OCBC Bank raises its gold price forecast, expecting it to break through $4,000 in 2026

Heng Koon How, head of global economics and market research at Oversea-Chinese Banking Corporation, said that with the continued increase in global retail investment demand, there is no sign of gold's upward trend slowing down. Since breaking through $3500 per ounce technically, gold has continued to rise over the past month. He pointed out that strong safe-haven fund inflows driven by de-dollarization concerns are supporting the demand for gold ETFs, futures, and related investment products. All the key long-term bullish factors for gold - especially the further weakening of the US dollar and the continued increase in central bank allocations - remain solid. Coupled with the surge in retail investment interest, Oversea-Chinese Banking Corporation has further raised its gold price expectations, expecting it to break through $4000 per ounce by 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Protocol USPD Loses $1 Million in “CPIMP” Attack

TERRA Classic Price Prediction 2025, 2026 – 2030: Will LUNC Price Reclaim $0.0007?

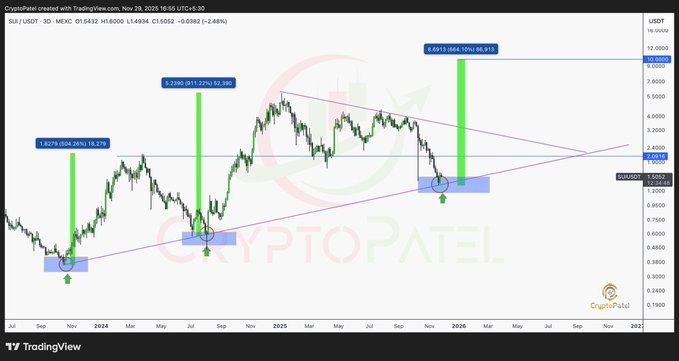

SUI Price Prediction: Is the New SUI ETF the Catalyst for a 500% Rally?

Polymarket Hiring Internal Team to Trade Against Its Own Users