Privacy Coins Quietly Outperform Bitcoin and Ethereum With 71.6% Gains in 2025

While Bitcoin and Ethereum dominated headlines, privacy coins quietly became 2025’s best performers, with Zcash recording major gains.

In a year dominated by headlines about Bitcoin’s (BTC) record highs, Ethereum’s (ETH) rally, meme coins, layer-2 solutions, and more, privacy coins have quietly emerged as the cryptocurrency sector’s top performers.

Despite minimal media attention and subdued public interest, the privacy coin market has outpaced every other sector. The growth has been further propelled by the recent bullish rally in leading privacy tokens.

Privacy Coins Emerge as 2025’s Best-Performing Crypto Sector

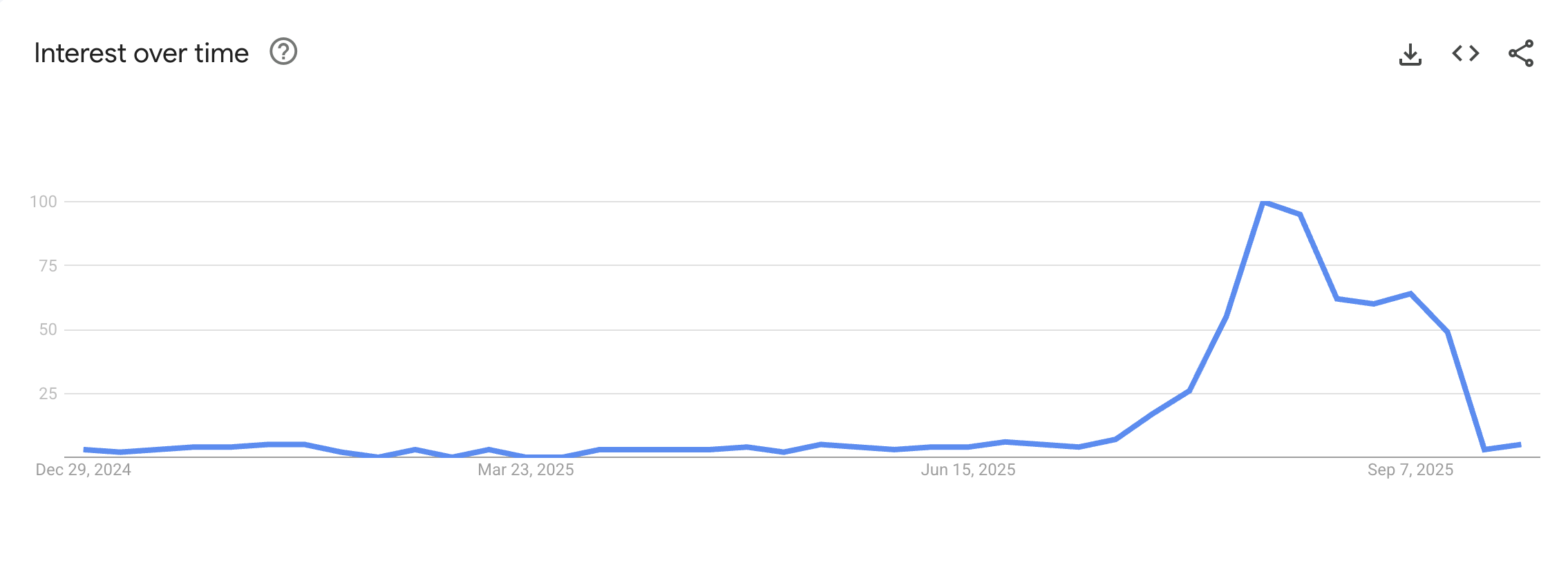

Google Trends data indicated that search interest for the term ‘privacy coin’ remained low through the first half of 2025, only beginning to accelerate in August and reaching a peak. However, this was short-lived as public curiosity faded again and interest dropped.

Search Interest in The Term ‘Privacy Coin.’ Source:

Google Trends

Search Interest in The Term ‘Privacy Coin.’ Source:

Google Trends

In addition, when compared to searches for terms like ‘crypto’ or ‘altcoin,’ interest remained completely flat. This showed a lack of retail interest in the sector.

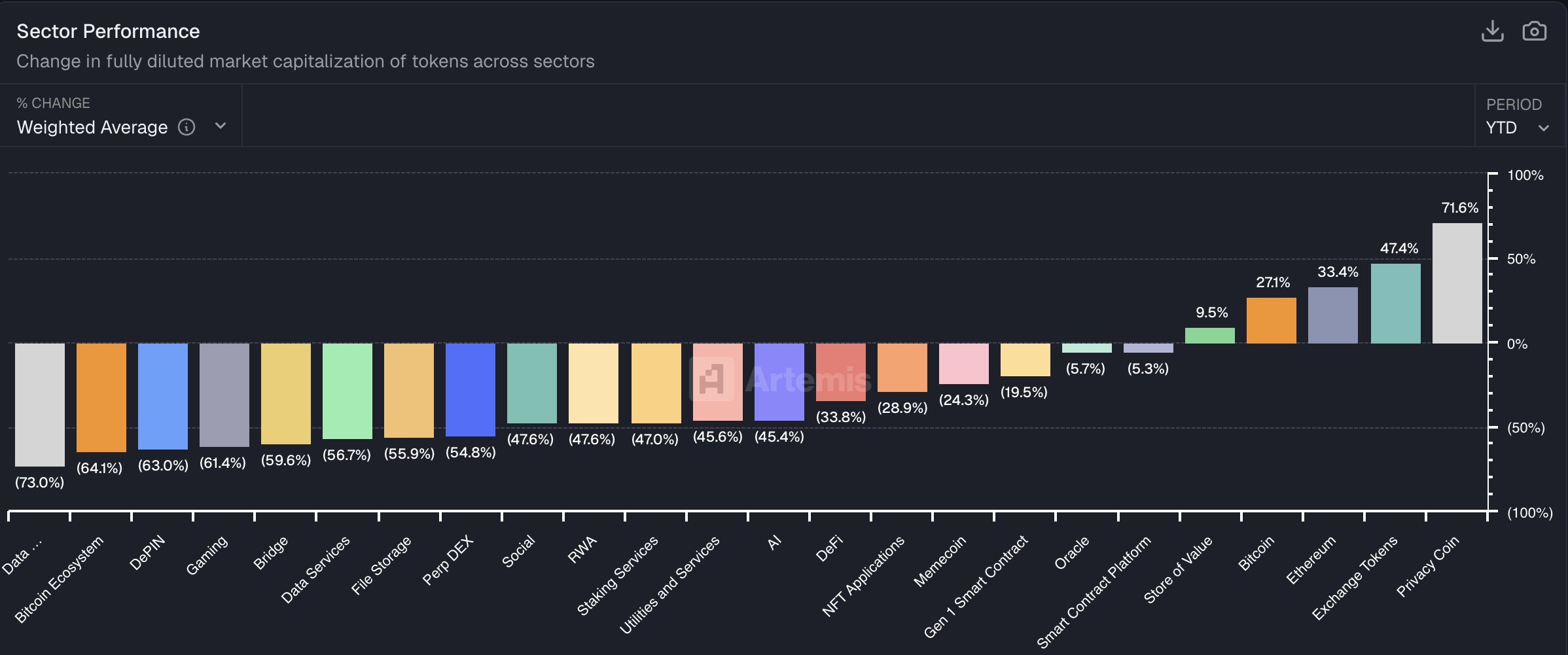

Despite this, privacy-focused cryptocurrencies have continued to grow. According to the latest data from Artemis, the sector has risen 71.6% in 2025, the highest uptick among all crypto sectors.

Privacy Coins Performance. Source:

Artemis

Privacy Coins Performance. Source:

Artemis

In comparison, Bitcoin has seen a 27.1% increase. Additionally, Ethereum, exchange tokens, and store-of-value assets have appreciated 33.4%, 47.4%, and 9.5%, respectively. Meanwhile, the rest of the sectors have all seen losses.

Zcash Leads Privacy Coin Rally in 2025

That being said, retail interest is not entirely absent from privacy coins. The latest rallies in leading tokens show that momentum has intensified recently.

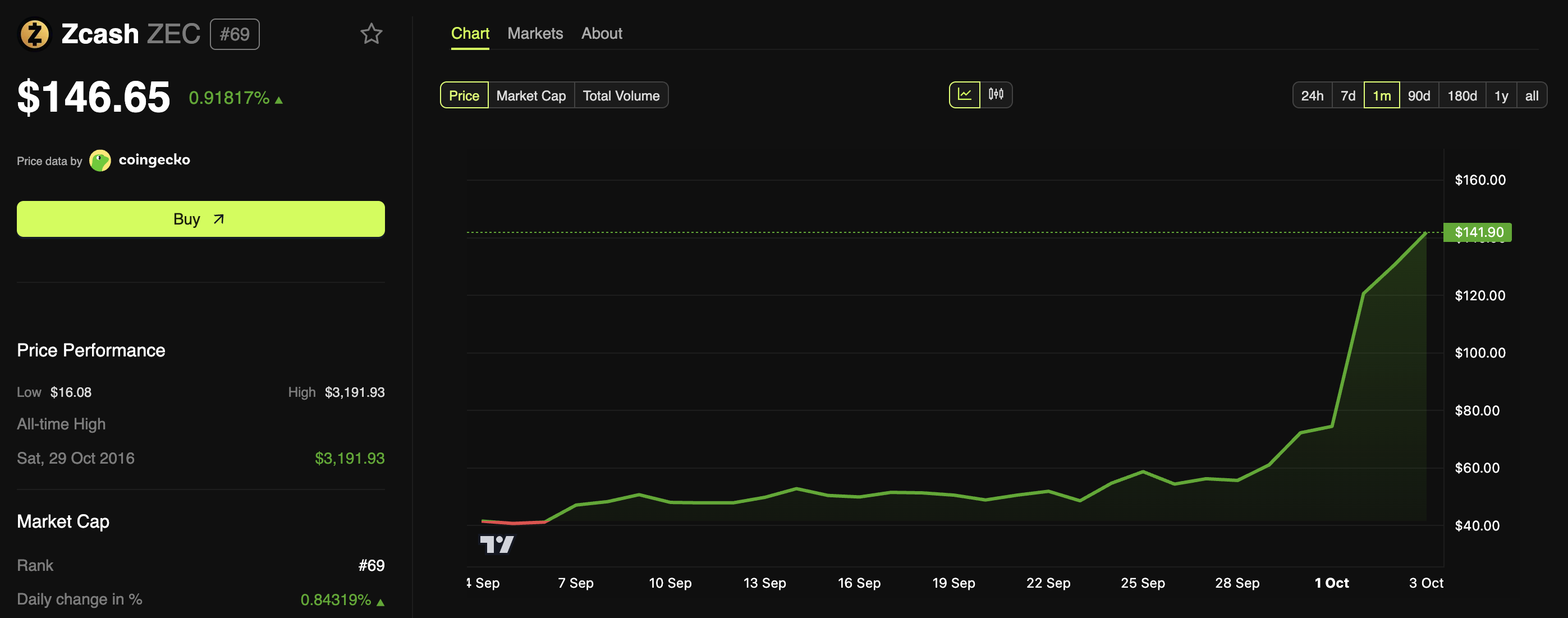

For instance, Zcash (ZEC) has been the standout, surging over 150% in the past week. BeInCrypto recently reported that the altcoin reached a three-year high, with a 247% monthly return.

Bitcoin is insurance against fiat.ZCash is insurance against Bitcoin.

— Naval (@naval) October 1, 2025

The catalyst was Grayscale’s launch of a Zcash Trust, enabling accredited investors to gain exposure without direct token handling and boosting demand. At the time of writing, the privacy coin traded at $146.65, up 0.918% over the past day.

Zcash (ZEC) Price Performance. Source:

BeInCrypto Markets

Zcash (ZEC) Price Performance. Source:

BeInCrypto Markets

Meanwhile, Monero (XMR), the sector’s leader with a market cap of approximately $6.1 billion, has also performed strongly. Over the past week, the coin has gained nearly 14%, less than ZEC but still outperforming the broader crypto market’s gains.

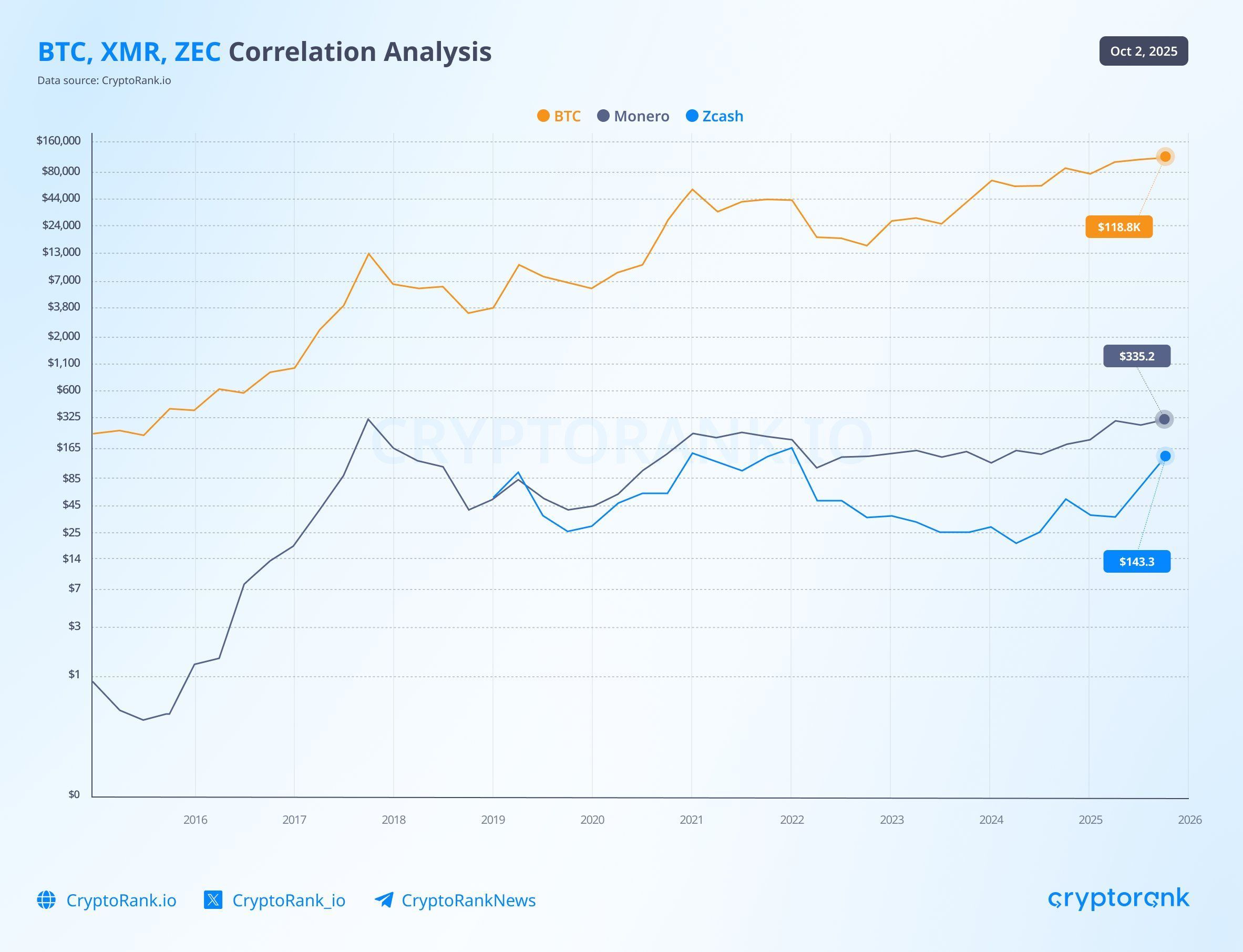

CryptoRank pointed to a mix of factors behind the recent upswing in privacy coins. One explanation is capital rotation, typically seen in crypto markets.

Another is the theory that privacy tokens often see stronger runs closer to the later stages of a market cycle. At the same time, tightening regulations and accelerating adoption have renewed attention on privacy as a potential growth theme.

“Privacy coins don’t just pump at cycle tops. Data shows they grow across different stages – XMR & ZEC moving in sync with BTC prove it,” CryptoRank added.

XMR, ZEC, and BTC Correlation. Source:

X/CryptoRank_io

XMR, ZEC, and BTC Correlation. Source:

X/CryptoRank_io

Thus, with momentum building, privacy tokens are positioning themselves as a core narrative in the ongoing bull market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL Price Forecast and Solana's Market Strength in Late 2025: A Two-Factor Assessment

- Solana (SOL) faces pivotal 2025 juncture with Fed easing and blockchain upgrades driving price resilience. - Fed rate cuts and $421M institutional inflows via ETFs (e.g., REX-Osprey) boost crypto adoption amid low yields. - Firedancer/Alpenglow upgrades cut validator costs by 80%, enabling 100-150ms finality and $10.2B DeFi TVL growth. - $133 support level and bullish TD Sequential signals suggest $150-$165 target by year-end despite inflation risks.

The Federal Reserve's Change in Policy and Its Effects on Rapidly Growing Cryptocurrencies Such as Solana

- Fed's 2025 rate cut and QT halt injected $72.35B liquidity, briefly boosting crypto markets and Solana (+3.01%) amid easing monetary policy. - Prolonged US government shutdown and $19B October liquidation event exposed crypto's liquidity risks, despite Fed support for speculative assets. - Solana saw $3.65B trading volume but 6.1% price drop in November, with TVL falling 4.7% as regulatory pressures and macro volatility offset institutional inflows. - SIMD-0411 proposal aims to reduce Solana issuance by

LUNA Rises 42.62% Over the Past Week Amid Ongoing Legal Developments in the Terra Ecosystem

- Terra's LUNA token surged 42.62% in 7 days amid ongoing legal proceedings against co-founder Do Kwon. - Prosecutors seek 12-year prison sentence for Kwon over 2022 Terra collapse, which triggered $40B market losses. - LUNA Classic and LUNC rose 70-130% as investors view legal drama as catalyst for renewed Terra ecosystem interest. - Kwon's guilty plea and sentencing hearing on Dec 11 could shape market sentiment, though pardon odds remain at 2%. - "Bankruptcy concept coins" like USTC and FTT also surged,

Bitcoin’s Latest Price Swings and Institutional Outlook: Managing Uncertainty in an Evolving Cryptocurrency Environment

- Bitcoin's 40% November 2025 price drop highlights volatility challenges despite growing institutional adoption and regulatory clarity. - 55% of hedge funds now hold Bitcoin as strategic inflation hedge, driven by ETF approvals and $3 trillion institutional asset unlocking. - Macroeconomic correlations (S&P 500 at 0.48) and Fed policy shifts demonstrate Bitcoin's evolving role as macroeconomic barometer. - 72% of institutions adopted advanced risk frameworks in 2025, emphasizing AI monitoring and regulato