BNB is approaching the $1,100 level with institutional-driven demand, low volatility (1.2%), and rising Open Interest of $2.14B, signaling a likely sustained bullish move if it holds above $1,100 and reclaims $1,115–$1,150 as the next targets.

-

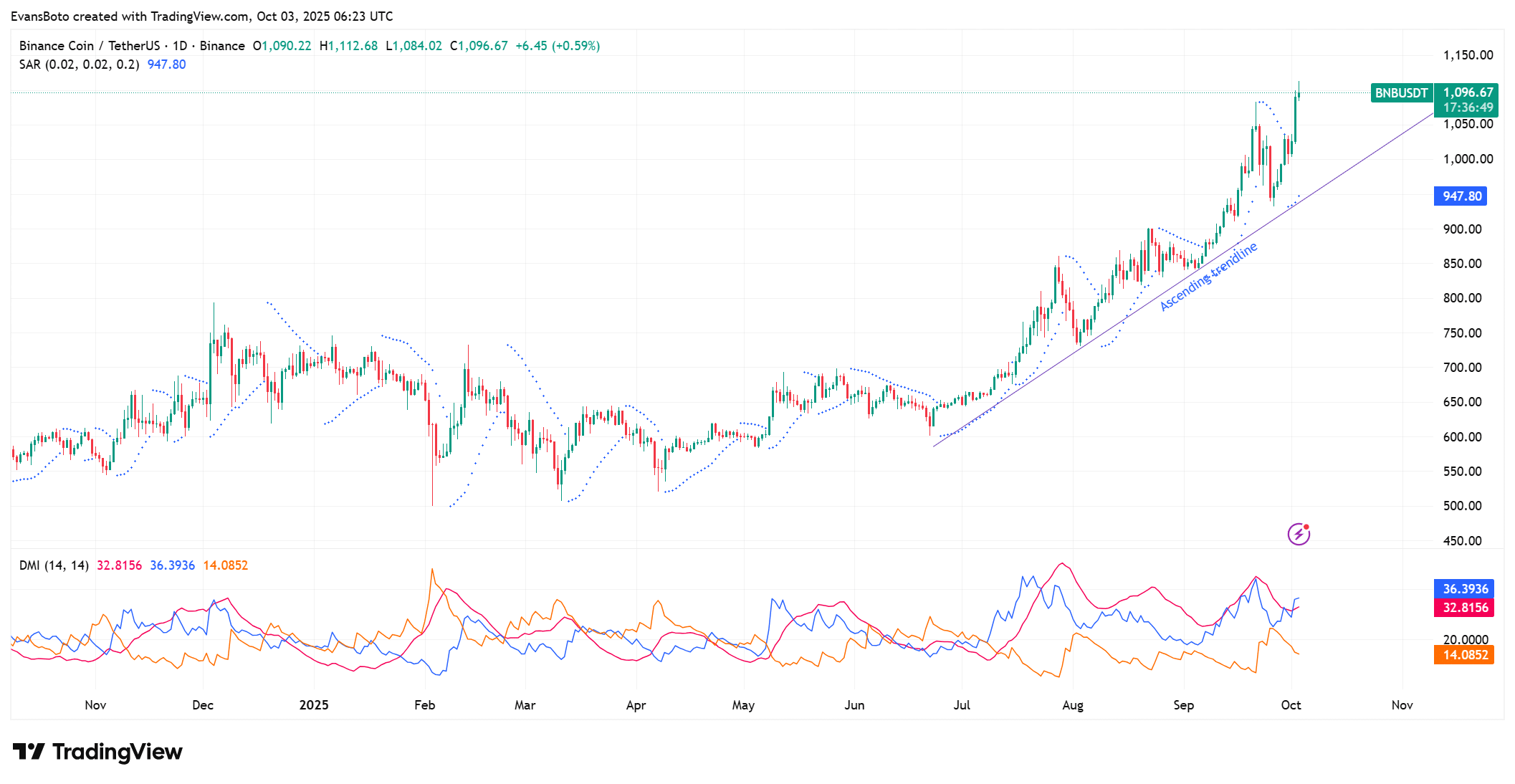

BNB neared $1,113 while holding an ascending trendline

-

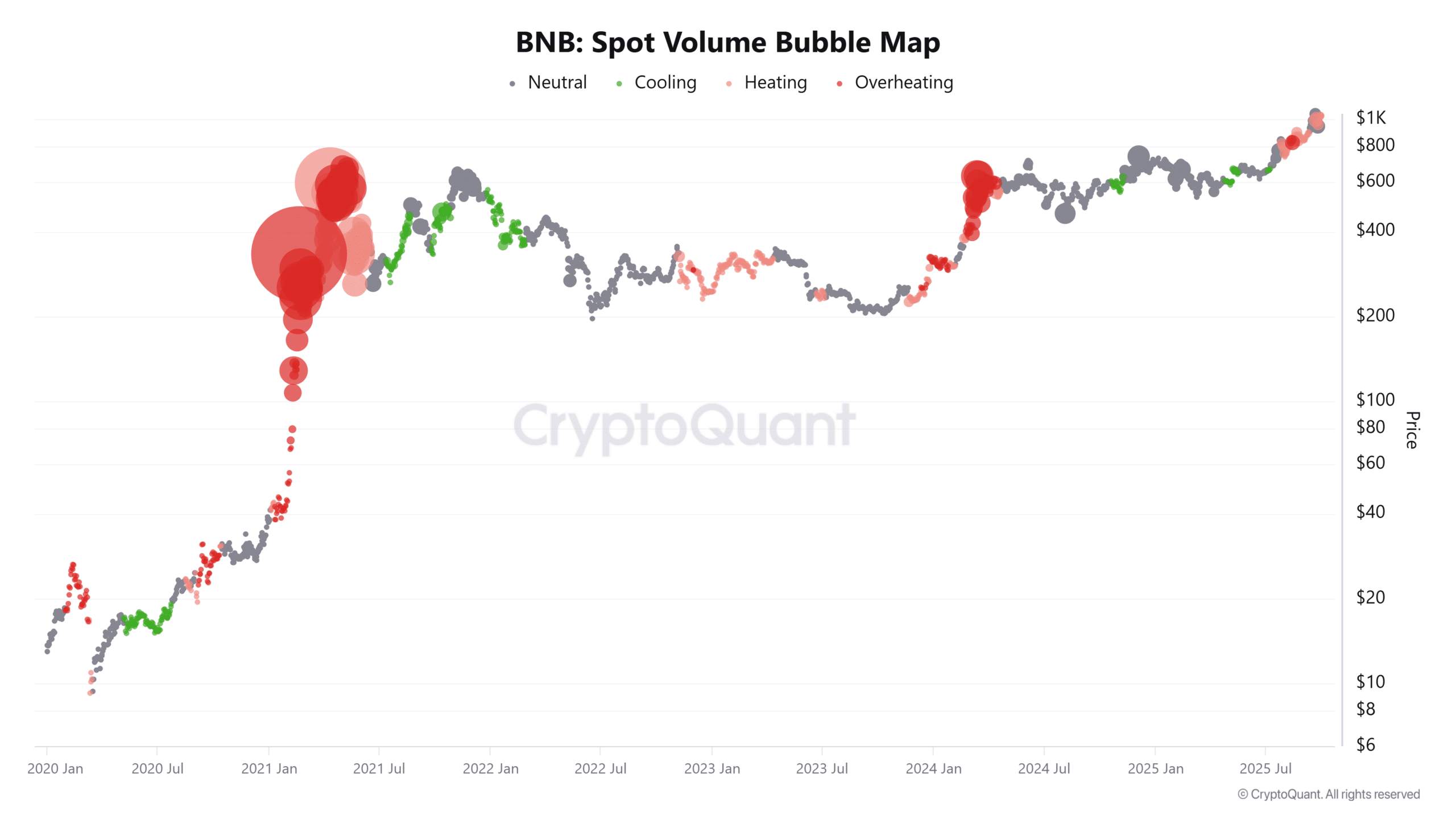

Spot volume and liquidity have intensified, supporting higher price levels

-

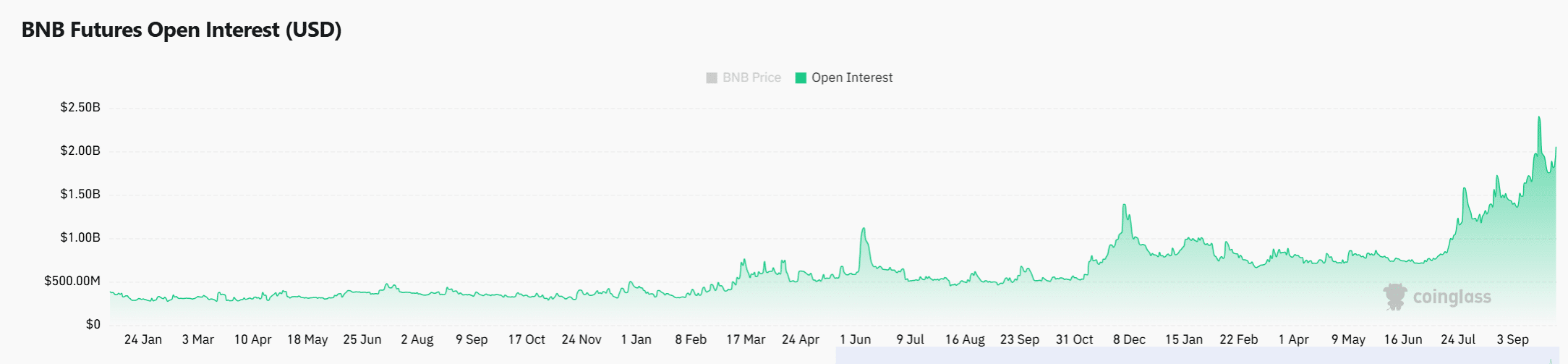

Open Interest jumped 15.27% to $2.14 billion, signaling stronger positioning

BNB price nears $1,100 with low volatility and rising Open Interest — watch for a breakout to $1,150. Read the latest analysis and key trade signals.

What is BNB price doing as it nears $1,100?

BNB price is staging a steady ascent toward $1,100, trading around $1,096 at press time while volatility cools to ~1.2%. The move appears institutionally supported, with buyers defending an ascending trendline and momentum indicators favoring continued upside.

How did BNB react as it approached $1,100?

BNB surged to $1,113 before retracing, showing strong demand while maintaining support above its rising trendline. Each trendline retest has sparked renewed rallies, underscoring buyer conviction in the $1,100–$1,115 zone.

How is trendline strength influencing a potential breakout?

The Parabolic SAR remains below price and the DMI shows +DI leading –DI, confirming positive directional momentum. A decisive close above $1,115 with continued volume support would strengthen the case for a breakout toward $1,150.

Can BNB’s trendline strength unlock a breakout above resistance?

BNB continues to respect its ascending trendline, reinforcing bullish strength across sessions. The Parabolic SAR is positioned below price, reflecting buyers in control and minimizing immediate downside risk.

The Directional Movement Index (DMI) shows persistent positive momentum, with +DI above –DI. Together with repeated trendline bounces, these technicals point to growing buyer confidence around the $1,100 area.

Source: TradingView

How is spot volume affecting BNB’s rally?

Spot volume has increased materially, with bubble-map data showing intensified participation and deeper liquidity pools. Rising spot demand often sustains higher price levels and lowers the risk of abrupt reversals.

This pattern implies BNB’s rise is supported by real buyer inflows rather than purely speculative flows, which improves the odds of a durable move above $1,100 if liquidity holds.

Source: CryptoQuant

Why does Open Interest matter for BNB’s outlook?

Open Interest (OI) jumped 15.27% to $2.14 billion, reflecting heavier speculative positioning in derivatives markets. Expanding OI during an uptrend typically amplifies momentum as leveraged bulls add exposure.

However, enlarged OI also raises liquidation risk if sentiment flips. The current alignment—rising spot demand, low volatility, and expanding OI—favors continuation but requires monitoring for sudden volatility spikes.

Source: CoinGlass

Will BNB sustain above $1,100 and extend higher?

BNB’s path depends on whether it holds the $1,100 threshold with continued spot inflows and stable volatility. A close above $1,115–$1,120 paired with rising volume would point toward $1,150 as the next logical target.

In the near term, the market is skewed to buyers thanks to institutional demand and steady technical support. Traders should watch OI and volume for confirmation and remain mindful of liquidation-driven volatility.

Frequently Asked Questions

How high can BNB go if it breaks $1,100?

If BNB sustains a breakout above $1,115 with robust volume, short-term targets include $1,150 and then $1,200. Confirmation requires follow-through buying and expanding spot liquidity.

What indicators confirm a valid BNB breakout?

Look for a daily close above resistance, increased spot volume, rising Open Interest, Parabolic SAR below price, and +DI leading –DI on the DMI. These combined signals reduce false-breakout risk.

Is current BNB volatility supportive of a sustained rally?

Yes. Low realized volatility (~1.2%) suggests measured buying rather than frantic speculation, which often leads to more sustainable moves if liquidity remains intact.

Key Takeaways

- BNB maintains bullish momentum: Trendline support and technical indicators favor buyers.

- Liquidity is improving: Rising spot volume underpins price stability and reduces reversal risk.

- Derivatives show confidence: A 15.27% OI spike to $2.14B signals stronger positioning but increases liquidation risk.

Conclusion

BNB is trading near $1,100 with low volatility, rising spot demand, and a notable Open Interest increase, all of which point to institutional-driven momentum. Holders and traders should watch $1,100–$1,115 for confirmation; a sustained break could target $1,150. For now, conditions favor continuation while requiring vigilance on volume and OI shifts.