Date: Sat, Oct 04, 2025 | 01:04 PM GMT

Date: Sat, Oct 04, 2025 | 01:04 PM GMT

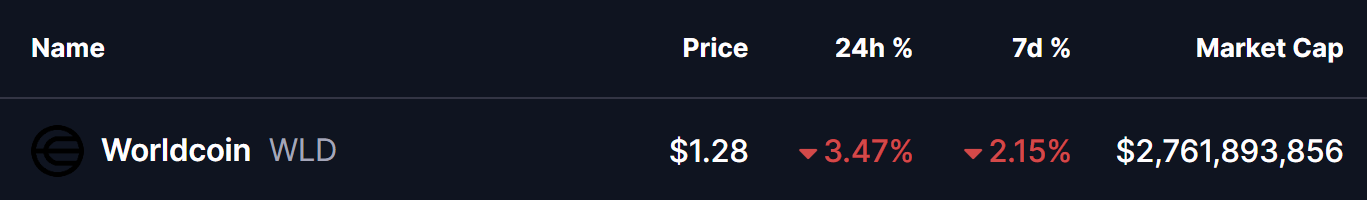

The cryptocurrency market is showing strength as the prices of both Bitcoin (BTC) and Ethereum (ETH) have surged over 11% in the past 7 days. Riding this resilience, major altcoins have made significant gains excluding Worldcoin (WLD).

WLD is still trading in red on the weekly performance, but what makes it more interesting is its technical structure, which could be gearing up for a bullish reversal in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

Rounding Bottom in Play?

On the 4H chart, WLD appears to be shaping a rounding bottom, a classic bullish reversal pattern that often signals accumulation before a powerful upward move.

The pattern began forming after WLD faced rejection near $1.38, which led to multiple highs and lows within the structure. The recent rejection from the neckline zone has now pulled the price back to $1.28 near the rounding bottom support, where a potential bounce could take place.

Worldcoin (WLD) 4H Chart/Coinsprobe (Source: Tradingview)

Worldcoin (WLD) 4H Chart/Coinsprobe (Source: Tradingview)

What’s Next for WLD?

If the pattern continues to play out as expected, buyers need to defend this support around $1.27. A successful reclaim of the 100 MA could position WLD for a breakout from the neckline resistance zone above $1.38. A breakout confirmation would likely trigger a bullish move toward the next potential target of $1.57.

That said, traders should also keep a close watch on the rounding bottom support, as a breakdown below it may invalidate the bullish outlook.