IOSG: When DeFi Meets the Mobile World, the Next Wave of Consumer-Grade Apps Is on the Way

Hyperliquid's tech stack has significantly lowered the barrier to entry for mobile frontend development, with retail users increasingly expecting a mobile-native transaction experience in traditional finance, a trend that is now extending to the cryptocurrency space.

Original Article Title: "IOSG Weekly Brief | DeFi Meets Mobile: The Next Wave of Consumer Apps is on the Horizon"

Original Article Author: Max, IOSG Ventures

Key Takeaways TL;DR

Mobileization of retail investment in traditional finance (tradfi) has already happened (zero commissions + app user experience). This trend is now extending to the cryptocurrency space, with retail users seeking a fast, familiar, low-friction mobile-native transaction experience.

Hyperliquid's technology stack (HyperEVM + CoreWriter + Builder Code) significantly lowers the development barrier for mobile frontends, while balancing the execution efficiency of a CEX-like experience with the advantages of a DEX (self-custody, fast listing, fewer geographical/KYC restrictions).

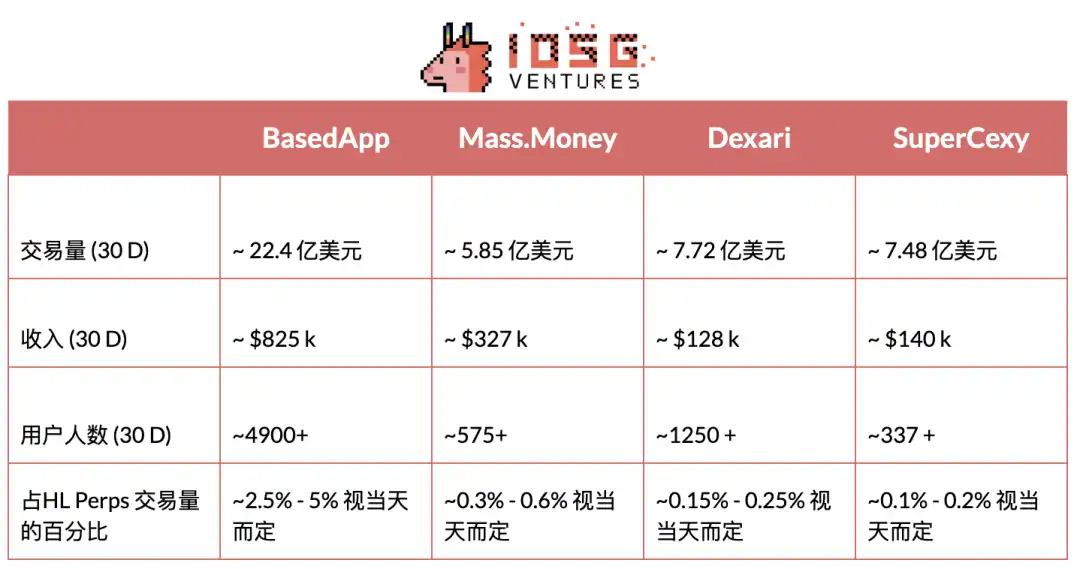

The wave of native mobile apps based on HL has begun: BasedApp, Mass.Money, Dexari, Supercexy. These apps have a daily trading volume of $50,000 (monthly recurring revenue of $1.5 million), accounting for 3-6% of HL perpetual contract volume. The target user base varies (crypto-native users, Web2 retail users, professional traders).

Why now? "Hyper-speculation" + creator content loop have raised retail user risk appetite; mobile apps reduce user onboarding time, simplify crypto complexity, and add sticky features (copy trading, fiat on-ramp, card payments, money market, yield tools).

Key Argument:

- Cryptocurrency mobile trading frontends benefit from the strong tailwind of Web2 mass audiences and retail behavior.

- For the cryptocurrency market to achieve scale and volume growth, more crypto-native mobile apps need to be provided for mainstream Web2 consumers.

- Compared to Web3 business models, this sector has truly sustainable scale revenue characteristics and extremely low marginal expansion costs.

Over the past few months, mobile trading + DeFi applications targeting retail consumers have significantly increased, with many of them built on Hyperliquid infrastructure. This article aims to delve into this vertical sector, analyze the current market-leading applications, and provide relevant insights.

Background

Overall, the scale of retail investor participation in traditional investment has seen tremendous growth over the past decade. This trend began in 2019 when several large U.S. brokers, in competition with Robinhood, lowered stock trading commissions to zero, significantly reducing the trading costs for small accounts. The COVID-19 pandemic in 2020 further accelerated this process: lockdown policies, stimulus checks, and continued optimization of mobile app experiences brought millions of newcomers into the market. By 2022, the Federal Reserve's Consumer Finance Survey showed a significant increase in stock market participation — 58% of U.S. households directly or indirectly own stocks, with direct ownership percentage jumping from 15% to 21%, marking the largest historical increase.

Retail trading's share in daily market activity continues to stand out: currently accounting for 20-30% of U.S. stock trading volume, well above pre-pandemic levels. This phenomenon is not limited to the U.S. and is equally pronounced globally: the number of investment accounts in India surged from tens of millions pre-pandemic to over 200 million by 2025. Investment channels have also continued to broaden — record inflows into ETFs in 2024-2025, along with the popularity of fractional share trading and mobile brokerage services, have provided retail investors with more convenient investment tools. The cost impact of zero commissions, the channel impact of mobile trading apps, and the liquidity impact of ETFs have collectively driven retail investors to enter the public markets on a large scale, making consumer-level investment apps a significant structural force in the market.

Mobile Trading Apps

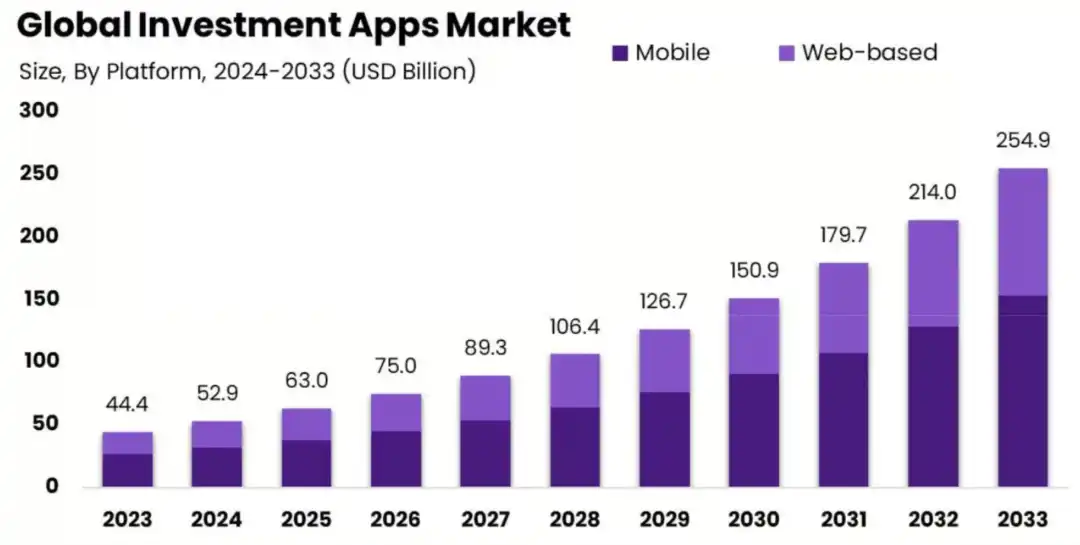

Since 2021, the vertical of mobile trading apps in the retail trading market has continued to expand, driven by the increasing penetration of mobile devices and the rise of a new generation of self-directed retail investors. The global investment app market size is expected to reach around $254.9 billion by 2033, with a compound annual growth rate (CAGR) of 19.1%.

Why are mobile trading apps so favored by retail investors? The main reasons can be summarized in two dimensions:

Social-Driven (All about gamification, gamblification)

Contemporary social culture is dominated by dopamine loops, gamified mechanisms, and hyper-speculative behaviors. The rise of the creator economy and short video platforms (such as TikTok and YouTube Shorts) has reshaped user behavior patterns, with people pursuing instant gratification, and mobile trading apps perfectly align with this demand on multiple levels.

On the social front, communities like Wall Street Bets on platforms like Reddit are filled with users showcasing massive gains and losses. The phenomenon of daily gains or losses exceeding $100,000 has become normalized, and retail users are gradually desensitized to such amounts. Many users disconnect their Robinhood account funds from real currency, viewing their portfolios as game chips. Coupled with rising living costs, widening wealth gaps, and people's negative emotions towards "overworking," many middle-class individuals believe that only through "hyper-speculation" can they achieve the American Dream — seeking extraordinary returns through high-risk investments.

Mobile trading apps have successfully captured this social and cultural dividend. By offering options for short-term trading, leverage products, instant execution, and a gamified user interface, these apps have successfully transitioned users from casinos to the stock market. Users now only need a smartphone to simultaneously experience dopamine rushes, gaming excitement, and speculative trading.

App Features

On the app features front, mobile trading apps have significantly optimized various dimensions. At the user onboarding stage, they have compressed the account opening process from time-consuming days of tedious paperwork to near-instant online operations. From identity verification to transaction execution, all user processes are integrated into a single interface, empowering users to comprehensively manage their investment portfolios.

On the trading experience end, by eliminating friction points of traditional brokerage models and incorporating new value propositions like fractional share purchasing and dollar-cost averaging, these platforms have simultaneously lowered financial and cognitive barriers to entry. Drawing from consumer design language familiar to mainstream apps has shortened the trading decision path, while personalized features such as curated asset lists and portfolio performance analysis sustain user engagement.

Furthermore, post-investment features such as performance breakdown reports and automated tax reporting bring the experience closer to a full-service financial app where users can perform all operations, rather than just a trading terminal. On the social front, content elements further lower usage barriers by providing a user-friendly sharing interface, fostering social engagement and incentives (e.g., behaviors driven by WSB forum). These features collectively explain why mobile platforms have become the default investment channel and a persistent driver of retail market participation.

What's the Impact on the Cryptocurrency Industry?

The mobile-first app trend has extended from the traditional finance/Web2 market into the Web3 space.

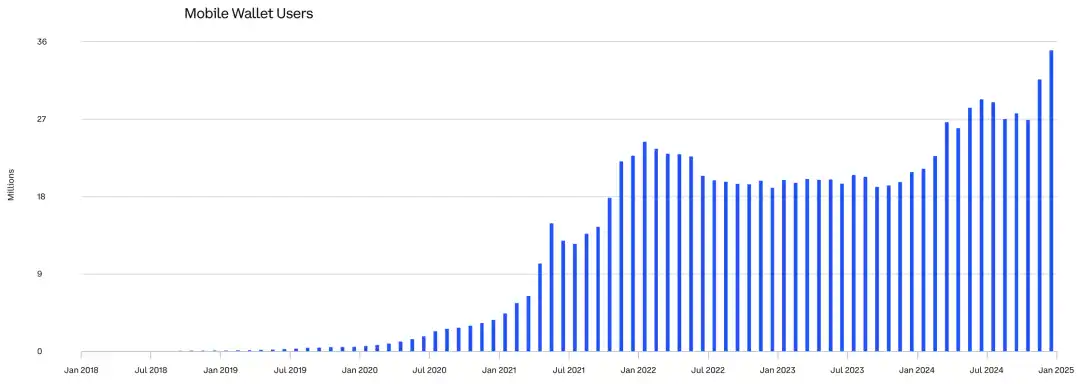

Over the past five years, there has been a significant increase in the usage of cryptocurrency wallet apps, demonstrating the market's demand for mobile-native crypto products. As transactions and yield are inherent features of cryptocurrency, perpetual contracts and DeFi naturally became the pioneer sectors transformed in the "mobilization" process.

With the rise of Hyperliquid since late 2024 and the launch of its modular, high-performance trading infrastructure, numerous mobile perpetual contract DEX trading and DeFi frontend products have started to be built on the HL infrastructure and flood the market.

Why Hyperliquid and DEX?

From a developer's perspective, the infrastructure of HyperEVM is highly attractive due to the powerful tools it provides. CoreWriter and precompiled contracts allow smart contracts on HyperEVM to directly interact with positions on HyperCore perpetual contracts, enabling unique use cases and near-instant execution. Builder code offers developers a clear incentive layer, allowing them to earn fee splits when users transact through their frontend. These features not only lower the development threshold but also make HyperEVM one of the most developer-friendly platforms, attracting top teams and talent to join. This is also why 99% of crypto mobile trading frontends choose to build on Hyperliquid.

As for why choose a DEX? Traders are generally attracted to the structural advantages of DEXes: providing a broader access opportunity by eliminating KYC and jurisdictional restrictions, faster listings and a wider range of tokens, as well as autonomy in fund custody. Previously, CEXes attracted retail users because they significantly reduced the complexity of participating in the market: providing multiple trading markets in a single mature web application, with instant execution, low slippage, and high liquidity, and integrating wallet management, stablecoin yields, fiat gateways, and other auxiliary functions. However, users had to bear significant counterparty risk and give up asset self-custody rights for this.

Hyperliquid is a platform that perfectly integrates all of this. This on-chain decentralized exchange platform enjoys both the structural advantages of a DEX perpetual contract platform and the liquidity, execution efficiency, and overall user experience of a CEX. Therefore, it has become the ideal liquidity layer for building mobile cryptocurrency trading applications.

So how does all of this relate to mobile wallet trading?

Thanks to the availability of this modular high-performance architecture, the development cost of building a mobile trading front end has become extremely low — this is precisely why a large number of related applications have begun to emerge in the market.

Currently, most mobile trading front ends offer similar functionality centered around perpetual contract trading, but some applications have begun to go beyond perpetual contracts, providing users with more auxiliary products. Overall, these applications generally have the following features:

- Fiat On-Ramp: Supporting various deposit methods such as credit/debit cards, bank transfers, Apple Pay, Google Pay, Venmo, etc.

- Investment Strategy Tools: Providing dollar-cost averaging plans, take-profit and stop-loss functions, and early access to new tokens

- Money Market Integration: One-stop access to DeFi lending protocols

- Yield Farming: Earning rewards through automatic compounding

- Dapp Explorer: Searching for and connecting to emerging decentralized applications

- Debit Card/Credit Card Services: Directly using self-custodied funds for spending

The implementation of these features has been made possible by Hyperliquid's infrastructure greatly simplifying the development difficulty of the core perpetual contract product, allowing teams to focus on innovation in other derivative areas. Due to the modular nature of the entire ecosystem, most projects based on HL can easily achieve multi-domain parallel development. Many applications can offer rich functionality, mainly attributed to: 1. The low development threshold of Hypercore builder code; 2. High integration willingness of other protocols

In addition, major applications are mainly competing in user experience/interface design and social brand building. Currently, the most promising representatives in the market include:

Basedapp

Currently, Based app is the most watched and fastest growing mobile trading frontend application in the market. In addition to offering perpetual contracts and spot trading, the platform has innovatively introduced a debit card/credit card solution directly linked to the user's trading wallet, supporting payment needs in everyday consumption scenarios. Its long-term goal is to transform into an emerging digital bank similar to Etherfi.

Mass.Money

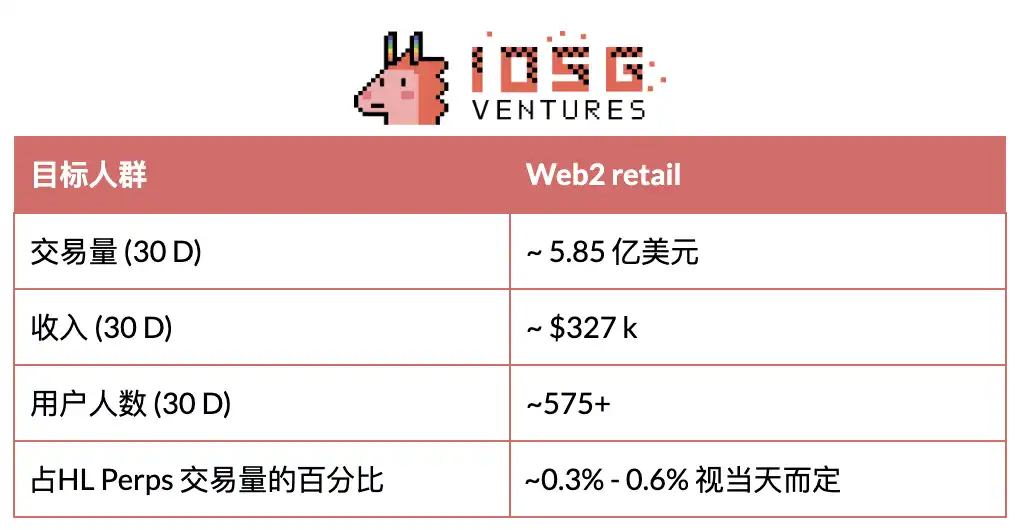

Closely following in the mobile trading frontend competition is Mass.money. Unlike Based app, this platform is more focused on the Web2 retail user base, a positioning that is fully reflected in the product design: in addition to standard HL perpetual contracts and spot trading, it integrates features such as Apple Pay deposit channels, social copy trading, DeFi money market access, and cross-chain EVM spot exchange for full-service offerings. Its interface design deeply integrates gamified elements, heavily drawing inspiration from Web2 consumer-facing app design language.

However, due to its higher fee structure and broader product portfolio, their single-user revenue and trading volume are significantly higher than Basedapp.

Dexari

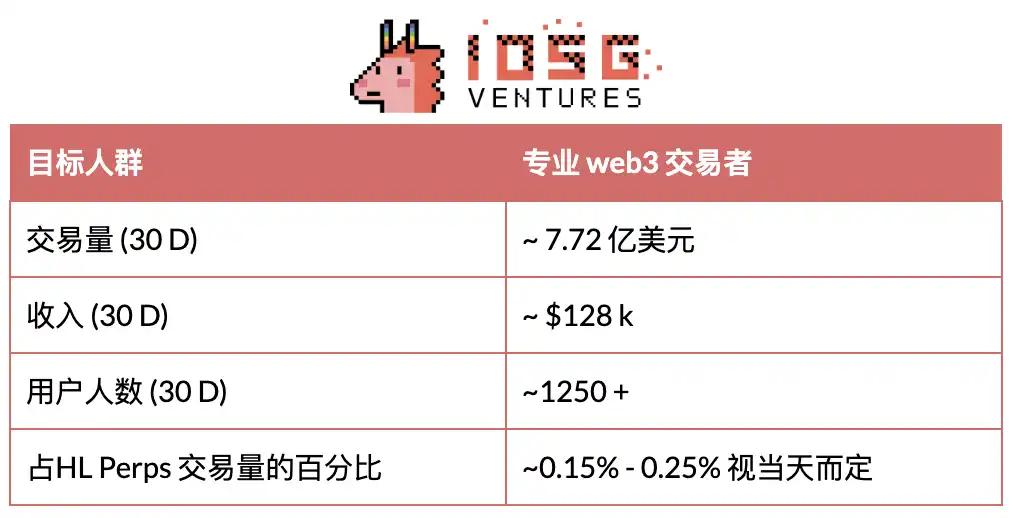

Following closely after Mass.money is Dexari. This is a mobile trading frontend focused on professional traders, purely emphasizing trading functions. Therefore, its main product features include HL perpetual contracts and spot trading, with user experience and interface design focusing on asset discovery features, analytical tools, and execution efficiency. Their goal is to become the Axiom (professional trading benchmark) in the mobile trading frontend field.

Supercexy

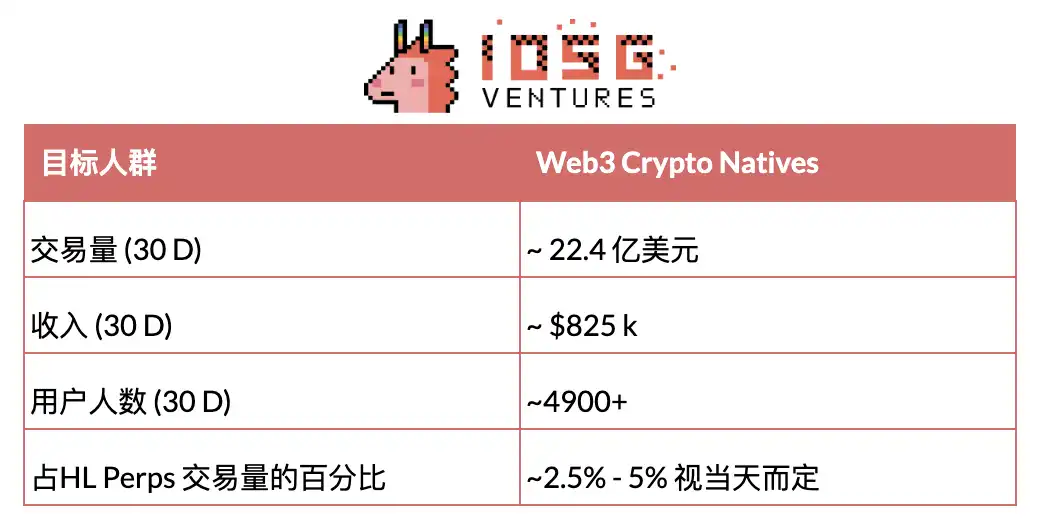

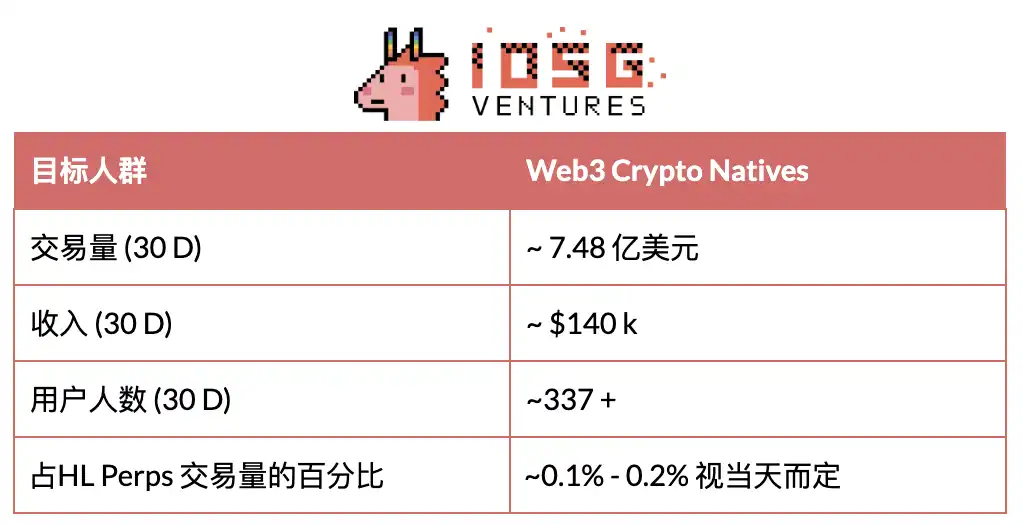

Last but equally important is Supercexy. This platform has not chosen the pure mobile frontend route but is also optimizing the web-end perpetual contract DEX trading experience, aiming to provide a CEX-like user experience, but entirely based on the Hyperliquid infrastructure. Its product suite integrates DeFi staking features and money market access services, making this application mainly serve Web3 native traders.

Comprehensive Perspective

Overview

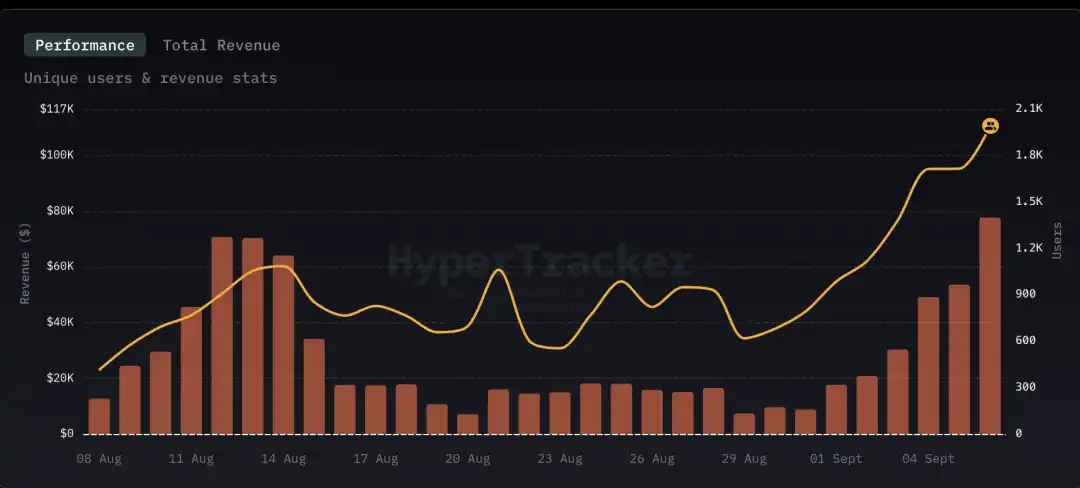

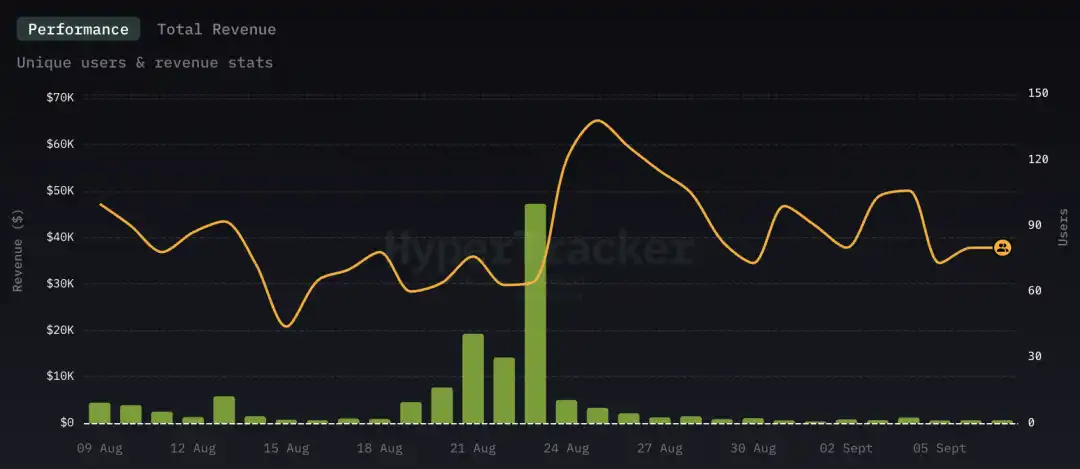

Overall, the combined average daily revenue of all relevant mobile transaction front-ends (including some applications not mentioned) is approximately $50,000, equivalent to around $1.5 million in Monthly Recurring Revenue (MRR). These applications represent about 3%-6% of Hyperliquid's perpetual contract total trading volume. For reference, Hyperliquid's HLP insurance pool accounts for approximately 5%.

Hyperliquid Mobile Transaction Front-end Revenue

Summary

Key Insights

1. Cryptocurrency Mobile Transaction Front-ends Benefit from Web2 Crowd and Retail Behavior's Strong Tailwinds

The societal trend of "hyper-speculation" has fundamentally altered the behavioral patterns of retail consumers. As demonstrated by the growth of Polymarket and Kalshi, the majority of users currently exhibit a high-risk preference. In an environment where market speculation demand is at historic highs, mobile trading applications have become the most directly benefited product form. As previously mentioned, the user growth and adoption rates of traditional financial mobile applications like Robinhood, Wealthsimple, and TD Ameritrade have significantly increased, largely due to their low barriers to entry and their business model that enthusiastically promotes short-term high leverage and gambling-like products to users. Clearly, retail users need a simple way to gain risk exposure and perform capital allocation, making mobile trading applications the most reasonable solution.

Cryptocurrency mobile trading applications are fundamentally no different; if they can effectively build product discoverability, they can also benefit from these consumer behaviors. The integration of crypto products into their applications by Robinhood, Wealthsimple, and Revolut is a clear demonstration of this. Even with high fees, the crypto products within these traditional financial applications have gained significant adoption, indicating a strong demand from retail users for easy mobile access to the crypto market. Without dedicated crypto mobile trading applications, the Web3 market will hand over a massive value capture opportunity to its Web2 competitors.

2. For the cryptocurrency market to achieve scale and volume growth, it needs to provide more crypto-native mobile applications to mainstream Web2 consumers.

Since 2023, there has been virtually no new retail inflow into the market. The current total stablecoin market capitalization is only about 25% higher than the 2021 all-time high. For any industry, this four-year growth rate is considered dismal — and this is happening against the backdrop of stablecoins enjoying the most favorable regulatory environment ever and strong presidential support for the crypto industry.

The market needs a solution to attract new retail liquidity, yet the major barrier to entry for new retail capital remains unsolved. The primary barriers are: first, the public perceives participation in the crypto market to involve a complex operational process, and second, there is a lack of accessible applications that truly understand Web2 user needs. Web2 retail users do not engage with complex wallets or multi-chain fund transfers. What they need is products packaged in a familiar way, providing simple deposit channels and a user-friendly experience akin to Robinhood or Wealthsimple accounts.

Cryptocurrency mobile trading front-end applications are the solution — they package products in a traditional financial manner familiar to Web2 users, fundamentally eliminating the cognitive barrier of crypto complexity and reducing entry barriers. This is the only effective way to bring cryptocurrency into mainstream exposure outside the Web3 bubble.

3. Real revenue models with practical, sustainable scale effects and extremely low expansion costs compared to Web3 business models

Cryptocurrency mobile trading front-ends mark the beginning of a new generation of applications in the Web3 market — a more sustainable and compliant development path. Unlike previous traditional crypto products (whether infrastructure or DApps), most projects did not focus on scale expansion or revenue generation in the past because it was not the core incentive direction. The North Star metric for most founders was acquiring initial users at any cost, regardless of how inefficient or extractive their growth funnel was, then raising venture capital, selling locked tokens over-the-counter, or waiting for the vesting period to end without improving the product. Typical examples include: Story Protocol ($IP), Blast, Sei Network ($SEI).

In contrast, cryptocurrency mobile trading front-ends adopt the opposite strategy: leveraging existing infrastructure to optimize scale, generating revenue first, and fundraising as needed. By becoming aggregators of different products and adopting a foundational fee structure, these front-ends have a structural advantage in integrating multiple verticals at very low costs while focusing on the user experience interface to enhance user acquisition and retention rates. This combination means revenue can be generated from day one and achieve exponential growth as operations continue. The ultimate result is building a more sustainable real business layer and value layer for Web3, replacing the extractive models of the past. This will bring increasing credibility to the entire Web3 industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens