October Decides the Outcome: Altcoin ETF Awaits Final SEC Verdict

The U.S. Securities and Exchange Commission (SEC) will make a final decision on at least 16 spot cryptocurrency exchange-traded funds (ETFs), with these applications involving various tokens beyond Bitcoin and Ethereum.

Original Title: "October Decides Everything: Altcoin ETFs to Face SEC's Final Verdict"

Original Author: 1912212.eth, Foresight News

In October 2025, the U.S. Securities and Exchange Commission (SEC) is set to make final decisions on at least 16 spot cryptocurrency exchange-traded funds (ETFs). These applications involve a variety of tokens beyond Bitcoin and Ethereum, such as SOL, XRP, LTC, DOGE, ADA, and HBAR. According to the latest developments, the SEC has withdrawn several delay notices and accelerated the approval process through new universal listing rules, shortening the review period to less than 75 days.

According to crypto journalist Eleanor Terrett, the SEC has requested issuers of LTC, XRP, SOL, ADA, and DOGE ETFs to withdraw their 19b-4 filings, as these documents are no longer necessary after the approval of the universal listing standards.

Since the approval of Bitcoin and Ethereum spot ETFs, there has been significant capital inflow, which has contributed to price increases. So, will these multiple ETFs be approved this time, and will there be a similar price surge effect?

The Final Deadline for Multiple Token ETFs Is in October

According to information compiled by Twitter user Jseyff, the final deadlines for several altcoin spot ETFs are spread throughout October. The first to be reviewed is Canary’s LTC ETF, with a deadline of October 2.

Next are Grayscale’s Solana and LTC trust conversions, with a deadline of October 10, and finally WisdomTree’s XRP fund, with a deadline of October 24.

According to a pending approval list created by Bloomberg ETF analyst James Seyffart, decisions may be made at any time before the final deadline.

These applications come from institutions such as Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton. Notably, BlackRock and Fidelity are not participating in this round, but this does not diminish the potential impact—if approved, these ETFs could pave the way for larger-scale products in the future.

Since the approval of BTC and ETH spot ETFs, no other cryptocurrencies have received SEC approval. The SEC has continued its usual practice of delaying these applications, but the upcoming final verdict will require the market to receive a definitive Yes or No decision.

The market is eagerly awaiting the outcome.

The approval or rejection of Litecoin and SOL, which will be decided first, may set the tone for market expectations going forward.

Approval Probability

At the end of July this year, the SEC’s new listing standards mainly focused on eligibility requirements and operational mechanisms for crypto ETPs. First, physical creation and redemption are now officially allowed, meaning authorized participants can exchange ETP shares with actual crypto assets instead of cash.

The SEC also announced listing standards for spot ETFs. The new standards, expected to take effect in October 2025, aim to simplify the ETF listing process. The "universal listing standard" requires that crypto assets must have been listed on futures markets of major exchanges such as Coinbase for at least six months. This rule is intended to ensure sufficient liquidity and market depth, and to prevent manipulation.

Litecoin, known as a long-established altcoin, is considered a prime candidate for early approval due to its maturity and non-security status. Litecoin founder Charlie Lee recently stated in an interview that he expects a spot LTC ETF to launch soon. This view is based on the SEC’s approval of universal listing standards for crypto ETFs and LTC being included as one of the ten assets that meet the criteria.

Charlie Lee discussed LTC’s prospects under the evolving regulatory framework in the interview. He mentioned that the SEC’s recent approval of universal crypto ETF listing standards is a key driver and emphasized that Litecoin meets the conditions for rapid approval.

As of now, the probability of a Litecoin spot ETF being approved this year has risen to 93% on Polymarket.

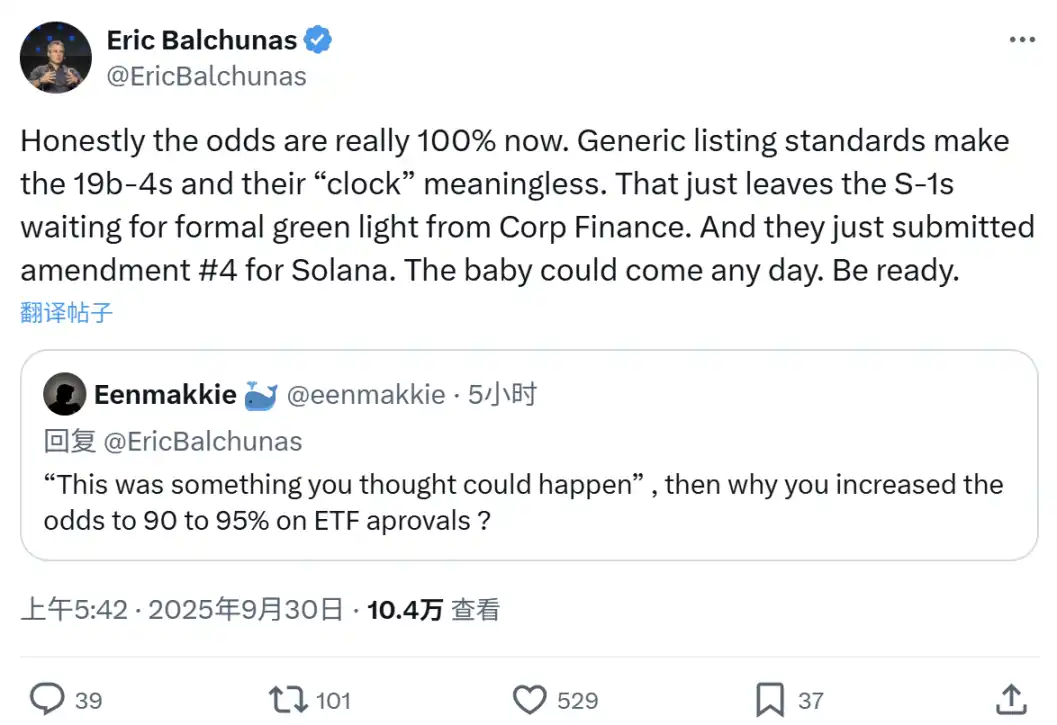

Regarding the SOL spot ETF, Bloomberg ETF analyst Eric Balchunas commented, "To be honest, the success rate for SOL spot ETF approval is now close to 100%. The universal listing standards have rendered the 19b-4 filings and their timelines meaningless. Now, only S-1 form matters. The baby could be born at any time, so be prepared."

It is worth noting that ADA is the last token awaiting a decision at the end of October, and the probability of its ETF being approved has also risen to 93% on Polymarket.

The SEC’s decision in early October will clearly serve as a market indicator.

Previously, the SEC approved the Hashdex Crypto Index ETF. Recently, the Hashdex Nasdaq Crypto Index U.S. ETF (NCIQ) added support for XRP, SOL, and XLM, allowing U.S. investors to gain exposure to BTC, ETH, XRP, SOL, and XLM through a single investment vehicle.

Earlier, the SEC approved the conversion of the Bitwise 10 Crypto Index Fund into an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

Will Approval Benefit Token Prices?

Bitfinex analysts previously predicted that the approval of crypto ETFs could trigger a new altcoin season or rally, as these approvals would provide traditional investors with more crypto investment exposure.

However, not all analysts agree with this view.

Bloomberg ETF analyst James Seyffart stated that the current market is experiencing an altcoin rally driven by digital asset financial companies (DATCO) rather than traditional token price increases. Seyffart pointed out that institutional investors prefer multi-crypto portfolio products over single altcoin ETFs. He emphasized that institutional funds are more inclined to gain crypto exposure through regulated products rather than directly holding tokens, and this structural shift could permanently change the pattern of altcoin price surges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A 6200-fold profit: Who is the biggest winner of Moore Threads?

On December 5, Moore Threads officially debuted on the STAR Market, opening at 650 yuan, which represents a 468.78% surge compared to its issue price of 114.28 yuan.

K-shaped Divergence in Major Asset Pricing: The Subsequent Evolution of "Fiscal Risk Premium"

Southwest Securities believes that the current market is in a dangerous and fragmented period driven by "fiscal dominance," where traditional macro logic has failed, and both U.S. stocks and gold have become tools to hedge against fiat currency credit risk.

"Shadow Fed Chair" Hassett speaks out: The Federal Reserve should cut rates next week, expected 25 basis points

Hassett stated in a media interview that the FOMC now appears more inclined to cut interest rates, and he expects a rate cut of 25 basis points.

Key Market Intelligence for December 5: How Much Did You Miss?

1. On-chain funds: Today, $55.7M flowed into Ethereum; $51.4M flowed out of Base. 2. Top gainers and losers: $OMNI, $FTN. 3. Top news: At 23:00 tonight, the US will release the annual Core PCE Price Index for September, with an expected 2.9%.