operation and blockchain software development.

Under AB471, exchanging digital assets is exempt when the transaction does not involve conversion to legal tender or deposits to deposit accounts. The proposal aims to reduce regulatory uncertainty for local developers and service providers.

Progress of AB471 Bill. Source: Bitcoin Laws

What is Wisconsin crypto bill AB471?

Wisconsin crypto bill AB471 is proposed state legislation that exempts certain blockchain activities from state money transmitter licensing. The bill specifically lists activities such as operating a node, developing blockchain software, transferring digital assets and participating in staking as non‑licensable when they don’t convert to legal tender.

How does AB471 change money-transmitter licensing rules?

The bill narrows the DFI’s licensing scope by defining explicit exemptions. It states that neither a state agency nor political subdivision may prohibit accepting digital assets as payment or custodying them in self‑hosted wallets or hardware wallets.

Key provisions include: 1) permission to operate nodes and participate in protocol operations; 2) allowance for blockchain software development; 3) clarity on peer transfers of digital assets; and 4) protected activity for staking on blockchain protocols. Source: Wisconsin Legislative Reference Bureau.

Who sponsors the bill and what is its legislative status?

AB471 is sponsored by seven Republican members in the Assembly with two Republican Senate co-sponsors. The measure is currently referred to the Committee on Financial Institutions and recorded at approximately 25% progression in Legiscan tracking.

Frequently Asked Questions

Will AB471 protect developers building blockchain software in Wisconsin?

Yes. AB471 explicitly allows developing software on blockchain protocols without a DFI money-transmitter license, reducing regulatory friction for local developers and startups.

How will AB471 affect exchanges operating in Wisconsin?

Exchanges that do not convert digital assets to legal tender or accept deposits may fall under the exemption. Exchanges performing fiat conversions or deposit services would still face licensing requirements.

Key Takeaways

- Regulatory clarity: AB471 aims to clearly exempt specific blockchain activities from money-transmitter licensing.

- Limited scope: Exemptions apply only when transactions avoid conversion to legal tender or bank deposits.

- Next steps: The bill is in committee with a 25% progression; stakeholders should monitor legislative movement and prepare compliance plans.

Conclusion

Assembly Bill 471 could materially reduce licensing burdens for mining, staking, node operation and blockchain development in Wisconsin, while keeping conversion-to-fiat activity regulated. Watch committee actions and legislative calendars for updates and prepare operational governance that respects the exemption’s scope. Publication: 2025-09-30. Author: COINOTAG.