Ethereum Foundation Converts 1,000 ETH to Stablecoins – Here’s Why

The Ethereum Foundation has conducted 17 ETH sales so far in 2025, totaling several thousand ETH across multiple months.

The Ethereum Foundation has announced plans to sell 1,000 ETH, worth roughly $4.5 million, as ETH’s price climbs above $4,500 for the first time since mid-September.

The sale, disclosed on October 4, will be executed using CowSwap’s Time-Weighted Average Price (TWAP) feature. This automated tool spreads large transactions over time to prevent sudden market disruptions.

Ethereum Foundation’s 17th ETH Sale This Year Renews Market Debate

By using TWAP, the Foundation aims to reduce price volatility, minimize slippage, and secure more balanced execution prices.

Institutional investors and crypto treasuries often rely on similar strategies to offload large holdings without triggering sharp price swings.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap's TWAP feature, as part of our ongoing work to fund R&D, grants and donations, and to highlight the power of DeFi.

— Ethereum Foundation (@ethereumfndn) October 3, 2025

As a result, the proceeds will be converted into stablecoins to fund ongoing operations such as ecosystem research, developer grants, and community donations.

According to the Foundation, this sale aligns with its broader strategy of managing its treasury more efficiently while leveraging DeFi tools.

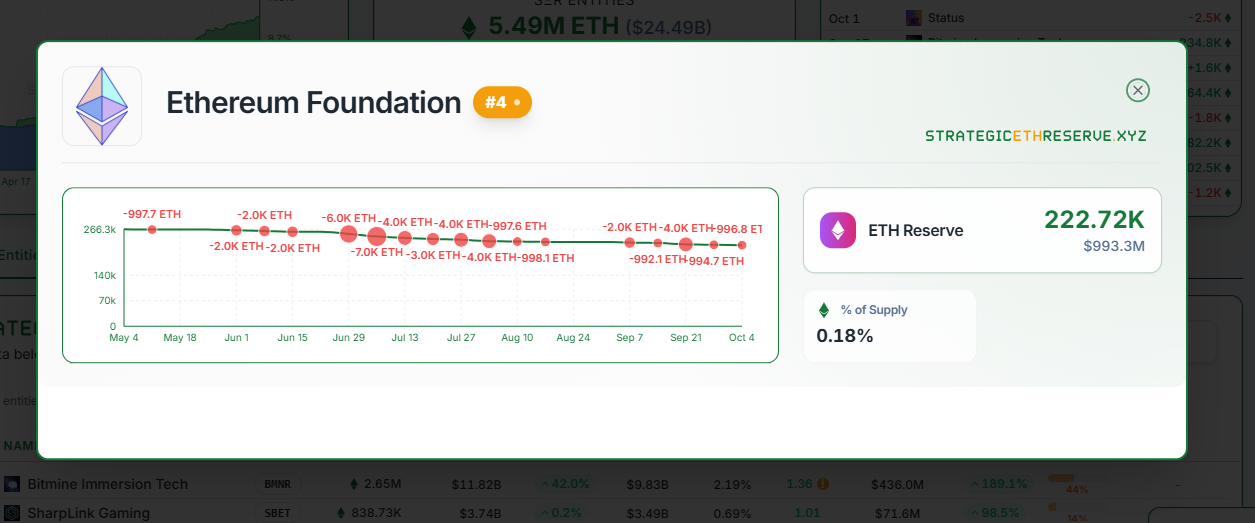

Meanwhile, this marks the Foundation’s 17th ETH sale in 2025. Its remaining balance now stands near 222,720 ETH—worth approximately $1 billion at current prices.

Ethereum Foundation ETH Holdings. Source:

Strategic ETH Reserve

Ethereum Foundation ETH Holdings. Source:

Strategic ETH Reserve

The frequent sales have raised concerns among community members, who argue that such activity can create bearish sentiment and weaken investor confidence.

While some critics have questioned the optics of repeated sales during bullish momentum, others view the move as a necessary step toward responsible treasury management.

Crypto researcher Naly suggested that the Foundation could “highlight the power of DeFi” by using decentralized tools to generate liquidity rather than selling tokens outright.

Naly proposed an alternative: “Supply ETH on Aave, earn interest, borrow stablecoins, and fund operations using DeFi-generated capital.”

Advocates say this method would allow the Foundation to maintain exposure to ETH’s potential upside while still accessing liquidity for expenses.

Still, not all feedback has been negative.

Several community members have praised the Foundation’s transparency for announcing its sales publicly. According to them, this practice is uncommon among large crypto organizations.

As of press time, Ethereum trades around $4,500, up 12% from last week’s low near $4,000, according to BeInCrypto data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Latest Updates: VanEck's SOL ETF Custody Agreement Indicates Growing Institutional Adoption of Blockchain Assets

- VanEck partners with SOL Strategies to custody its Solana (SOL) ETF, advancing institutional blockchain adoption. - SOL Strategies' ISO 27001/SOC 2-certified validator node secures $4.37B in assets for the ETF's staking operations. - The ETF builds on existing $382M in inflows from competing Solana funds, signaling growing institutional demand for crypto exposure. - The partnership validates SOL Strategies' infrastructure capabilities and highlights rising interest in compliant staking solutions.

Investors Are Now Able to Buy and Sell Digital Shares of a Maldivian Resort Prior to Its Construction

- Trump Organization and Dar Global launch world's first tokenized hotel project in Maldives, using blockchain for real-time asset-backed token trading. - The 80-villa resort allows investors to buy digital shares during development, enabling fractional ownership and liquidity in luxury real estate. - This model democratizes access to high-end investments, building on Dar's 2022 Oman NFT experiment and Trump's crypto-focused corporate strategy. - Analysts predict $4 trillion in tokenized real estate by 203

CZ Shifts Focus to Collaboration as Cryptocurrency Faces Regulatory Turning Point

- Binance founder CZ received a Trump pardon after a 2023 $4.3B U.S. settlement, including $2.5B forfeiture and $1.8B fine. - CZ pledged to reinvest any potential refund into the U.S. economy, emphasizing gratitude amid political backlash over "pay-to-play" claims. - Legal experts clarify presidential pardons don't void corporate penalties, as Binance remains barred from U.S. customers under Treasury oversight. - Critics accuse Trump's administration of regulatory favoritism, while CZ's team denies crypto

Investors Rush to Acquire Mutuum Tokens Ahead of Price Increase

- Mutuum Finance (MUTM) targets Q4 2025 V1 launch, raising $18.8M in presale with 18,000 holders. - Token price surged 250% to $0.035 in Phase 6, nearing 99% allocation amid fixed-price presale competition. - V1 protocol introduces ETH/USDT liquidity pools, mtTokens, and liquidator bot on Sepolia testnet. - CertiK audit (90/100 score) and $50K bug bounty reinforce security, while 24-hour leaderboards boost community engagement. - Automated smart contracts eliminate intermediaries, positioning MUTM as a DeF