ZeroHash Tie Lifts Morgan Stanley Bitcoin Infrastructure Reach

Morgan Stanley, a major force in global finance, is moving to broaden its digital asset portfolio. They’ve announced a partnership with ZeroHash, a key player in crypto infrastructure. According to Crypto News Hunters, this collaboration will bring crypto trading to Morgan Stanley’s E*Trade platform by mid-2026. Clients will be able to trade Bitcoin, Ethereum, and Solana right away at launch. Furthermore, this is a noteworthy action that obviously addresses the growing investor demand for digital assets.

Bitcoin Infrastructure Gains Momentum With ZeroHash Collaboration

Morgan Stanley’s new partnership with ZeroHash is a clear move to strengthen its position in the digital asset space. By integrating ZeroHash’s solid crypto infrastructure into E*Trade, Morgan Stanley will provide consumers with efficient, secure access to trading. Thus, that’s a major victory for consumers who are interested in handling crypto and conventional investments without the usual hassle.

The demand for crypto trading is growing fast, and Morgan Stanley is making sure it doesn’t get left behind. So, by tapping into ZeroHash’s expertise, the firm is showing it’s serious about delivering a full-service financial platform that covers every base.

Major players in finance have all begun integrating digital assets, and this partnership puts Morgan Stanley in the center of that development. In a market where innovation is everything, joining forces with ZeroHash is a smart, strategic step to maintain a lead.

Will New Wallets and Tokenization Attract Crypto Investors?

Morgan Stanley is moving beyond simple crypto trading. They’re building out a full-scale digital wallet system. This is about giving clients a secure, centralized place to manage all their digital assets. Additionally, it’ll easily integrate with the E*Trade platform, offering customers an effortless, intuitive experience instead of switching between apps.

On top of that, the bank is digging into tokenization. Basically, they want clients to be capable of holding digital versions of traditional assets. The platform is expanding to include equities, bonds, and even real estate. Also, it’s a push to modernize asset ownership, signaling the firm’s desire to set the standard in the digital finance space. Overall, Morgan Stanley is expanding its digital asset services in a manner that sets it as a leader as the market continues to change.

Bitcoin Infrastructure Moves Ahead With Institutional Backing And Innovation

Morgan Stanley’s partnership with ZeroHash isn’t an additional story. They’re moving into crypto trading and upgrading wallet infrastructure for their clients. So, basically, they’re investing in long-term Bitcoin infrastructure and signaling real commitment.

On top of that, their focus on tokenization shows they’re anticipating what’s next. Quite frankly, it’s a strategic decision. Additionally, the financial sector is evolving rapidly, and by intervening early, Morgan Stanley is aiming to lead. Also, they’re positioning themselves to stay competitive and relevant as the digital finance landscape keeps shifting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Climbs 0.75% as Rumors Swirl About SBF Clemency and Ongoing Legal Updates

- LUNA rose 0.75% in 24 hours, driven by speculation around Sam Bankman-Fried’s potential legal resolution. - Market speculation about SBF’s possible pardon and Terra-Luna collapse legal fallout fueled investor interest. - LUNA’s long-term recovery remains uncertain despite short-term gains, as legal clarity and ecosystem rebuilding are critical.

Bitcoin Leverage Liquidation Spike: Systemic Threats and Institutional Investor Responses in 2025

- 2025 Bitcoin leverage liquidations exposed systemic risks across DeFi, institutional portfolios, and traditional markets, triggered by macroeconomic tightening and regulatory uncertainty. - Institutions accelerated adoption of AI-driven risk frameworks, with 72% implementing crypto-specific strategies post-crisis to mitigate cascading losses. - MicroStrategy's 60% stock collapse and $3.5B Bitcoin ETF outflow highlighted cross-market contagion, while hedging tools helped institutions navigate volatility.

Bitcoin Price Fluctuations and Institutional Involvement in Late 2025: Optimal Timing for Long-Term Investment

- Bitcoin's 2025 volatility dropped to 43% amid $732B inflows and institutional-grade infrastructure maturing. - Regulatory clarity (MiCA/GENIUS Act) and $115B ETF assets (BlackRock/Fidelity) normalized crypto in institutional portfolios. - $90K price near Fibonacci support zones reflects technical strength and improved liquidity from tokenized assets. - Vanguard's $9T Bitcoin access and Fed policy shifts reinforced crypto's transition from niche to $4T mainstream asset class.

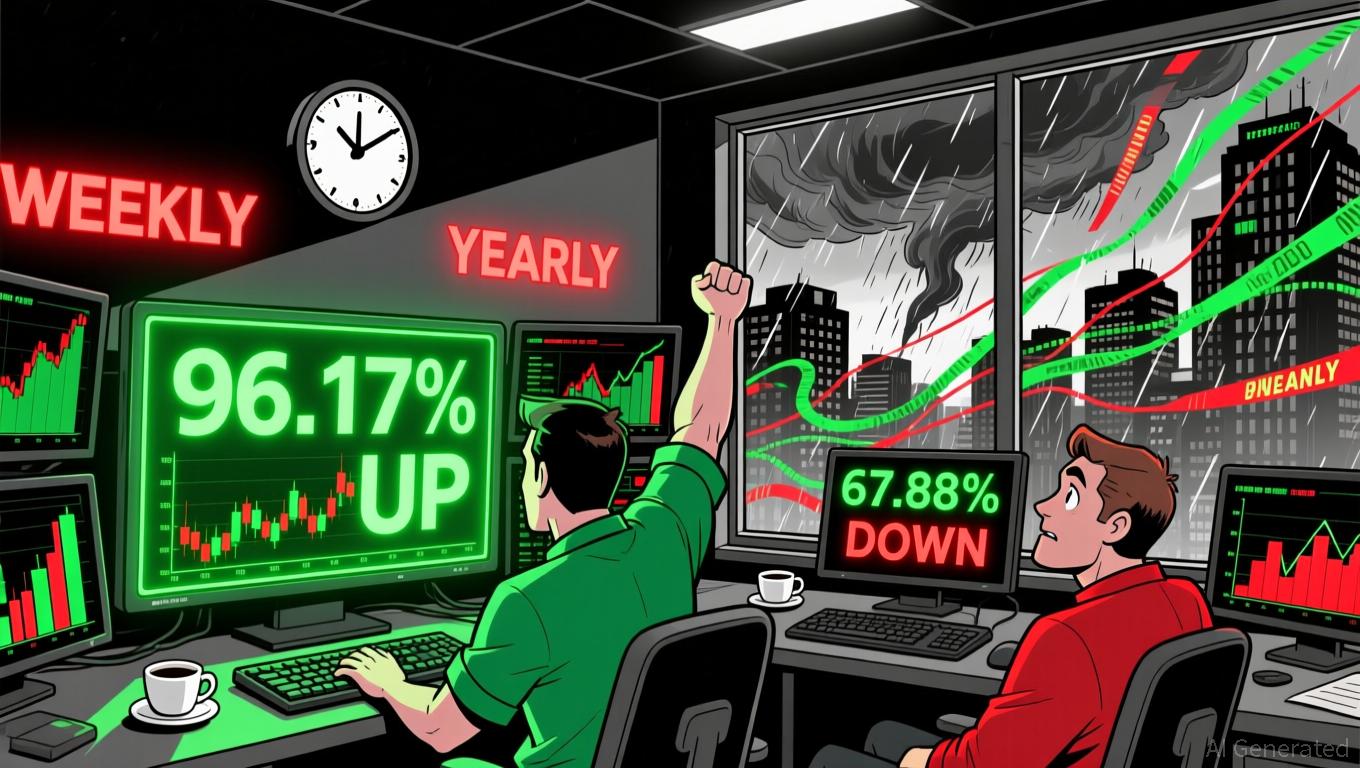

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.