When the US Dollar Meets Bitcoin: The US Uses Stablecoins to Counter BRICS, Restarting the Global Monetary Order

The article discusses the challenges faced by the US dollar and the rise of stablecoins, highlighting that bitcoin, with its decentralized nature, has become the preferred choice in the global digital dollar revolution. It also analyzes the weakness of the US bond market and the impact of a multipolar world on the US dollar. Summary generated by Mars AI Model: The content produced by the Mars AI Model is still undergoing iterative updates, and its accuracy and completeness may not be fully guaranteed.

As the "GENIUS Act" consolidates the status of stablecoins backed by US Treasuries, bitcoin's decentralized network makes it a more suitable blockchain for global adoption, especially as it addresses the trend of declining demand for US bonds in a multipolar world.

As the world shifts from a US-dominated unipolar order to a multipolar structure led by BRICS countries, the dollar faces unprecedented pressure due to declining bond demand and rising debt costs. The passage of the "GENIUS Act" in July 2025 marks a bold US strategy to address this situation by legislatively recognizing stablecoins backed by US Treasuries, thereby unleashing massive overseas demand for US bonds.

The blockchains that carry these stablecoins will shape the global economy for decades to come. With its unparalleled decentralization, the privacy of the Lightning Network, and robust security, bitcoin stands out as the superior choice to drive this digital dollar revolution, ensuring lower conversion costs when fiat currencies inevitably decline. This article explores why the dollar must and will be digitized via blockchain, and why bitcoin must become its operational rail for the US economy to achieve a soft landing from its global empire status.

The End of a Unipolar World

The world is transitioning from a unipolar world order—where the US was the sole superpower able to sway markets and dominate global conflicts—to a multipolar world, where Eastern alliances can organize independently of US foreign policy. This Eastern alliance, known as BRICS, is composed of major countries such as Brazil, Russia, China, and India. The rise of BRICS inevitably leads to a geopolitical reshuffling, challenging the hegemony of the dollar system.

There are many seemingly isolated data points indicating this restructuring of world order, such as the US-Saudi Arabia military alliance. The US no longer defends the petrodollar agreement, which once stipulated that Saudi oil be sold only in dollars in exchange for US military defense in the region. The petrodollar strategy was a major source of dollar demand and has been considered key to US economic strength since the 1970s, but in recent years it has effectively ended—at least since the start of the Ukraine war, Saudi Arabia has begun accepting currencies other than the dollar for oil-related trade.

The Weakness of the US Bond Market

Another key data point in the geopolitical transformation of world order is the weakness of the US bond market, as doubts about the US government's long-term creditworthiness grow. Some worry about internal political instability, while others doubt whether the current government structure can adapt to a rapidly changing high-tech world and the rise of BRICS.

Elon Musk is reportedly among the skeptics. Musk recently spent months with the Trump administration, attempting to restructure the federal government and the country's finances through the Department of Government Efficiency, but abruptly exited politics in May.

Musk shocked the internet at a recent summit, saying: "I haven't been to Washington since May. The government is basically hopeless. I appreciate David Sacks' noble efforts... but ultimately, if you look at our national debt... if AI and robots can't solve our national debt problem, we're doomed."

If even Musk can't save the US government from financial doom, who can?

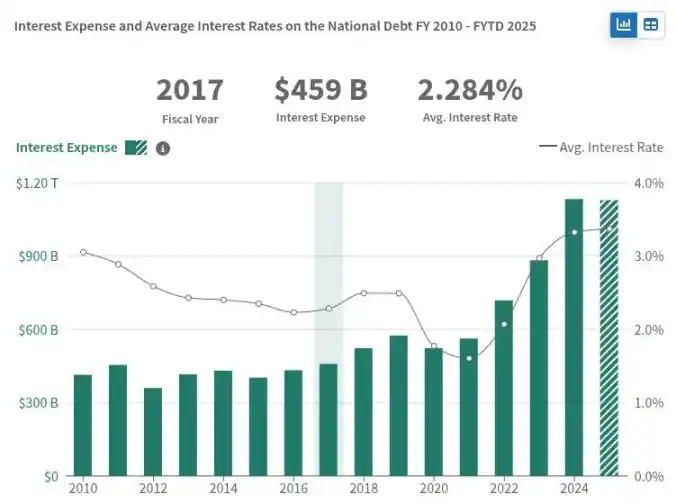

Such concerns are reflected in the low demand for long-term US bonds, which manifests as the need to raise interest rates to attract investors. Today, the yield on 30-year US Treasuries stands at 4.75%, a 17-year high. According to Reuters, demand for long-term bonds like the 30-year Treasury is also declining, with 2025 demand described as "disappointing."

The weakening demand for long-term US bonds has significant implications for the US economy. The Treasury must offer higher interest rates to attract investors, which in turn increases the interest the US government must pay on its debt. Today, US interest payments are approaching $1 trillion per year, exceeding the entire national military budget.

If the US fails to find enough buyers for its future debt, it may struggle to pay its immediate bills and be forced to rely on the Federal Reserve to purchase this debt, expanding its balance sheet and the money supply. While the effects are complex, it will likely lead to dollar inflation, further harming the US economy.

How Sanctions Devastated the Bond Market

Further weakening the US bond market was the US's manipulation of its controlled bond market to target Russia in response to its invasion of Ukraine in 2022. When Russia invaded, the US froze Russia's overseas Treasury reserves, which were intended to repay its sovereign debt to Western investors. Reportedly, to force Russia into default, the US also began blocking all Russian attempts to repay its debt to foreign bondholders.

A female spokesperson for the US Treasury confirmed at the time that certain payments were no longer allowed.

"Today is the deadline for another Russian debt payment," the spokesperson said.

"Starting today, the US Treasury will not allow any dollar debt payments from Russian government accounts at US financial institutions. Russia must choose whether to exhaust its remaining dollar reserves or new sources of income, or default."

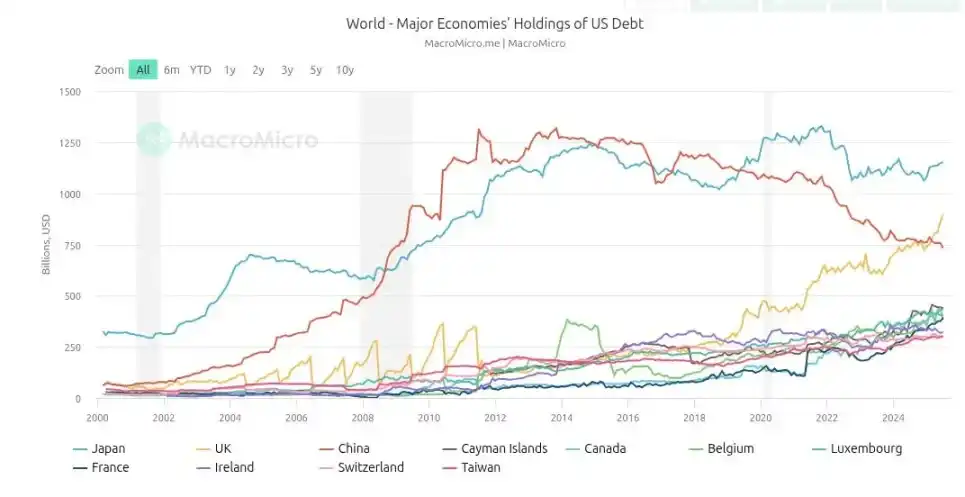

By using its foreign policy sanctions mechanism, the US effectively weaponized the bond market against Russia. But sanctions are a double-edged sword: since then, foreign demand for US bonds has weakened as countries at odds with US foreign policy seek to diversify risk. China has led this move away from US bonds, with its holdings peaking at over $1.25 trillion in 2013 and accelerating downward since the Ukraine war began, now nearing $750 billion.

While this event demonstrated the devastating power of sanctions, it also deeply damaged confidence in the bond market. Not only was Russia prevented from repaying its debt under Biden administration sanctions, but investors suffered collateral damage, and the freezing of foreign Treasury reserves sent a message to the world: if you, as a sovereign nation, defy US foreign policy, all bets are off—including in the bond market.

The Trump administration no longer uses sanctions as its main strategy, as they harm the US financial sector, and has shifted to a tariff-based foreign policy approach. These tariffs have had mixed results so far. While the Trump administration boasts record tax revenue and private sector infrastructure investment at home, Eastern countries have accelerated their cooperation through the BRICS alliance.

The Stablecoin Playbook

While China has reduced its US bond holdings over the past decade, a new buyer has emerged and quickly risen to the top of the power structure. Tether, a fintech company born in bitcoin's early days, now holds $171 billion in US bonds, close to a quarter of China's holdings and more than most other countries.

Tether is the issuer of the most popular stablecoin, USDT, with a circulating market cap of $171 billion. The company reported a Q1 2025 profit of $1 billion, with a simple yet excellent business model: buy short-term US bonds, issue USDT tokens backed 1:1, and pocket the US government's coupon interest. With 100 employees at the start of the year, Tether is said to be one of the most profitable companies per capita in the world.

Circle, the issuer of USDC and the second most popular stablecoin on the market, also holds nearly $50 billion in short-term Treasuries. Stablecoins are used worldwide, especially in Latin America and developing countries, as alternatives to local fiat currencies, which suffer from much worse inflation than the dollar and are often hindered by capital controls.

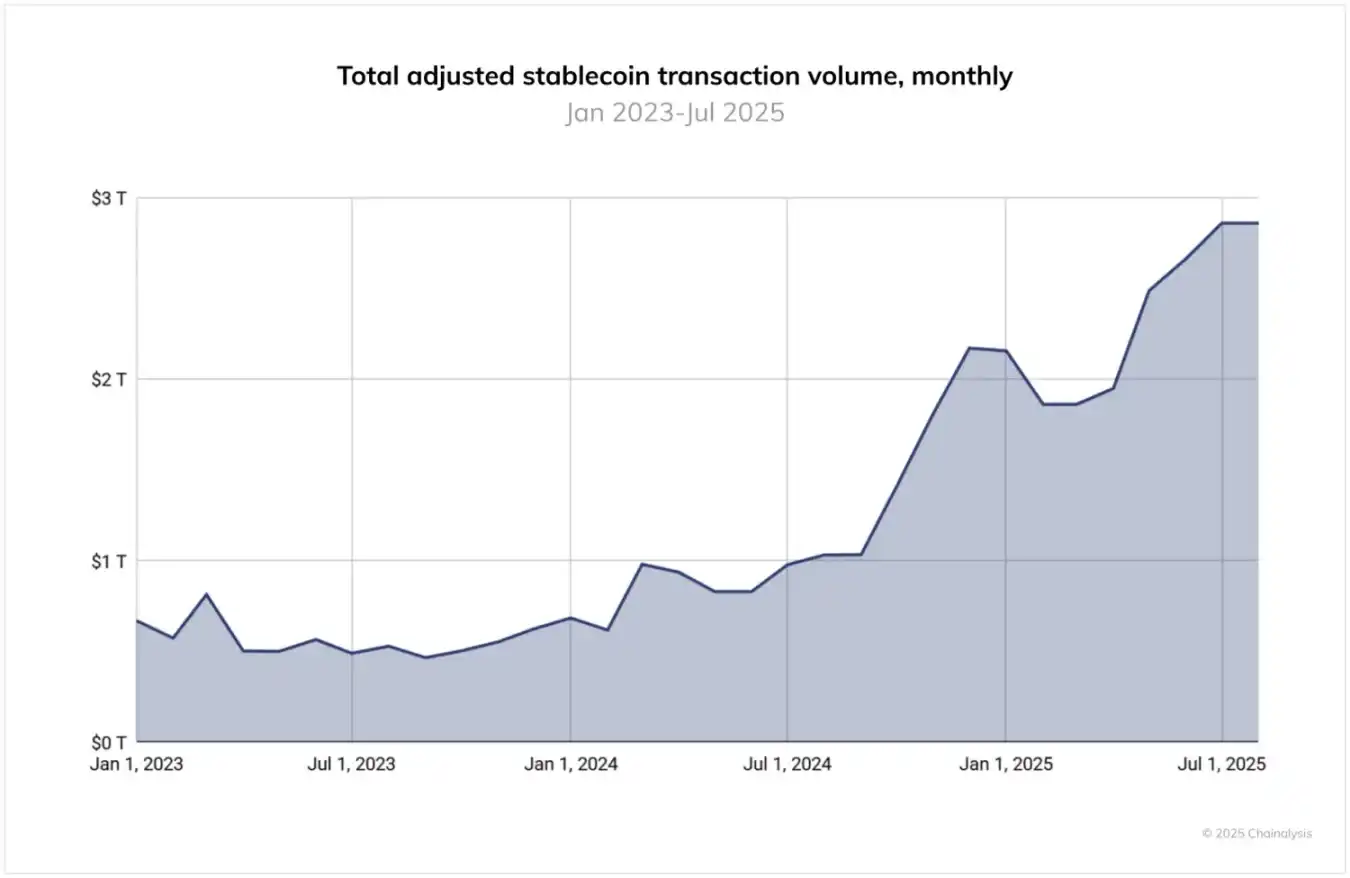

Today, stablecoin transaction volumes are no longer a niche, geeky financial toy—they have reached trillions of dollars. A 2025 Chainalysis report states: "Between June 2024 and June 2025, USDT processed over $1 trillion per month, peaking at $1.14 trillion in January 2025. Meanwhile, USDC's monthly volume ranged from $1.24 trillion to $3.29 trillion. These volumes highlight the continued central role of Tether and USDC in crypto market infrastructure, especially for cross-border payments and institutional activity."

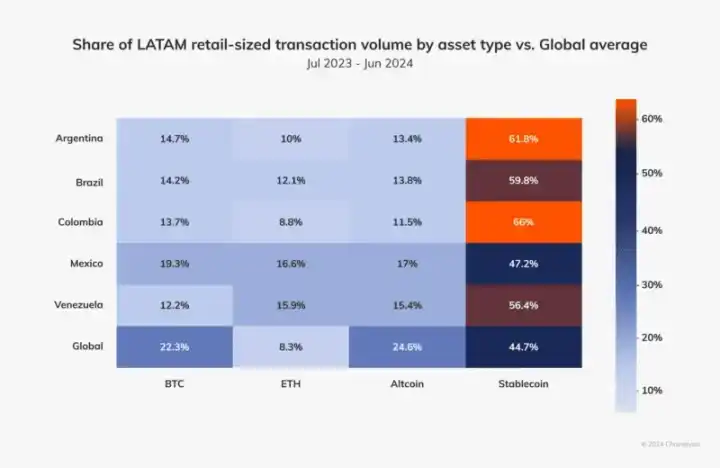

For example, according to a 2024 Chainalysis report focused on Latin America, the region accounted for 9.1% of total crypto value received between 2023 and 2024, with annual usage growth rates between 40% and 100%, more than 50% of which was stablecoins, demonstrating strong demand for alternative currencies in the developing world.

The US needs new demand for its bonds, and this demand exists in the form of demand for dollars, as most people in the world are stuck with fiat currencies far inferior to the US dollar. If the world shifts to a geopolitical structure that forces the dollar to compete on equal footing with all other fiat currencies, the dollar may still be the best among them. Despite its flaws, the US remains a superpower with tremendous wealth, human capital, and economic potential, especially compared to many small countries and their questionable pesos.

Latin America has shown a deep desire for dollars, but there are supply issues, as local countries resist traditional banking dollar channels. In many countries outside the US, obtaining a dollar-denominated account is not easy. Local banks are usually tightly regulated and answer to local governments, which have an interest in maintaining their pesos. After all, the US is not the only government that knows how to print money and maintain its currency's value.

Stablecoins solve both problems: they create demand for US bonds and can transmit dollar-denominated value to anyone, anywhere in the world.

Stablecoins leverage the censorship-resistant features of their underlying blockchains, a function local banks cannot provide. Thus, by promoting stablecoins, the US can reach untapped foreign markets, expand its demand and user base, and export dollar inflation to countries with no direct influence on US politics—a long-standing tradition in dollar history. Strategically, this sounds ideal for the US and is a simple extension of how the dollar has operated for decades, just built on new financial technology.

The US government understands this opportunity. According to Chainalysis: "The stablecoin regulatory landscape has changed significantly over the past 12 months. While the US 'GENIUS Act' has not yet taken effect, its passage has spurred strong institutional interest."

Why Stablecoins Should Surpass Bitcoin

The best way to ensure bitcoin helps the developing world escape mediocre fiat is to ensure the dollar uses bitcoin as its operational rail. Every dollar stablecoin wallet should also be a bitcoin wallet.

Critics of the bitcoin-dollar strategy will say this betrays bitcoin's libertarian roots—bitcoin was meant to replace the dollar, not enhance it or bring it into the 21st century. However, this concern is largely US-centric. It's easy to condemn the dollar when you're paid in dollars and your bank account is denominated in dollars. It's easy to criticize it when 2-8% dollar inflation is your local currency. In many countries outside the US, annual 2-8% inflation is a blessing.

A large portion of the world's population suffers from fiat currencies far worse than the dollar, with inflation rates from low double digits to high double digits, even triple digits. That's why stablecoins have already achieved mass adoption in the third world. The developing world needs to get off the sinking ship first. Once they're on a stable boat, they may start looking for ways to upgrade to the bitcoin yacht.

Unfortunately, although most stablecoins originally started on bitcoin, they do not run on bitcoin today, and this technical reality creates significant friction and risk for users. Today, most stablecoin volume runs on the Tron blockchain, a centralized network operated by Justin Sun on a handful of servers, making it easy for foreign governments that dislike dollar stablecoins spreading within their borders to target.

The blockchains that most stablecoins run on today are also completely transparent. Public addresses serving as user accounts are openly traceable, often linked to user personal data by local exchanges, and easily accessible to local governments. This is a lever foreign countries can use to counter the spread of dollar-denominated stablecoins.

Bitcoin does not have these infrastructure risks. Unlike Ethereum, Tron, Solana, etc., bitcoin is highly decentralized, with tens of thousands of nodes worldwide and a robust peer-to-peer network for transmitting transactions, easily bypassing any bottlenecks or obstacles. Its proof-of-work layer provides a separation of powers not found in other proof-of-stake blockchains. For example, Michael Saylor, despite holding a large amount of bitcoin (3% of total supply), has no direct voting power in the network's consensus politics. The same cannot be said for Vitalik and Ethereum's proof-of-stake consensus, or Justin Sun and Tron.

Additionally, the Lightning Network built on bitcoin unlocks instant transaction settlement, benefiting from the security of bitcoin's underlying blockchain. It also provides significant privacy for users, as all Lightning Network transactions are off-chain by design and do not leave traces on its public blockchain. This fundamental difference in payment methods allows users to enjoy privacy when remitting funds to others. The number of threat actors able to violate user privacy is reduced from anyone who can view the blockchain to a handful of entrepreneurs and tech companies, at worst.

Users can also run their own Lightning nodes locally and choose how to connect to the network, and many do, taking privacy and security into their own hands. These features are not seen in most blockchains used for stablecoins today.

Compliance policies and even sanctions can still be applied to dollar stablecoins, whose governance is anchored in Washington, using the same analytics and smart contract-based methods used today to prevent criminal use of stablecoins. Fundamentally, something like the dollar cannot be decentralized—after all, it is designed to be centralized. However, if most stablecoin value is transferred via the Lightning Network, user privacy can also be maintained, protecting users in developing countries from organized crime or even their local governments.

Ultimately, end users care about transaction fees and the cost of transferring funds, which is why Tron still dominates the market. However, with USDT launching on the Lightning Network, this may soon change. In a bitcoin-dollar world order, the bitcoin network will be the medium of exchange for the dollar, while the dollar will remain the unit of account for the foreseeable future.

Can Bitcoin Bear All This?

Critics of this strategy also worry that the bitcoin-dollar strategy may impact bitcoin itself. They wonder whether placing the dollar on top of bitcoin will distort its underlying structure. The most obvious way a superpower like the US government might try to manipulate bitcoin is by forcing it to comply with sanctions requirements, which theoretically could be done at the proof-of-work layer.

However, as mentioned above, the sanctions regime has arguably peaked, giving way to the era of tariffs, which attempt to control the flow of goods rather than funds. This post-Trump, post-Ukraine war shift in US foreign policy strategy actually relieves pressure on bitcoin.

As Western companies like BlackRock, and even the US government, continue to adopt bitcoin as a long-term investment strategy—or, in President Trump's words, as a "strategic bitcoin reserve"—they also begin to align with the future success and survival of the bitcoin network. Attacking bitcoin's censorship resistance would not only undermine their investment in the asset but also weaken the network's ability to deliver stablecoins to the developing world.

In a bitcoin-dollar world order, the most obvious compromise bitcoin must make is to give up the unit of account dimension of money. This is bad news for many bitcoin enthusiasts, and rightly so. The unit of account is the ultimate goal of hyperbitcoinization, and many users already live in that world today, making economic decisions based on the final impact on their satoshi holdings. However, for those who understand that bitcoin is the soundest money ever, nothing can truly take that away. In fact, belief in bitcoin as a store of value and medium of exchange will be strengthened by this bitcoin-dollar strategy.

Sadly, after 16 years of trying to make bitcoin as ubiquitous as the dollar as a unit of account, some realize that, in the medium term, the dollar and stablecoins are likely to fulfill that use case. Bitcoin payments will never disappear; companies led by bitcoin enthusiasts will continue to rise and should continue to accept bitcoin as payment to build their bitcoin reserves. But for the next few decades, stablecoins and dollar-denominated value are likely to dominate crypto trade.

Nothing Can Stop This Train

As the world continues to adapt to the rise of Eastern powers and the emergence of a multipolar world order, the US may have to make tough and critical decisions to avoid a prolonged financial crisis. In theory, the US could cut spending, pivot, and restructure to become more efficient and competitive in the 21st century. The Trump administration is certainly trying to do so, as shown by the tariff regime and other related efforts aimed at bringing manufacturing back to the US and cultivating local talent.

While several miracles might solve the US's fiscal woes—such as sci-fi-level labor and intelligent automation, or even the bitcoin-dollar strategy—ultimately, even putting the dollar on the blockchain won't change its fate: to become a collector's item for history buffs, a museum-worthy, rediscovered ancient empire token.

The dollar's centralized design and reliance on US politics ultimately doom its fate as a currency, but if we're realistic, its demise may not be seen for 10, 50, or even 100 years. When that moment truly arrives, if history repeats itself, bitcoin should be there as the operational rail, ready to pick up the pieces and fulfill the prophecy of hyperbitcoinization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.