Date: Fri, Oct 03, 2025 | 11:20 AM GMT

The cryptocurrency market is showing strength as the prices of both Bitcoin (BTC) and Ethereum (ETH) have surged over 10% and 15% respectively in the past 7 days. Riding this resilience, several altcoins are starting to flash bullish signals — and Avalanche (AVAX) is one of them.

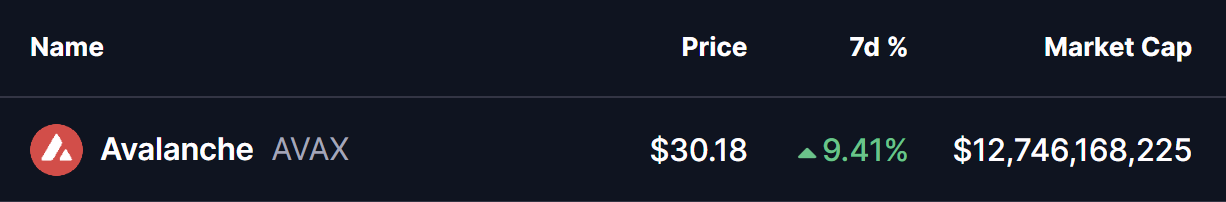

AVAX is back in green with 9% gains, but what makes it more interesting is its technical structure, which closely resembles a historical fractal pattern that previously led to a sharp bullish rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Move

On the daily chart, AVAX’s structure looks strikingly similar to its November 2024 setup. Back then, after forming a broad falling wedge, AVAX carved out a rounding bottom pattern and made a breakout and retest, which fueled a massive 82% rally toward the wedge’s upper resistance trendline.

Fast forward to now, AVAX has once again rebounded from its wedge support while forming another rounding bottom.

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

Recently, it made a breakout and retest of its neckline around $27.42, pushing its price up to $30.16, showing strong signs of upside continuation.

What’s Next for AVAX?

If this fractal continues to play out, AVAX could have a promising roadmap. Maintaining the current momentum may allow the token to rally toward the upper wedge resistance near $42.0 — a potential 39% upside from current levels. If AVAX manages to break beyond this wedge structure, it could trigger a broader bullish rally.

Of course, fractals don’t guarantee future results, but they often highlight recurring market behavior. In AVAX’s case, the resemblance to its earlier breakout is striking — and if history rhymes, early holders could be positioned for significant upside.