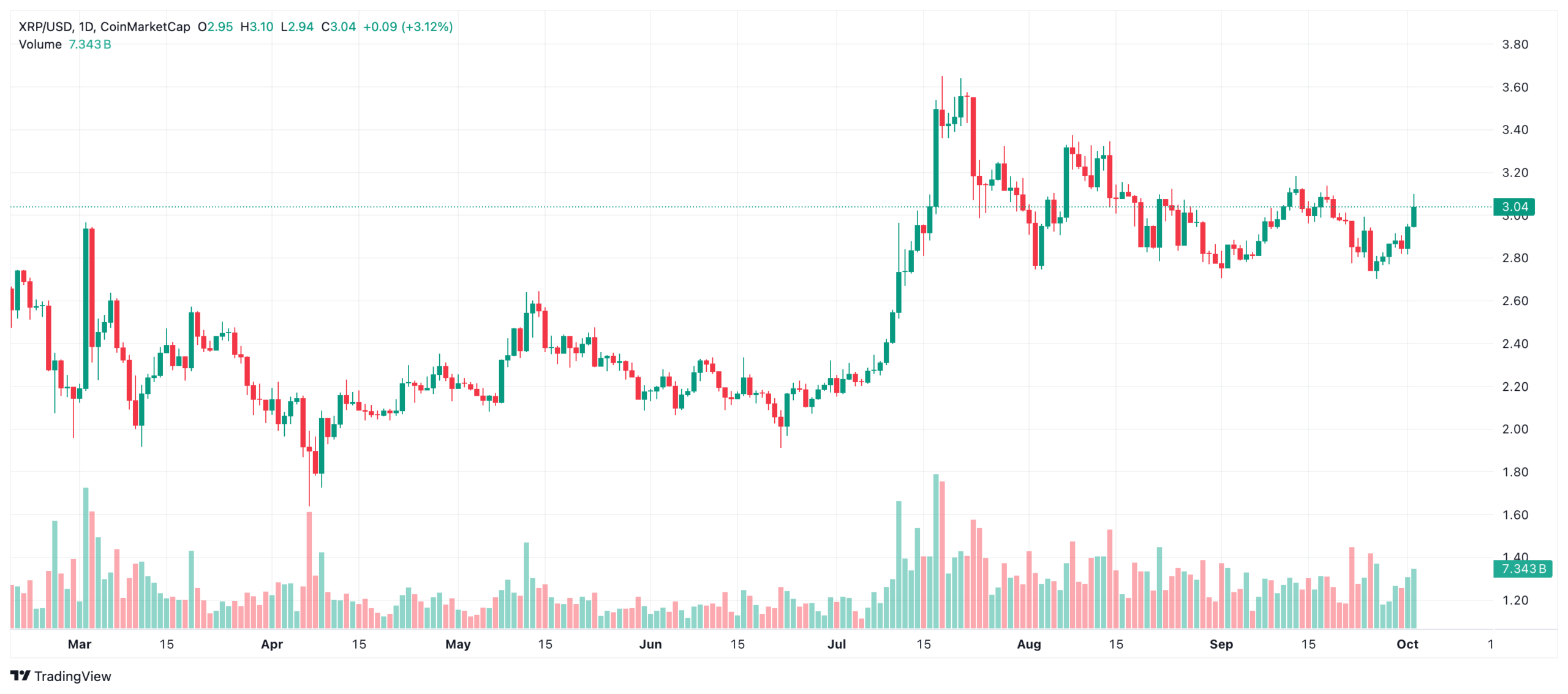

XRP is currently maintaining its position above $3, bolstered by the expansion of lending services by a Japan-based firm and the anticipation surrounding an upcoming ETF decision in the U.S. Meanwhile, BNB has surpassed the $1,100 threshold, piquing interest in the ecosystem’s cryptocurrencies. DOGE continues to fluctuate within the $0.251–$0.264 range. During October 2-3, significant trading volumes from institutional sources had a marked impact on price behavior, leading to a retest of critical levels.

XRP’s Uphill Journey Beyond $3

XRP experienced a 1.74% increase in the last 24 hours, jumping from $2.98 to $3.03. The growth was influenced by SBI Holdings’ expansion of institutional XRP lending services and the concurrent review process of seven spot XRP ETF applications in the U.S. The anticipation of initial ETF decisions from October 18 onward has directed pricing behavior in the cryptocurrency .

While trading between $2.95 and $3.10, XRP saw a swift leap from $3.00 to $3.06, with a trading volume of 212.6 million coins highlighting buyer interest. At the $3.10 level, a $129 million sell pressure intensified, leading to a sideways movement within the $3.00–$3.05 range by day’s end. In the short term, the $2.99–$3.00 area is viewed as support. Hourly and daily closures above $3.10 could propel the price to $3.20.

BNB and DOGE Encounter Pivotal Levels

BNB has surpassed the $1,100 mark, accelerating fund flows toward fee and transaction-focused projects on the network. For example, PancakeSwap’s CAKE token soared by approximately 30% in 24 hours. Some newly listed ecosystem tokens also recorded double-digit gains. Recent derivatives reflected a $97 million BNB liquidation over 24 hours, indicating leverage cleansing and a limited rise in the ecosystem’s total value locked (TVL).

DOGE, on the other hand, moved within the $0.251 to $0.264 range, losing momentum as it approached daily closure with a sale of 33.1 million coins. Buyers were active within the $0.251–$0.253 band throughout the day, while the $0.262–$0.264 range stood out as the initial resistance zone. Technical patterns revealed a rising megaphone formation and hidden positive divergence. Sustaining above $0.262 and breaking $0.264 could reignite the target of $0.34.