CMCC Global Initiates $25M Fund for Sonic Ecosystem

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Immediate boost for Sonic (S) token price.

- Momentum for DeFi and consumer app growth.

CMCC Global’s Resonance Fund aims to fuel Sonic ecosystem growth with a $25 million investment, focusing on DeFi and consumer apps. This boost has already led to a significant 7% rise in the Sonic (S) token price.

Points Cover In This Article:

ToggleImpact on the Sonic Ecosystem

The event significantly impacts the Sonic ecosystem, accelerating its growth through DeFi and consumer apps investment, with immediate positive reactions from the market.

Fund Details and Leadership

CMCC Global has introduced the $25 million Resonance Fund to support the Sonic ecosystem . With a strong track record in digital assets, CMCC Global aims to enhance DeFi protocols and consumer applications, focusing on Fee Monetization infrastructure.

Mitchell Demeter, newly appointed CEO of Sonic Labs, and James Tran, Portfolio Manager at CMCC, are pivotal figures in this initiative. Demeter, noted for co-founding Netcoins, stated the fund will have a meaningful impact on present and future builders on Sonic.

“At CMCC Global, we are not driven by hype; we build independent, high-conviction theses on the assets and ecosystems we support. The fundamentals of the Sonic ecosystem are fully in place and are currently ahead of the market narrative. Sonic’s performant design and scalability are uniquely positioned to meet the demands of sophisticated DeFi, next-generation consumer apps, and new primitives. The time is right to capitalize on this foundational strength.” — James Tran, Portfolio Manager, Resonance, CMCC Global

Market Reaction

The announcement led to a 7% surge in Sonic (S) token price, with a 70% increase in trading volume, reflecting strong market optimism. This underscores the significant potential perceived by institutional investors in the Sonic ecosystem.

Focus on Fee Monetization

The fund’s focus on Fee Monetization tools emphasizes the potential for economic benefits and innovation in the blockchain space. As the Sonic ecosystem grows, the involvement of CMCC Global is seen as a boost to developer activity and market value.

Future Outlook

While the Sonic token experienced a price surge following the announcement, similar VC-driven funds historically show stabilization after the initial excitement. The strategic push also indicates a potential pathway for enhanced liquidity and ecosystem development.

No direct regulatory responses or substantial impacts on other major cryptocurrencies such as ETH or BTC have been reported. The fund retains a Sonic-centric approach, emphasizing its unique market positioning.

Investment Trends

CMCC Global’s initiative indicates a broader trend towards targeted investments in specialized crypto ecosystems. This move aligns with historical trends where focused venture capital can significantly elevate specific market segments and token performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

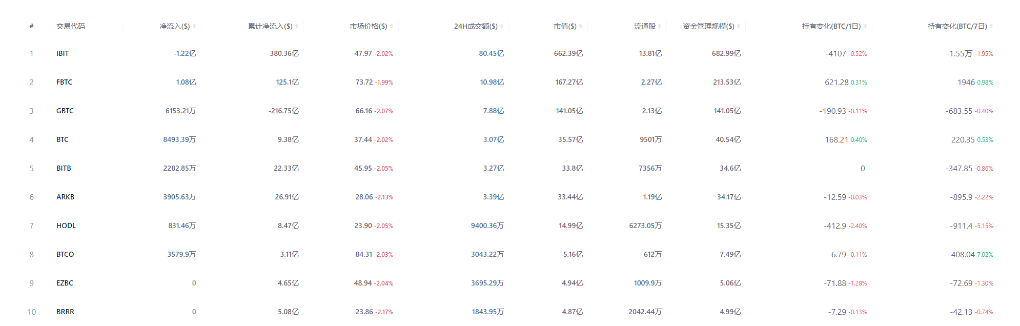

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?