PayPal’s PYUSD stablecoin supply doubles to $2.5b in a month

PayPal’s PYUSD supply has surged 113% month-over-month, hitting an all-time high of $2.54 billion.

- PayPal’s PYUSD stablecoin doubled its circulating supply, reaching $2.54 billion

- Over the past month, the token’s supply surged 113%

- USDT and USDC still dwarf all other stablecoins combined

PayPal’s stablecoin PYUSD has broken out of its quiet launch phase. On Friday, Oct. 3, the stablecoin reached an all-time high in circulating supply at $2.54 billion. Over the past month, this figure rose 113%. At the same time:

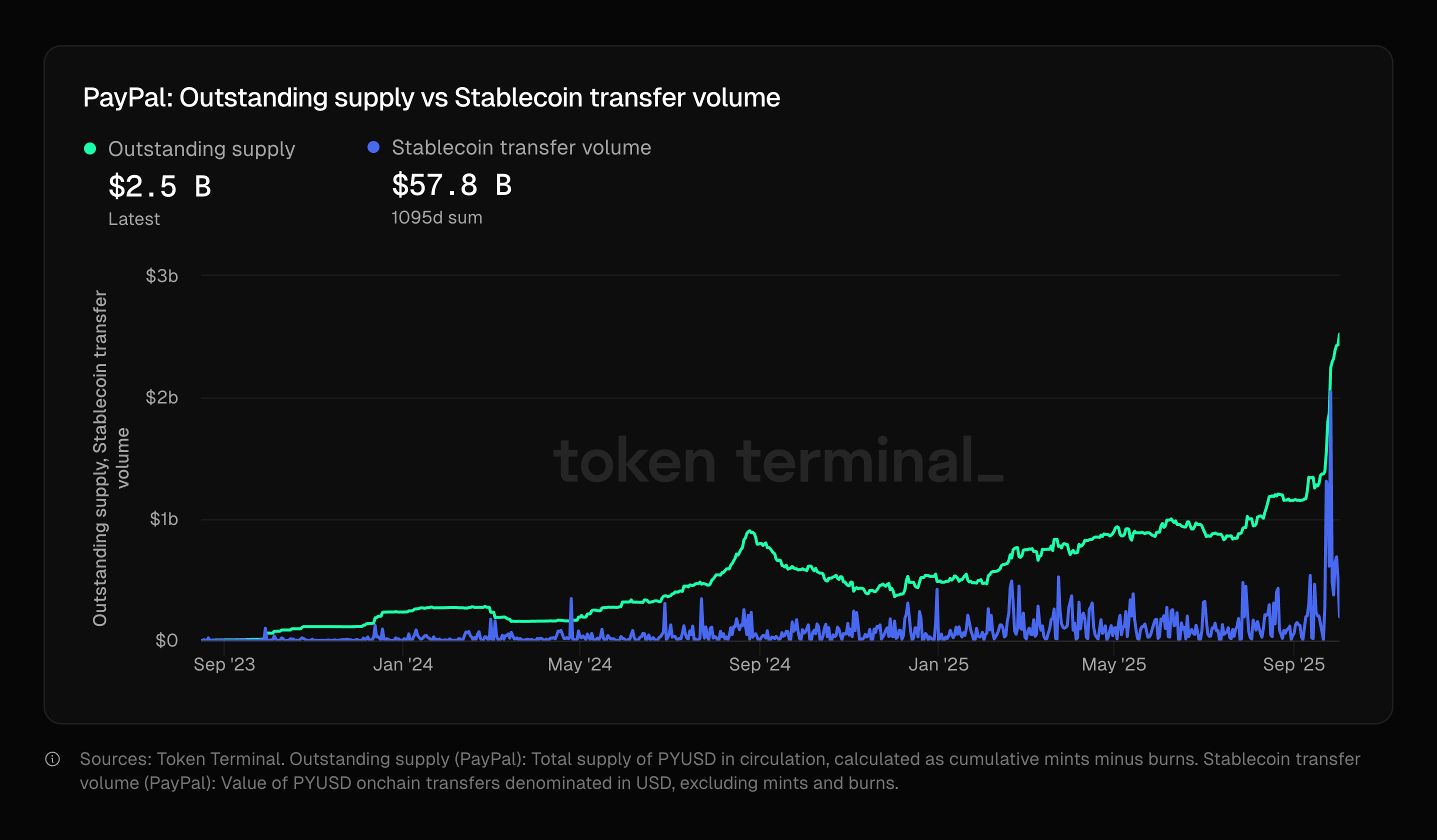

PayPal’s PYUSD outstanding supply and stablecoin transfer volume | Source: Token Terminal

PayPal’s PYUSD outstanding supply and stablecoin transfer volume | Source: Token Terminal

A circulating supply of $2.54 billion puts PYUSD in seventh place among stablecoins, behind USDe, USDS, DAI, and USD1. Much of that supply, specifically $1.84 billion, is on Ethereum (ETH) . At the same time, $624 million worth of PYUSD is on Solana (SOL) .

PYUSD transfer volume peaked at $2 billion daily on Sept. 26, according to data from Token Terminal. So far, the stablecoin has facilitated almost $60 billion in total transfers. PYUSD has also reached a milestone of 40,000 holders, a figure that has risen consistently since January 2025.

Still, giants Tether and USDC continue to dominate the market, with $176 billion and $75.9 billion in circulating supply. Together, they account for almost 85% of all circulating supply. PYUSD itself accounts for 0.84% of the stablecoin market.

PYUSD stablecoin is taking off

At launch, many called the PYUSD stablecoin a “nothing burger” , citing its limited reach beyond the PayPal and Venmo ecosystem. Still, the firm has worked on decentralizing PYUSD, enabling users to send to external wallets and holding it non-custodially.

PYUSD’s all-time high coincided with the stablecoin market cap breaking the total value of $300 billion. U.S.-denominated stablecoins lead the charge, with USDC growing rapidly. What is more, the monthly stablecoin transfer volume reached $3.27 trillion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Tether's Risky Reserve Change: Exposure to Cryptocurrency and Gold Poses a Challenge to Stablecoin Stability

- Tether's USDT faces scrutiny as Arthur Hayes warns a 30% drop in gold/Bitcoin reserves could trigger insolvency risks. - S&P downgraded USDT's stability rating to "weak" over 5.6% Bitcoin exposure exceeding overcollateralization margins. - Tether CEO dismissed criticism, claiming no "toxic" assets while regulators globally intensify reserve transparency demands. - Debate centers on balancing crypto volatility with liquidity resilience amid $34B cash shortfall and redemption risks.

Zcash Halving and Its Effects on the Dynamics of the Cryptocurrency Market

- Zcash's halving mechanism reduces block rewards every four years, enhancing scarcity and mimicking Bitcoin's deflationary model while offering optional privacy features. - Historical halvings (2020, 2024) triggered sharp price swings, with Zcash surging 1,172% post-2024's NU5 upgrade and institutional adoption via Grayscale Zcash Trust. - Next halving projected for late 2028 faces risks from regulatory scrutiny of shielded transactions and competition from privacy coins like Monero. - Long-term investors

Zcash (ZEC) Rallies as Interest in Privacy Coins Grows: Can the Momentum Last?

- Zcash (ZEC) surged 900% in Q4 2025, peaking at $702.04, driven by institutional adoption and regulatory clarity via the CLARITY/GENIUS Acts. - The November 2025 halving reduced block rewards by 50%, historically correlating with price surges, while shielded transactions now account for 20-25% of supply. - Zcash diverged from broader crypto weakness, gaining 35% weekly in November despite Bitcoin's decline, fueled by privacy-focused retail demand and $2B+ trading volume. - Upgrades like Zashi wallet and P

Trending news

MoreBitcoin News Update: Tether's Risky Reserve Change: Exposure to Cryptocurrency and Gold Poses a Challenge to Stablecoin Stability

Bitget Daily Digest (Dec. 1) | Bitget Daily Briefing (December 1)|Long liquidations hit $478 million in the past 24 hours; Spot Chainlink ETF expected to launch this week; 55.54 million SUI unlocks today