BlackRock buys over $600 million of these two cryptocurrencies

Crypto exchange-traded funds (ETFs) are continuing their positive streak this week, recording consistent green daily inflows since September 26.

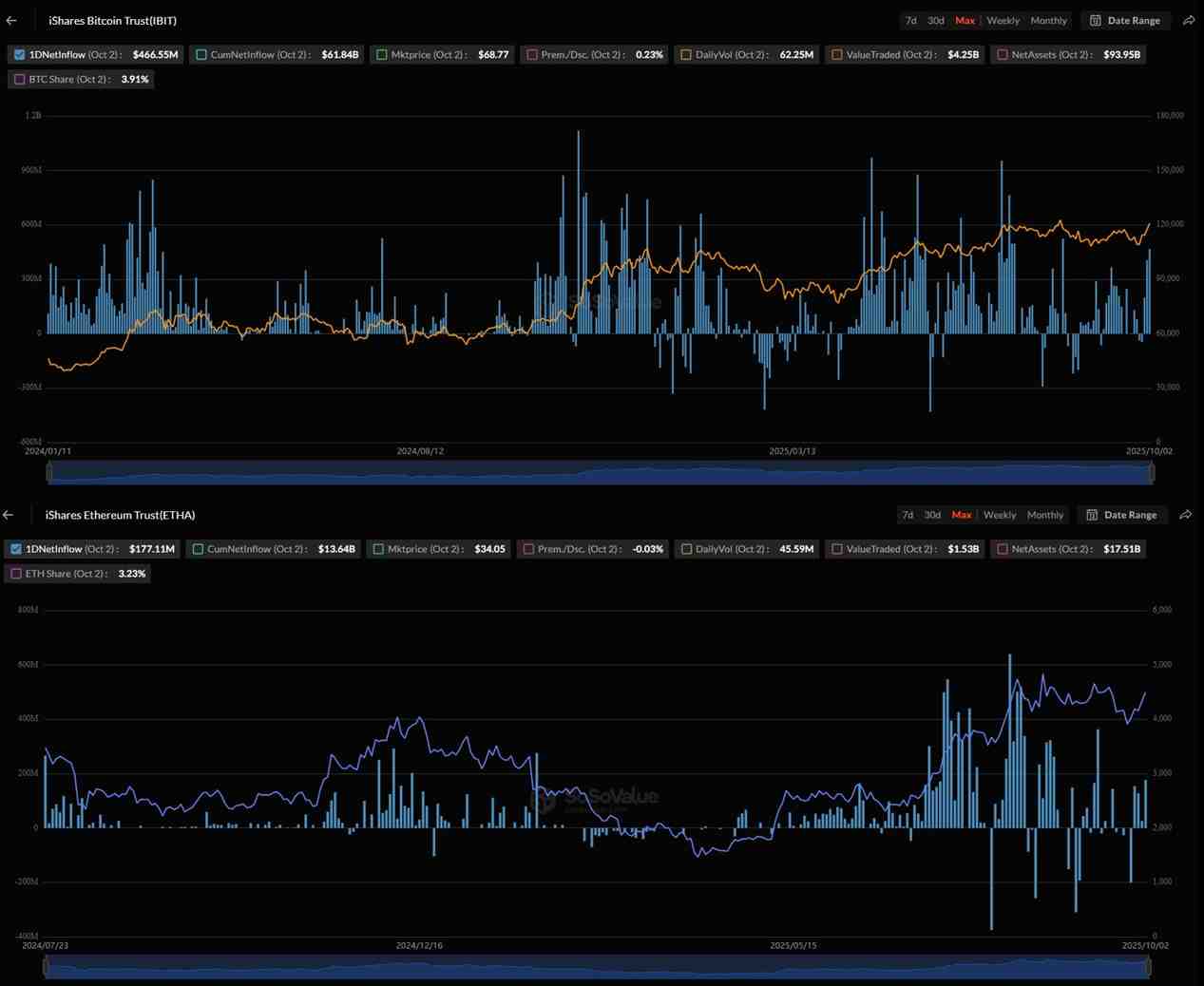

As usual, BlackRock is dominating the landscape, having seen approximately $446 million in Bitcoin (BTC) and $177 million in Ethereum (ETH) inflows, or around $623 million in total, on Thursday, October 2, according to data retrieved by Finbold from SoSoValue.

With the fresh capital, the world’s largest fund now has nearly $111.5 billion in the two assets, Bitcoin accounting for 84% of its overall holdings and Ethereum for about 14%.

Daily volumes are likewise strong, with $4.25 billion traded in the last 24 hours, as the total Bitcoin ETF market capitalization hovers at some $161 billion.

Institutional appetite for BTC and ETH grows

U.S. spot Bitcoin ETFs are regaining momentum after a brief cooldown in late September, with renewed capital signaling renewed investor confidence at the start of “Uptober.”

In addition to BlackRock, Fidelity and ARK also posted some gains, the former recording $89.62 million and the latter $45.18 million in inflows on the same day, bringing the total cumulative net inflow to $59.07 billion.

Ethereum ETFs were also strong, as Fidelity and Bitwise saw $60.71 million and $46.47 million added, respectively. What’s more, only two of the nine products, Franklin and Invesco, recorded no positive net changes.

Big-money investors remain drawn to ETFs for their regulated structure, so the surge in ETF demand highlights the crypto’s accelerating appeal, as even long-known skeptics are starting to rethink their positions.

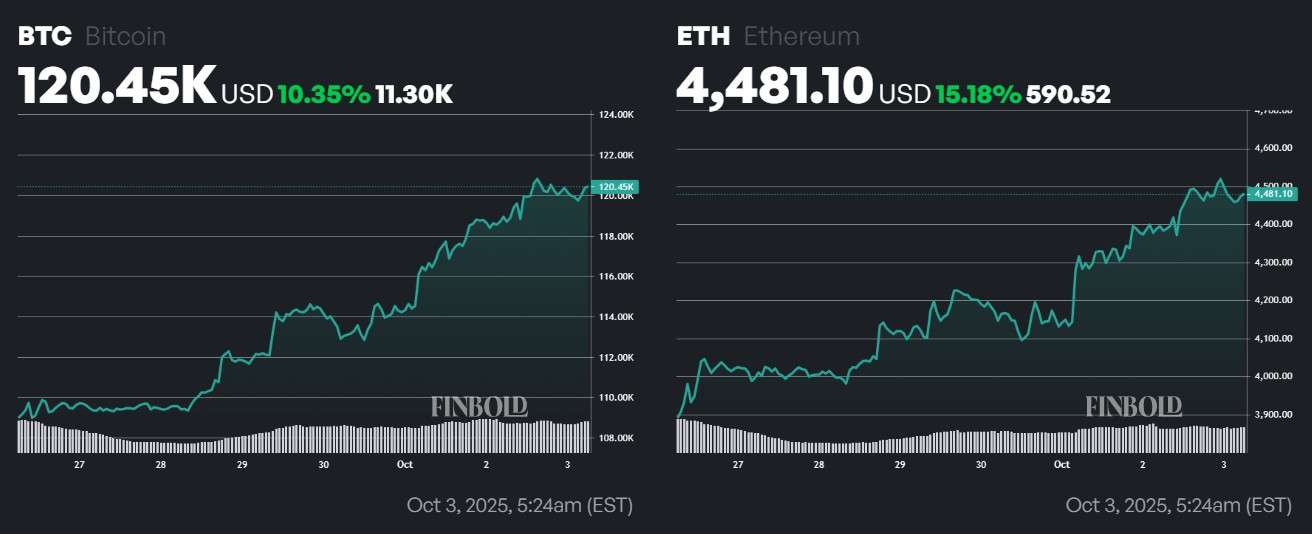

Bitcoin continues to trade over $120,450 at the time of writing, up over 10% this week, while Ethereum is holding steady at around $4,481, having gained more than 15% over the same period.

Both assets thus appear bullish, with analysts at Citigroup raising their year-end targets for Bitcoin at $132,000 and Ethereum at $4,500 on October 2.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.