Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

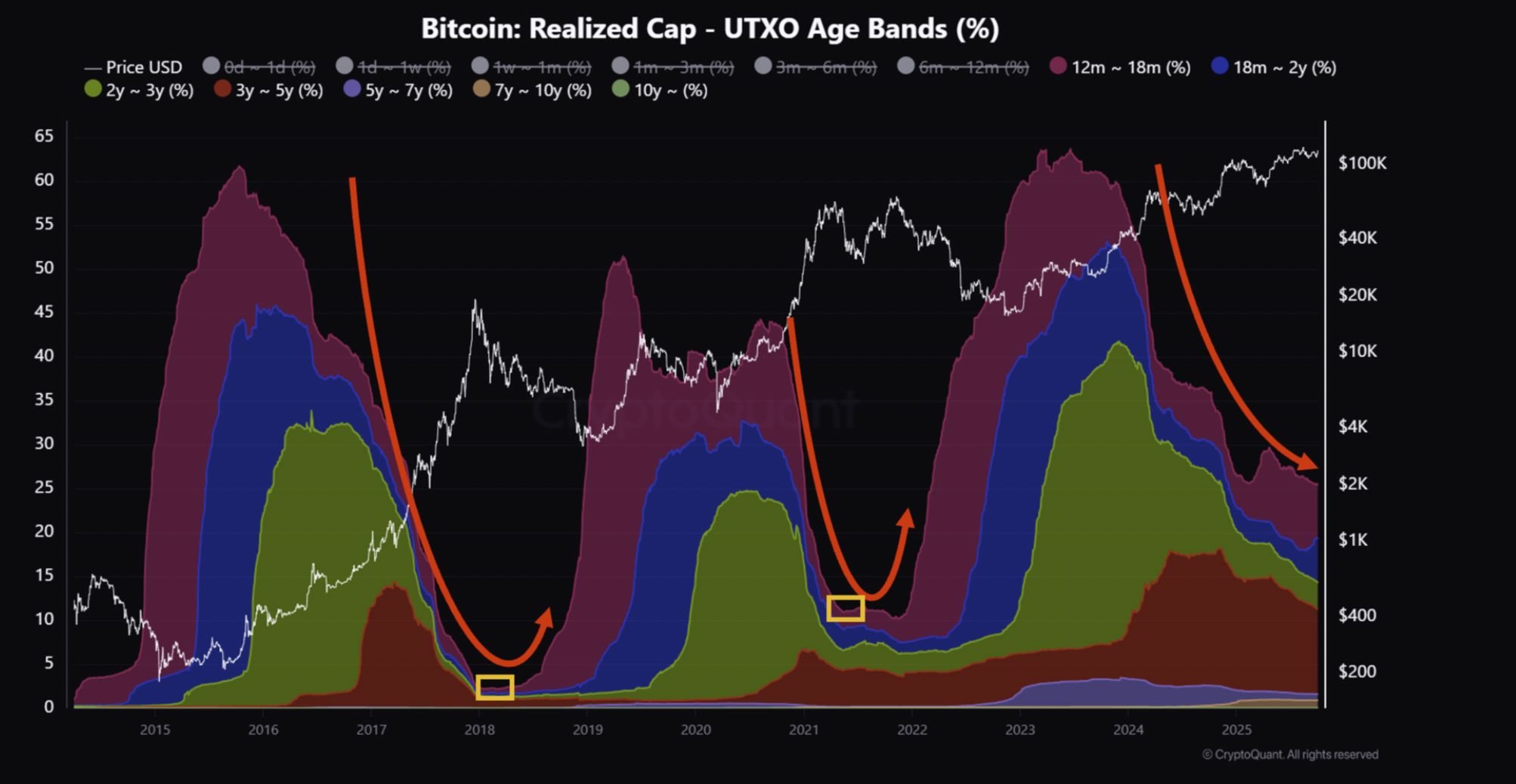

On-chain data back Uptober crypto market rally

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing the Enduring Infrastructure and Development Potential of the Xerox Campus Located in Webster, NY

- Xerox Campus in Webster, NY, receives $9.8M FAST NY Grant to modernize infrastructure and revitalize a 300-acre brownfield site. - EPA-compliant remediation and municipal road realignments enhance accessibility, reducing industrial vacancy rates to 2% by 2026. - Projected $1B industrial hub includes a $650M dairy facility, creating 250 jobs and driving 10.1% annual residential price growth. - Strategic infrastructure upgrades position the campus as a nearshoring hub, offering investors resilient ROI thro

ZK Atlas Enhancement and Its Influence on Layer-2 Expansion: Transforming Blockchain Transaction Models and Boosting DeFi Growth

- ZKsync's Atlas Upgrade introduces a modular architecture with RISC-V computation and streamlined proofs, achieving 15,000–43,000 TPS at $0.0001 per transaction. - EVM compatibility and shared liquidity architecture reduce migration friction for Ethereum apps while unifying L2/L3 liquidity, boosting TVL to $28 billion. - Gas fees dropped 70% since 2023, enabling micropayments and DeFi growth, with ZK token value rising 50% via deflationary buybacks and burns. - Analysts project 60.7% CAGR for ZK-based L2

YFI rises 5.33% as Yearn Finance retrieves $2.4 million after hack

- YFI surged 5.33% on Dec 2, 2025, reversing short-term losses after recovering $2.4M from a $9M yETH exploit on Nov 30. - Attackers exploited a legacy contract flaw to mint yETH, but Yearn Finance swiftly retrieved 857.49 pxETH via Plume and Dinero collaborations. - V2/V3 vaults ($600M+ assets) remained secure, while post-mortem audits and older contract reviews aim to prevent future vulnerabilities. - Transparent recovery efforts and community support stabilized sentiment, though DeFi security challenges