BTC Market Pulse: Week 41

Bitcoin has surged to a new all-time high near $125.5K, driven by renewed spot demand, record ETF inflows, and strong flows across derivatives markets.

Overview

Bitcoin has surged to a new all-time high near $125.5K, driven by renewed spot demand, record ETF inflows, and strong flows across derivatives markets. The rally reflects a decisive shift in sentiment, with capital rotating back into risk assets and confidence building across both institutional and on-chain participants.

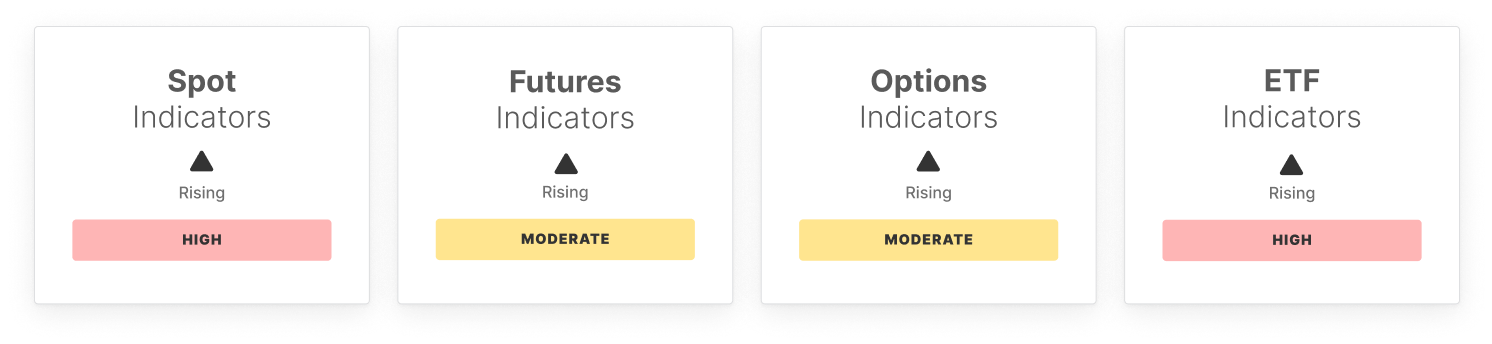

Spot demand has reaccelerated, with cumulative ETF inflows exceeding $2.2B and daily trade volumes surpassing $26B, highlighting renewed conviction among traditional investors. The sharp reversal from persistent outflows in September to record inflows in early October underscores the strength of renewed institutional appetite. This has coincided with improving liquidity conditions and renewed activity across both spot and derivatives venues.

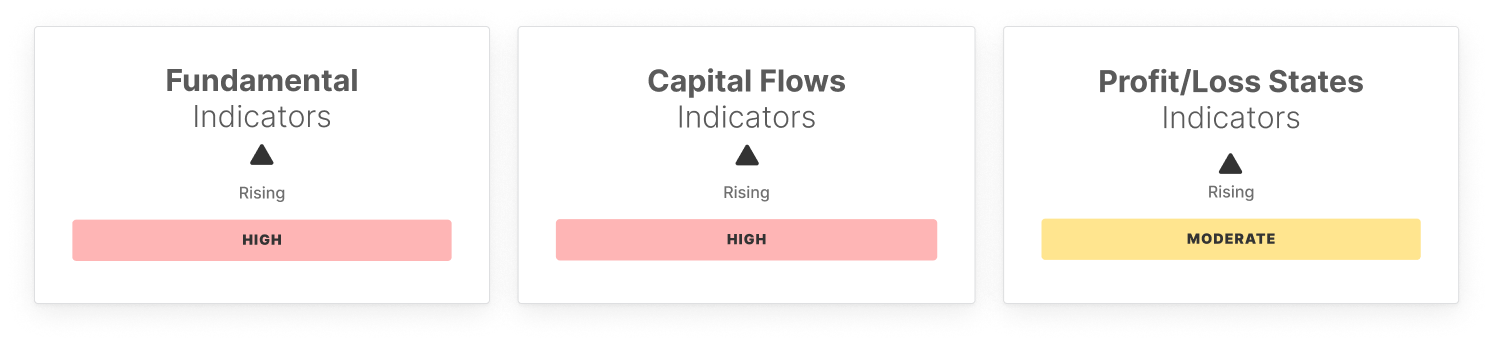

On-chain activity has strengthened meaningfully, with entity-adjusted transfer volumes up 39% and active addresses climbing 11%. These signals point to higher network utilization and organic demand growth. Profitability metrics remain robust, with 97% of supply now in profit and the Net Unrealized Profit/Loss Ratio rising to 5.7%, reflecting a market in clear profit dominance. While such conditions can invite near-term consolidation, the persistence of realized inflows and modest realized cap expansion suggest that profit-taking remains orderly.

Derivatives markets continue to validate this move. Futures open interest has risen 7.7% to $47.8B, signaling elevated speculative activity, while funding rates have turned decisively positive as traders increasingly pay to maintain long exposure. In the options market, the 25-delta skew has eased toward neutral, indicating a reduction in downside hedging demand and a tilt toward call buying. Volatility measures have also moderated, suggesting that the move higher is being absorbed efficiently rather than driven by panic short-covering.

In sum, Bitcoin’s new all-time high is underpinned by a synchronized expansion across spot, derivative, and on-chain markets. Improving liquidity, robust ETF inflows, and rising on-chain profitability highlight that this breakout is being supported by structural capital inflows and renewed investor participation, not speculative excess. The market enters Q4 on strong footing, with a foundation of genuine demand and a healthier balance between leverage, liquidity, and realized profitability.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: BTC Returns to 86,000, Trump’s Epic Showdown with Major Shorts, Macro Turmoil Just Settled

After last week's global market panic and subsequent recovery, bitcoin rebounded to $86,861. This week, the market will focus on new AI policies, the standoff between bears and bulls, PCE data, and geopolitical events, with intensified competition. Summary generated by Mars AI. The accuracy and completeness of this summary, produced by the Mars AI model, are still being iteratively improved.

At risk of being removed from the index? Strategy faces a "quadruple squeeze" crisis

Strategy is facing multiple pressures, including a significant narrowing of mNAV premiums, reduced coin hoarding, executive stock sell-offs, and the risk of being removed from indexes. Market confidence is being severely tested.

VIPBitget VIP Weekly Research Insights

How to plan a perfect TGE launch?

Most TGE failures are not due to poor products or inexperienced teams, but because their foundations were never prepared to face public scrutiny, competition, and shifts in narrative.