- Pepe trades at $0.00001012 with 24h gains of 1.3%, approaching resistance at $0.00001016.

- Support is set at $0.059593 as charts show a converging breakout structure.

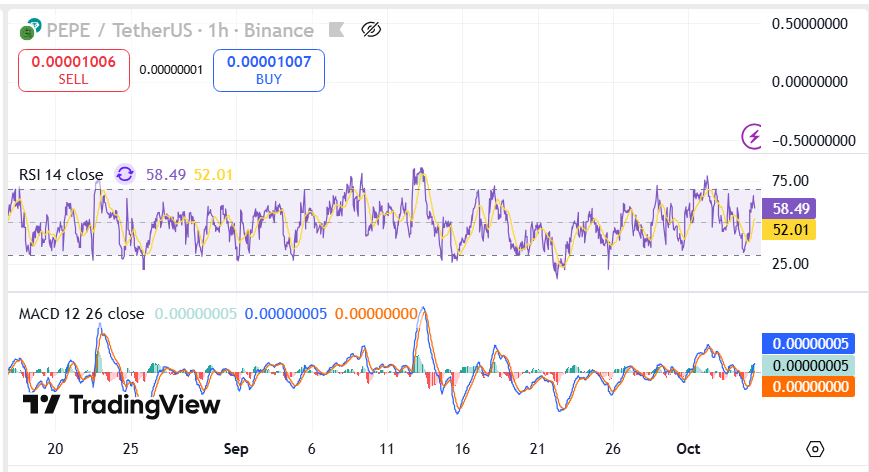

- RSI sits near 62, with MACD showing consolidation and neutral momentum.

The price of Pepe (PEPE) is trading at $0.00001012, representing an increment of 1.3% in the recent 24 hours. The token has been oscillating in a tight band and analysts are still tracking around the resistance level of about $0.00001016, which is currently being used as resistance. On the other hand, the support has been determined to be at $0.059593 where the market remains in an inconclusive zone. Late price action shows that there is a possible break out because the monthly chart shows a converging triangle pattern.

Resistance and Support Levels in Focus

The 24 hour trading range has been limited to either $0.00001012 or $0.00001016. The distance between price and resistance is a signal that things are tightening and that the traders are closely looking towards a decisive move. Support remains notable at $0.059593, suggesting that buyers have so far defended this zone against extended declines.

Alongside this, Pepe’s exchange data reflects broader interest . It has a token value of 0.0108116 BTC and 0.082206 ETH, which is an increase of 0.5% and 0.7% respectively when compared to the two popular cryptocurrencies. These two movements prove that the token has marginally done better than Bitcoin and Ethereum over the same period.

Technical Indicators Point to Consolidation

The Relative Strength Index (RSI) is 58.49 and the signal line is 52.27 on the one-hour chart. The range puts the RSI in the higher zone but not in the overbought range yet which supports the narrative of consolidation. The MACD (12,26) indicates weak divergence, with the values going around the neutral values. This indicates that momentum is contained for now, while volatility has compressed compared to earlier in September.

Source: TradingView

Source: TradingView

On the monthly timeframe, chart formations highlight a potential breakout structure. The converging trend lines show the price attempting to push upward toward the marked resistance at $0.000010221. The narrowing structure often reflects increasing market focus on a breakout point, though confirmation requires a close above the resistance line.

Market Context and Forward Watch

The data shows that current movements align with an extended consolidation. Importantly, the resistance level of $0.00001016 remains the first barrier to monitor. If sustained buying pressure continues, traders are likely to watch the upper boundary near $0.000010221.

Meanwhile, volume trends on the monthly chart show reduced activity compared to earlier peaks, further reinforcing the consolidation theme. With market participants awaiting clearer direction, the present levels serve as a critical zone where either upward momentum or renewed testing of support could unfold.