Trader’s $17.6 Million XRP Short Partially Liquidated Again, Total Losses Exceed $3.6 Million

Falllling’s $17.6M XRP short faced another partial liquidation, raising total losses past $3.6M. XRP’s price hovers near $2.90, leaving the remaining position close to its $2.93 liquidation level.

A prominent crypto trader known as “Falllling” has seen another partial liquidation on his reopened $17.6 million short position against XRP, pushing total losses above $3.6 million amid ongoing high-leverage gambles.

As XRP climbs to around $2.90 with a 1.5% 24-hour gain, the remaining $14.3 million position teeters near its $2.93 liquidation threshold, underscoring the trader’s persistent bearish stance in a recovering market.

Losses From Earlier High-Leverage Bets

Falllling’s latest wager follows a costly series of leveraged trades. Blockchain analytics firm Lookonchain shows that Falllling previously shorted 1,366.67 BTC—valued around $150 million at 40x leverage—and 2.78 million XRP worth roughly $7.7 million at 20x leverage.

Both trades had tight liquidation thresholds: $110,280 for Bitcoin and $3.0665 for XRP. When prices moved higher over the weekend, the trader closed both positions at a loss, incurring an estimated $3.4 million setback.

Gambler 's short was partially liquidated again, and the total loss has now exceeded $3.6M!

— Lookonchain September 30, 2025

Despite these losses, XRP climbed 2% in the last 24 hours, trading above $2.80. The rally forced many short sellers to cover positions, while the broader crypto market showed modest recovery.

New $17.6M Short Position

Undeterred, Falllling opened a new high-stakes short on 6.17 million XRP, valued at roughly $17.6 million using 20x leverage. After another partial liquidation, the position dropped to 4.98 million XRP, now valued at $14.3 million.

The liquidation level sits at $2.93—just above the current market price of $2.90. This narrow margin leaves little room for error. On-chain data shows the position already has a paper loss of around $121,000.

Any upward move beyond $2.93 would wipe out the position, while a sharp decline could generate significant gains. Analysts warn that high-leverage strategies can quickly amplify both gains and losses, especially when liquidation levels are close to spot prices.

Broader Market Liquidations

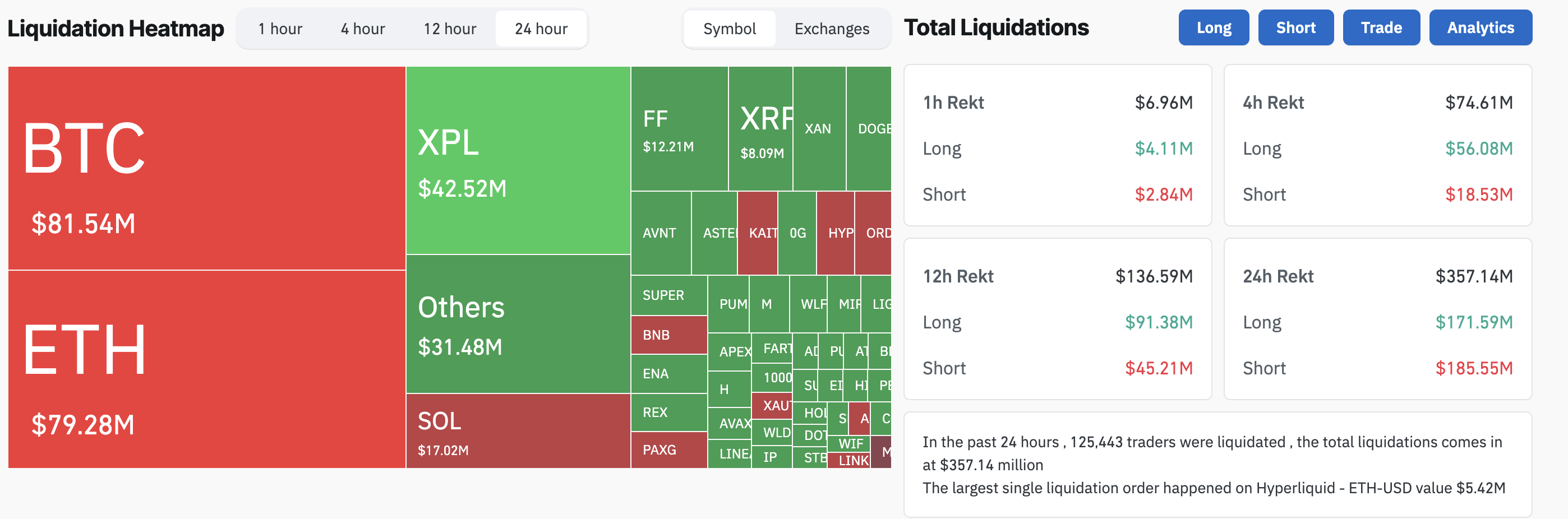

The weekend’s rally sparked liquidations across major cryptocurrencies. According to data, about $357.14 million in positions were liquidated within 24 hours, with short positions accounting for $185.55 million. Bitcoin led the market with $81.54 million in liquidations, while XRP accounted for $8.09 million.

Analysts warn that if XRP rises to $2.93—slightly above Falllling’s liquidation point—nearly $44 million in XRP shorts could be forced to close. The trader’s decision underscores ongoing skepticism from some market participants, even as prices stabilize and sentiment across the digital-asset sector improves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Grayscale Seeks Dogecoin ETF Approval: Meme Coin Gains Institutional Traction

- Grayscale files S-1 to convert Dogecoin Trust into spot ETF, seeking SEC approval by Nov 24, 2025. - This follows 2025 crypto ETF success and could drive $500M in inflows, leveraging Coinbase custody and Nasdaq listing. - Bloomberg analyst notes SEC's 20-day review window, suggesting potential rapid approval if no regulatory pushback occurs. - Dogecoin's volatility and regulatory scrutiny pose risks, but institutional adoption and social media momentum may drive growth.

Bitcoin News Update: Bitcoin Faces $83,000 Test as Whale Activity Drives Optimistic Predictions

- Bitcoin whale activity surged, with large holders transferring over 102,900 transactions above $100K and 29K above $1M, signaling a shift from selling to accumulation, per Santiment. - Analysts highlight $83K as a critical Fibonacci level, suggesting a successful defense could reignite Bitcoin's upward trajectory after stabilizing above $92K. - Derivatives markets show neutral funding rates and $83B daily volumes, indicating active participation despite drawdowns, while whale outflows suggest structured

Ethereum News Update: BlackRock's ETH Sell-Off Triggers Downward Trend as $2B Exits ETFs

- Ethereum ETFs face $2B outflows as BlackRock deposits $175.93M ETH into Coinbase Prime, signaling strategic offloading. - Death Cross pattern and oversold RSI highlight technical fragility, with price needing $3,200 to avoid $2,500 retest. - Institutional selling and macroeconomic uncertainty drive $73B ETP outflows since October, deepening bearish sentiment. - Analysts warn BlackRock's absence from crypto purchases since mid-2025 risks prolonged capitulation below $2,800 support.

Chainlink’s cross-chain advancements enhance liquidity, with LINK aiming to surpass the $14 mark

- Chainlink (LINK) partners with TAO Ventures and Project Rubicon to boost liquidity via CCIP, targeting a $14 price breakout. - The collaboration tokenizes Bittensor subnets into ERC-20 assets, enabling cross-chain DeFi access and staking rewards without selling assets. - Technical indicators (MACD convergence, ADX 37) suggest upward momentum, with analysts projecting $15–$20 price targets if $14 resistance breaks. - Institutional and retail interest grows as Chainlink's interoperability role strengthens,