LA Sheriff’s Deputy Pleads Guilty to Crypto Criminal Conspiracy

A former LA sheriff’s deputy has pleaded guilty to extortion and corruption charges tied to a crypto crime ring, facing decades in prison.

A former LA sheriff’s deputy just pleaded guilty to several crimes, acting as an enforcer in a greater crypto corruption scheme. He abused his authority to extort victims on behalf of his employer.

The incidents in question took place in 2021, but this is still an important breakthrough for crimefighters. The deputy in question could face over 20 years in prison.

One Deputy’s Crypto Crimes

Two months ago, a self-described “Crypto Godfather” made headlines with a notorious criminal ring, employing LA sheriff’s deputies to act as muscle in a crypto extortion scheme. This operation just took another blow, as one of the deputies in question pleaded guilty to corruption charges:

“Michael David Coberg, 44, of Eastvale, pleaded guilty to a two-count information charging him with conspiracy to commit extortion and conspiracy against rights. According to his plea agreement, Coberg – then employed as an LASD deputy and helicopter pilot – worked on the side with Adam Iza,” the relevant US Attorney’s Office claimed in a statement.

The report details a number of unsavory crypto crimes that Coberg and other LA sheriff’s deputies participated in. The “Godfather” paid him $20,000 a month for his services, planning to open another side hustle selling anabolic steroids. In the main, though, he acted as an enforcer.

Abusing A Badge for Extortion

In 2021, Coberg evidently took the lead in kidnapping a victim to extort $127,000 from him. Several security guards also facilitated this crime, but Coberg identified himself as an active-duty law enforcement officer to further increase his stature. He transported the victim, confiscated his passport, and threatened him with firearms over a two-day period.

As this incident shows, Coberg’s status as an LA sheriff’s deputy further enabled his crypto crimes. He and another corrupt deputy conspired to have one extortion victim arrested on false charges.

Specifically, they had one associate riding in a car with the target, carrying drugs in the vehicle. They then persuaded another policeman that the criminal accomplice was actually an informant, claiming that the victim was the owner of these drugs. This officer then arrested the extortion victim while the “Crypto Godfather” watched from nearby.

For these disturbing crypto crimes, this LA sheriff’s deputy will face at least 20 years in prison. He only pleaded guilty to these two offenses, and he may be able to reach a plea deal to reduce his time served. Still, his scamming days should be at an end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

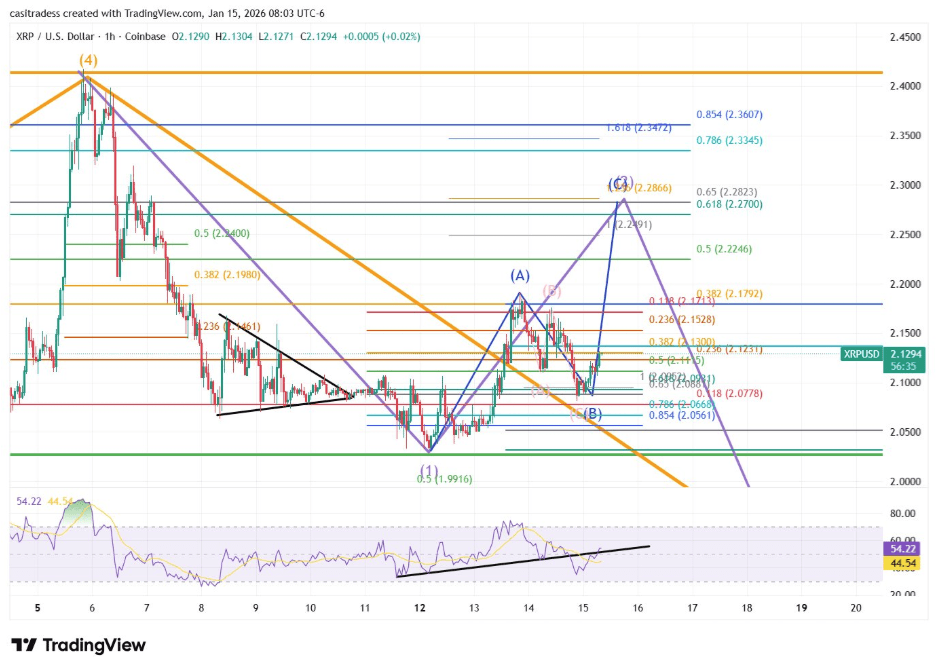

XRP Wave C Push On The Way: What Could Send Price Below $2

Top Cryptos Hold Strong Above Support Trendlines

BOJ Leaves Yen Observers Anxious for Hints of Interest Rate Increases