NFT sales double to $256m, Hypurrr tops the list

NFT sales volume more than doubled, surging by 103.11% to reach $256.9 million. This is a notable turnaround from last week’s $84.6 million in sales volume.

CryptoSlam data shows:

- The number of NFT buyers jumped by 18.25% to 694,348

- Sellers increased by 17.77% to 584,235.

- NFT transactions dipped by 8.67% to 1,874,619.

Bitcoin’s ( BTC ) rally to the $122,000 level has energized the entire crypto market. Ethereum ( ETH ) has followed suit, climbing to $4,500.

The global crypto market cap now stands at $4.2 trillion, up from last week’s $3.78 trillion. This bullish momentum has spilled over into the NFT sector, which has posted impressive gains.

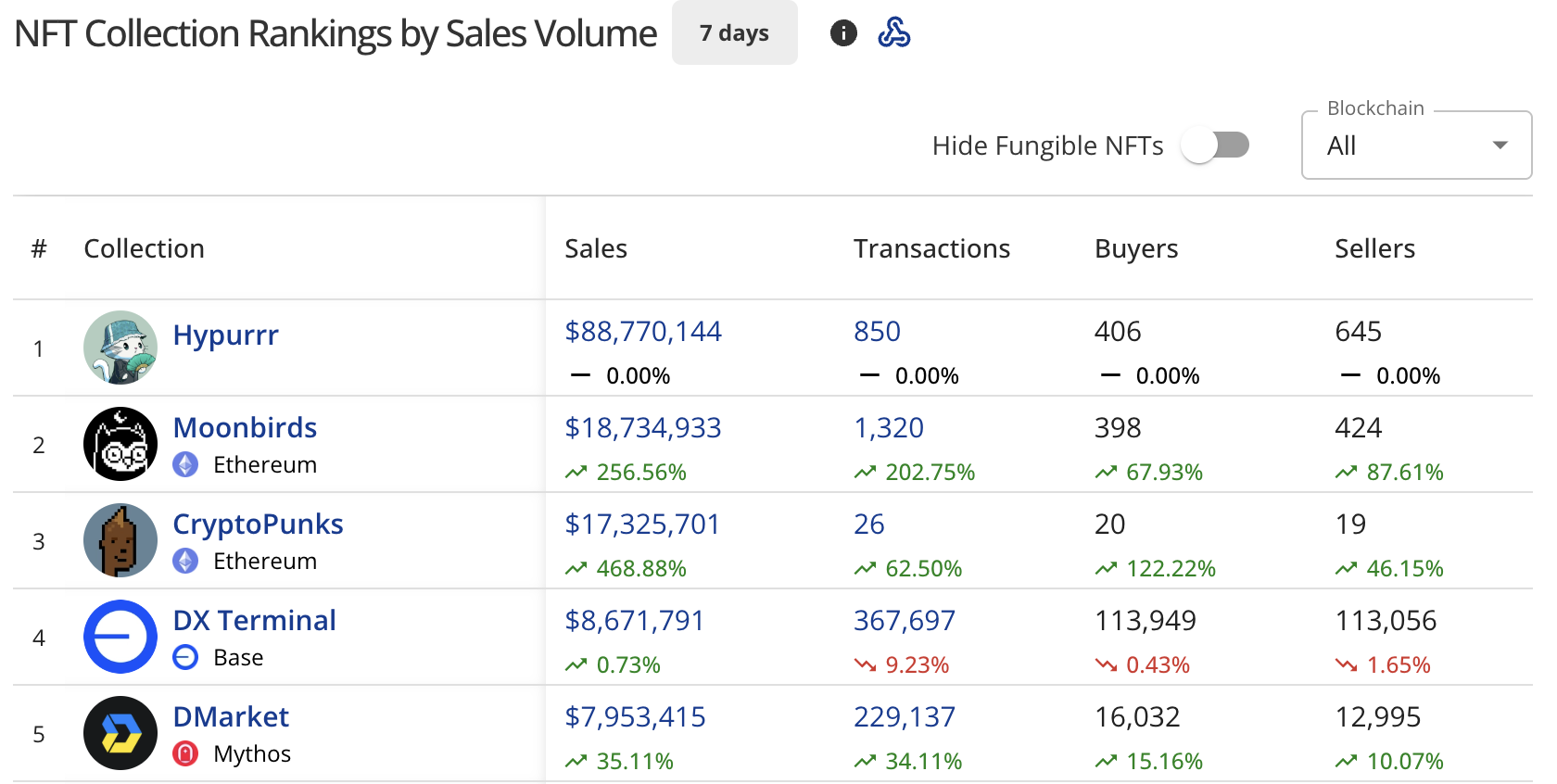

Hypurrr dominates NFT collections

The Hypurrr collection has emerged as the top performer this week, generating $88.77 million in sales across 850 transactions.

The collection attracted 406 buyers and 645 sellers. Hypurrr also dominated the top individual NFT sales, occupying four of the top five spots.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Moonbirds secured second place with $18.72 million in sales, posting a 254.57% increase. The Ethereum-based collection saw 1,319 transactions, with 398 buyers and 424 sellers participating.

CryptoPunks claimed third position at $17.33 million, recording a 468.88% surge. The collection had 26 transactions, with 20 buyers and 19 sellers.

DX Terminal on the Base blockchain came in fourth with $8.67 million in sales, up 0.73%. The collection processed 367,697 transactions and attracted 113,948 buyers.

DMarket rounded out the top five with $7.95 million in sales on the Mythos blockchain, up 34.95% from the previous week.

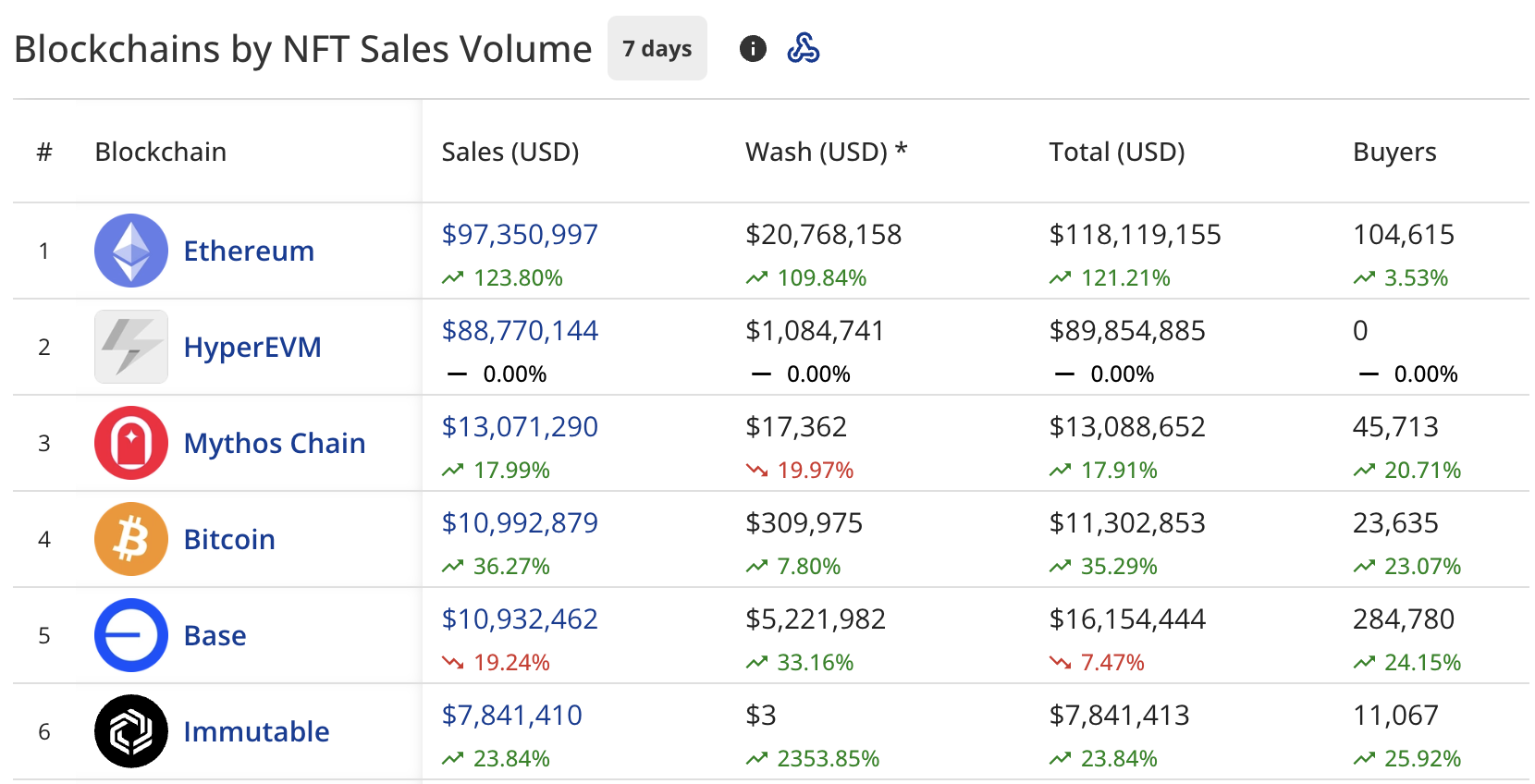

Ethereum leads blockchain rankings

Ethereum maintained its position as the leading blockchain for NFT sales, recording $97.4 million in volume, up 124.35% from last week’s $28.3 million.

The network processed wash trading worth $20.84 million, bringing its total to $118.24 million. The platform saw 104,625 buyers, up 3.55%.

HyperEVM took second place with $88.77 million in sales, driven entirely by the Hypurrr collection’s performance. Interestingly, the blockchain recorded zero buyers in the tracked period.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Mythos Chain ranked third with $13.07 million, up 17.69% from last week’s $10.9 million. The blockchain attracted 45,713 buyers, up 20.71%.

Bitcoin placed fourth at $10.97 million, which is a 36.20% increase from last week’s $14.12 million. The network saw 23,635 buyers, up 23.07%.

Base dropped to fifth position with $10.92 million, down 19.71% from the previous week. The blockchain had 284,780 buyers, up 24.15%.

Solana ( SOL ) landed in seventh place with $7.74 million, up 56.23% from last week’s $16.1 million. The blockchain recorded 56,811 buyers, up 18.33%.

Top individual sales

CryptoPunks #1563 led individual sales at $12.05 million (2745 ETH), sold two days ago.

Four Hypurrr NFTs followed:

- Hypurrr #3926 sold for $7.86 million

- Hypurrr #175 sold for $7.82 million

- Hypurrr #1131 sold for $7.63 million

- Hypurrr #3460 sold for $6.46 million

All four Hypurrr sales occurred five days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin Faces 23.6 Fib Level—Could Past Trends Spark an Altcoin Recovery?

- Bitcoin dominance fell to 59% at the 23.6 Fibonacci level, signaling potential altcoin rotation amid ETF outflows and price declines. - Corporate Bitcoin accumulation grows, with Hyperscale Data holding $70.5M in Bitcoin (77% of market cap) and Bitfarms holding $156M in Bitcoin. - Analysts highlight macroeconomic pressures and regulatory uncertainty as constraints on altcoin growth despite technical indicators suggesting capital rotation. - Market focus remains on Bitcoin stabilization above $80,000 and

Interoperability Fuels DeFi’s Evolution as Hemi and LI.Fi Connect Blockchains

- Hemi and LI.Fi expanded crosschain interoperability by integrating LI.Fi's bridge and swap API, enabling seamless token transfers across EVM and non-EVM networks like Solana . - Users can now transfer assets like USDC between chains in single transactions using routing tools, reducing friction for DeFi participants and developers. - The partnership standardizes crosschain workflows, eliminating fragmented bridge solutions while supporting liquidity aggregation across EVM, Solana, and alt-VMs. - By stream

Vitalik Buterin's Latest Support for ZK Technology and What It Means for the Cryptocurrency Industry

- Vitalik Buterin is driving a blockchain shift via ZK tech, enhancing Ethereum's scalability and privacy. - ZK infrastructure's $28B TVL surge highlights projects like zkSync Era and StarkNet boosting DeFi and gaming. - Investors target EVM-compatible ZK rollups and privacy toolkits, aligning with Ethereum's ZK roadmap.

XRP News Today: IMF Cautions That Tokenized Markets Could Face Collapse Without International Cooperation

- IMF warns tokenized markets risk destabilizing flash crashes due to rapid growth and interconnected smart contracts. - XRP highlighted as potential cross-border payment solution but not endorsed, alongside Stellar and Bitcoin-Lightning hybrid models. - Global regulators intensify oversight of tokenized assets, with ESMA, SEC, and central banks addressing governance and liquidity risks. - IMF stresses urgent need for coordinated policy frameworks to prevent fragmentation and systemic vulnerabilities in ev