Government Shutdown, Employment Stagnation: Will the Crypto Market Soar Again on the Back of Liquidity?

Coinbase believes that a weaker US dollar, increased global liquidity, and the Federal Reserve's cautious rate-cutting policy will benefit the cryptocurrency market, with BTC potentially leading gains until November. The government shutdown has caused delays in economic data, making markets rely on private indicators and strengthening expectations for a dovish Fed. Once the liquidity gap factors subside, this could drive prices higher. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Impact of the U.S. Government Shutdown

Coinbase's outlook for the crypto market in October is tactically bullish: we believe that a weaker dollar, short-term global liquidity increases, and the Federal Reserve's cautious inclination towards rate cuts will create favorable conditions for the cryptocurrency market. Unless there is an unexpected hawkish statement, we believe these factors will increase the likelihood of BTC leading an upward trend until November, when liquidity headwinds may come into play.

What does the U.S. government shutdown mean for cryptocurrencies? The U.S. is currently in a partial government shutdown, which could delay the release of some key economic statistics that the Federal Reserve relies on for policy-making. Due to funding shortages, agencies such as the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) will suspend data collection and delay the release of major data—including the monthly employment report and the Consumer Price Index (CPI)—until funding is restored.

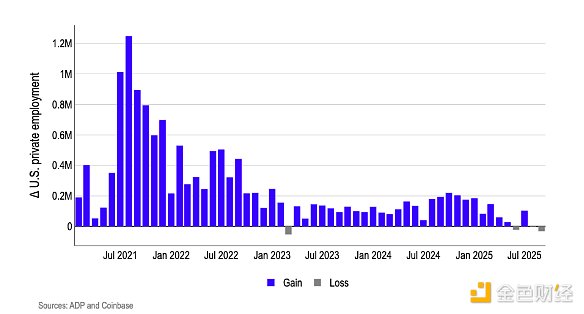

In the absence of official data releases, we believe the market will rely on private indicators such as ADP private sector employment data to gauge future rate cut expectations. ADP data shows that after years of deceleration (compared to over one million new jobs added per month in 2021), the current net job additions are essentially zero (Figure 1). We believe that the Phillips curve logic means that current employment weakness will shorten the channel for wage-driven services inflation, with a lag of about 10 months, reducing the cost of preemptively easing policy relative to the tail risk of a nonlinear labor market downturn.

Our view: Data uncertainty triggered by the government shutdown, combined with stagnation in private sector hiring, makes the market more optimistic about the Federal Reserve adopting a less restrictive policy path. It is also worth noting that multiple recent factors have jointly led to a temporary liquidity gap in the cryptocurrency market, specifically including: (1) the U.S. Treasury replenishing its General Account balance (which is now close to its target level, exceeding 800 billions USD); (2) quarter-end and month-end capital flows; (3) the "conference effect" brought by the Singapore TOKEN 2049 event. As these influences fade, there is hope for a positive boost to market price trends in the short term.

Figure 1. Monthly changes in U.S. private sector employment are at their lowest levels since 2023

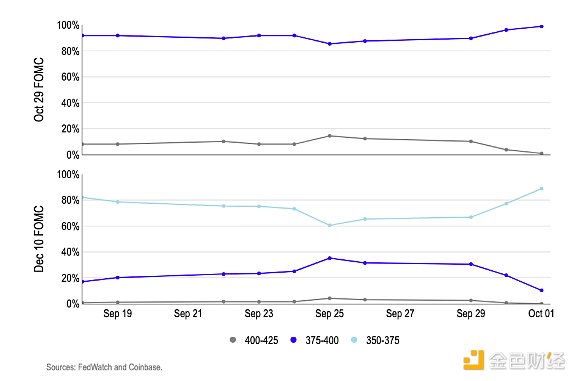

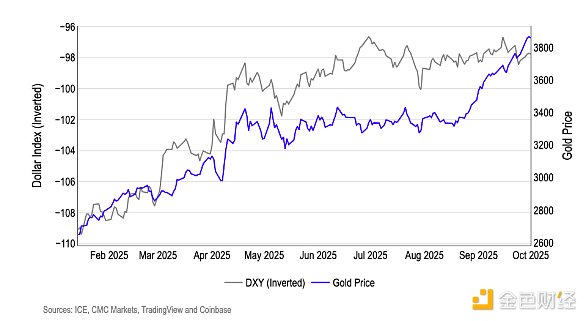

We believe the interest rate market has already priced in this shift—30-day federal funds futures currently reflect an 87% probability of two 25-basis-point rate cuts by year-end—cross-asset signals also confirm the mechanism of real rate cuts and a weaker dollar, which is favorable for cryptocurrencies (Figure 2). Currently, pricing for each successive FOMC meeting is concentrated in the 3.75-4.00% target range by the end of October, trending towards 3.50-3.75% by December. Meanwhile, the dollar is weakening and gold prices have hit record highs—this indicates that real rate expectations are easing and a broader "store of value" demand is emerging (Figure 3). We believe this combination will loosen U.S. dollar financial conditions and reduce the cash yield competition for risk assets, which should benefit cryptocurrencies.

Figure 2. The probability of two 25-basis-point rate cuts by year-end has reached 87%.

Figure 3. The dollar weakens, gold hits record highs

Can We Stop Talking About Gold?

In short, the answer is no, but the market seems to be struggling to explain why gold broke record highs in September while the price of bitcoin was sluggish last month. Part of the reason is that, although bitcoin's performance during periods of high inflation is inconsistent, many market participants and media commentators remain fixated on viewing bitcoin as an inflation hedge similar to gold. In reality, bitcoin often serves as a hedge against excessive monetary issuance, which is not exactly the same as inflation. This also explains why bitcoin often benefits from global liquidity injections.

In September, gold prices soared due to rate cuts by multiple central banks globally and market concerns over (1) the U.S. government shutdown and (2) potential damage to the Federal Reserve's independence. (That said, although the SPDR Gold ETF attracted 4.2 billions USD in inflows last month, U.S. spot bitcoin ETFs still saw a net inflow of 3.5 billions USD.) However, we believe this performance difference is not due to differences in institutional investor sentiment, but rather because bitcoin led the price trend in July and August. Therefore, bitcoin has continued to face selling pressure during technical rebounds, while liquidity has been drained from the market for the reasons mentioned above.

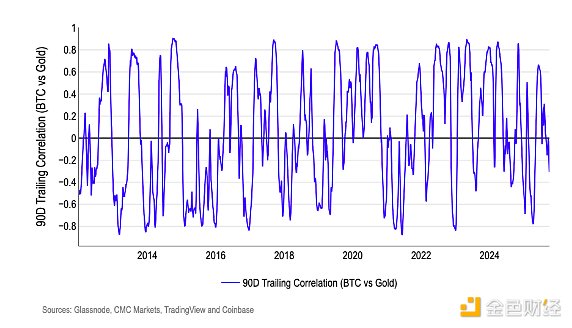

From a data perspective, we believe that gold indicators alone cannot serve as a strong indicator for bitcoin. Since 2013, the 90-day rolling correlation between BTC and gold has fluctuated dozens of times between two extremes (-0.8 to +0.8), showing short-term clustering volatility but lacking long-term persistence, indicating extremely weak average linkage (Figure 4). We believe that the common driving factor for positive linkage is enhanced liquidity: when real rates fall and the dollar weakens, both assets tend to absorb excess market liquidity. Conversely, when gold rises due to risk aversion while the dollar strengthens and liquidity tightens (as has been the case in recent weeks), BTC, as a high-beta risk asset, typically decouples or even moves inversely.

Our view: In fact, we believe liquidity is the most reliable macro signal for bitcoin, as evidenced by the approximately 0.9 correlation between our customized M2 global liquidity index and bitcoin over the past three years.

Figure 4. 90-day correlation between bitcoin and gold

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TheoriqAI Partners with OpenLedger to Build Accountable, Production-Ready DeFi AI Agents

Betting Shares Decline While NFL Prediction Wagers Rise on Gambling Platforms

Sui Blockchain’s Revolutionary Partnership with LINQ Transforms Crypto Access in Nigeria

Samourai Wallet Bitcoin Seizure: US Official Confirms Critical Policy Shift, Assets Remain Unsold