Date: Wed, Oct 01, 2025 | 06:50 PM GMT

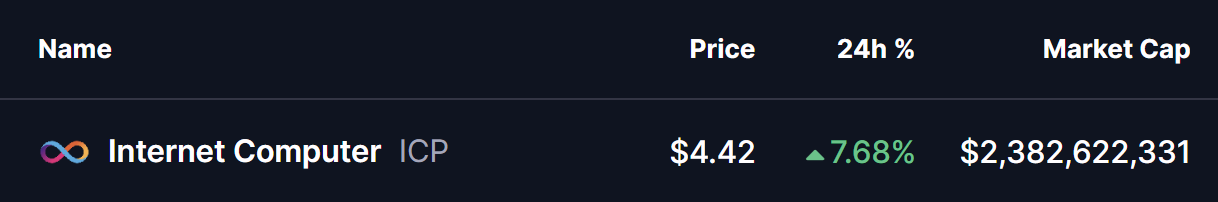

As the much-anticipated Q4 kicks off today, the cryptocurrency market is showing strength, with Bitcoin (BTC) surging over 3% and Ethereum (ETH) up more than 5%. Riding this momentum, several altcoins are beginning to show bullish signals — and Internet Computer (ICP) is one of them.

ICP has posted 7% gains today, and more importantly, its chart is highlighting the possibility of a “Power of 3” (PO3) structure — a setup that could set the stage for a meaningful reversal if confirmed.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play

On the daily chart, ICP’s price action appears to be following the three classic stages of the PO3 pattern:

Accumulation Phase

Between April and mid-September, ICP consolidated within a range capped at $6.08 resistance and supported near $4.57, suggesting accumulation as large players quietly positioned themselves.

Internet Computer (ICP) Daily Chart/Coinsprobe (Source: Tradingview)

Internet Computer (ICP) Daily Chart/Coinsprobe (Source: Tradingview)

Manipulation Phase

On Sept 22, ICP broke below its $4.57 support, sliding to a low of $3.99 before bouncing back toward the current zone near $4.42. This drop-and-recovery forms the “manipulation” phase, where weak hands are shaken out before a possible bullish push.

What’s Next for ICP?

Currently, ICP is still hovering in the manipulation zone, leaving room for short-term volatility. However, if buyers can reclaim the $4.57 level and break above the 200-day moving average ($5.16), it would strengthen the case for the expansion phase — the final and most powerful stage of the PO3 structure.

A confirmed move above $6.08 could then act as a launchpad for a rally toward the $8.17 target zone, which represents a potential 84% upside from its recent low.

For now, ICP’s structure is showing promise, but traders should be prepared for choppy price action before a clearer breakout signal emerges.