- Bitcoin nears record $124K after strong September and Uptober surge.

- Institutional ETF inflows and corporate buys fuel bullish momentum.

- Analysts project $160K–$200K if demand growth continues in Q4.

Bitcoin (BTC) has stormed into the final quarter of 2025 with the kind of momentum that traders had hoped for, breaking through the $120,000 barrier and reigniting talk of fresh all-time highs.

The rally comes on the heels of a surprisingly strong September and is already being described as the early stages of what could be a historic “Uptober.”

With BTC now hovering just a few percentage points below its record high of $124,128 set in August, analysts and on-chain observers say the conditions are aligning for a drive toward $200,000 before year’s end.

Seasonal surge takes hold

September closed above $114,000, up about 5% for the month, bucking the usual trend of weakness and building a foundation for October’s breakout.

Historically, whenever September has ended in the green, the fourth quarter has delivered outsized gains, with years like 2015, 2016, 2023, and 2024 producing average rallies above 50%.

That pattern, coupled with October’s average gain of 21.8% and November’s 10.8%, has cemented “Uptober” as more than a slogan for crypto traders.

Already this month, Bitcoin has climbed nearly 10% in a week, extending a year-to-date gain of about 27%.

The proximity to its all-time high adds to the sense of inevitability that new records are within reach if demand continues to hold.

Institutions are driving BTC demand

Behind the price action, institutional activity is setting the tone.

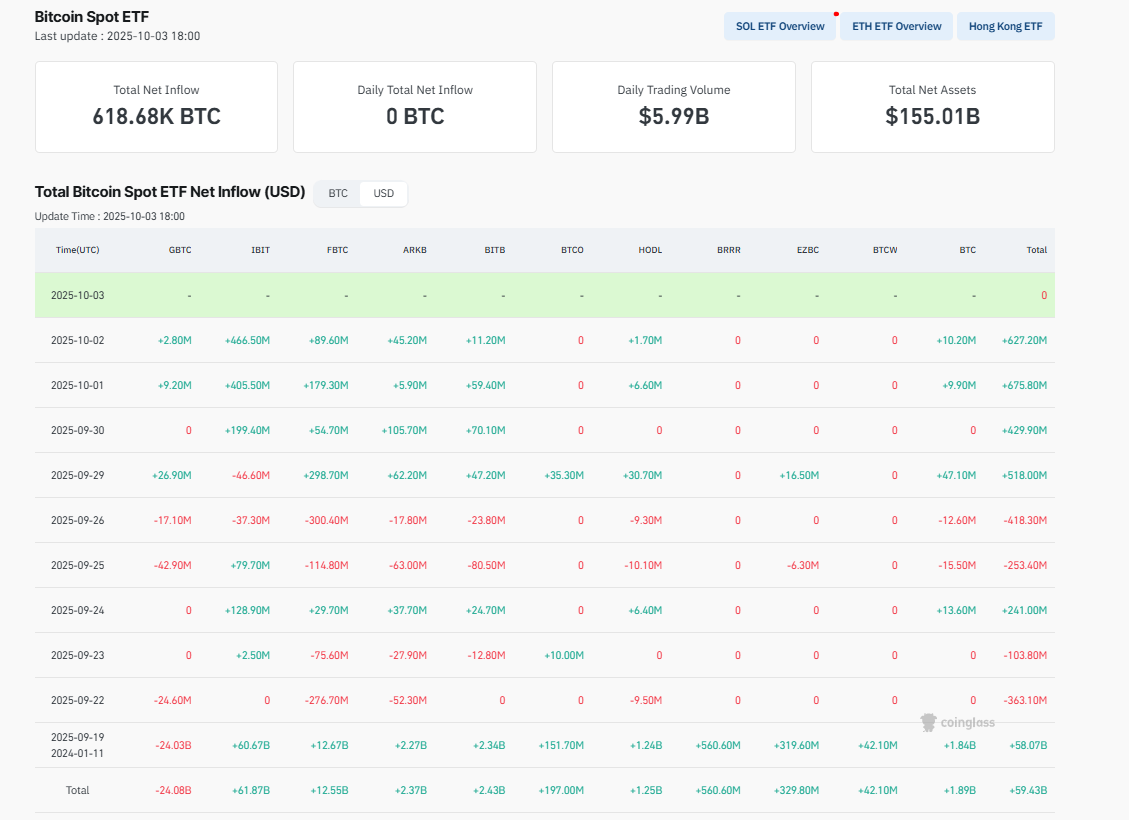

US spot Bitcoin ETFs have pulled in billions in inflows since early September, including more than $600 million for two consecutive days and $2.25 billion over the past week.

Source: Coinglass

Source: Coinglass

BlackRock’s IBIT ETF has emerged as the centre of this demand, with its options open interest topping $38 billion and even surpassing Deribit, traditionally the largest derivatives venue.

Corporations are also reinforcing the bullish trend. Strategy, formerly MicroStrategy, now controls 3.2% of Bitcoin’s total supply after adding more than 11,000 coins in recent weeks.

The steady accumulation reduces exchange supply and signals confidence from long-term holders.

This kind of sustained buying creates an upward pressure that is difficult for the market to ignore.

Bitcoin technical breakout confirms the momentum

The technical picture is equally supportive. Bitcoin has decisively broken above $119,500, a resistance level that capped prices through late September.

Indicators such as the MACD and RSI are flashing bullish signals, while the price continues to trade above short-term moving averages.

Source: CoinMarketCap

Source: CoinMarketCap

Eyes are on $124,600 as the next test, with Fibonacci extensions pointing toward $128,000–$130,000 as near-term targets.

However, the bigger story is what lies beyond. JPMorgan’s latest analysis compares Bitcoin with gold and suggests a theoretical fair value of $165,000 if adoption trends converge.

Citi has also issued a 12-month target of $181,000, and Standard Chartered has gone even further, projecting that institutional flows could push Bitcoin to $200,000 by year-end.

CryptoQuant’s bull score index hovers around 40–50, the same levels seen before major breakouts in 2020 and 2024, and the firm believes Bitcoin could reach between $160,000 and $200,000 this quarter if demand persists.

The US government’s shutdown has also shaken confidence in traditional markets, pushing investors toward hard assets like Bitcoin and gold.

$200k within sight

The mix of seasonal strength, institutional inflows, technical momentum, and macro uncertainty is creating conditions unlike any Bitcoin has faced before.

With the asset just shy of its all-time high and liquidity pouring in, analysts argue that $200,000 is no longer a bold outlier but a realistic scenario if buying pressure continues through the quarter.

For now, the key question is whether Bitcoin can sustain closes above $120,000 and break decisively past $124,000.

If it does, “Uptober” may prove to be the spark that propels the world’s largest cryptocurrency into its most explosive rally yet.