Date: Sun, Oct 05, 2025 | 03:58 AM GMT

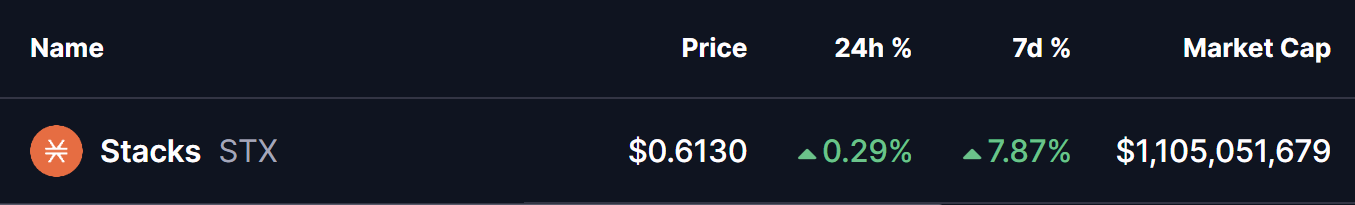

The cryptocurrency market is showing strength as the prices of both Bitcoin (BTC) and Ethereum (ETH) have surged over 13% in the past 7 days. Riding this resilience, several altcoins are starting to flash bullish signals — and Stacks (STX) is one of them.

STX has recorded a 7% weekly gain, but what makes it more interesting is its technical structure, which seems to be gearing up for a potential bullish breakout in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge in Play

On the daily chart, STX is carving out a falling wedge pattern — a setup often viewed as a bullish reversal structure that tends to appear near the end of prolonged downtrends.

During the recent correction, STX slipped toward $0.5550 after facing resistance at the wedge’s upper boundary. However, buyers stepped in to defend this key support level, sparking a rebound that has now pushed the token near $0.6123, moving closer to test the wedge’s resistance trendline.

Stacks (STX) Daily Chart/Coinsprobe (Source: Tradingview)

Stacks (STX) Daily Chart/Coinsprobe (Source: Tradingview)

This tightening wedge indicates that momentum is coiling up, with a decisive move likely on the horizon.

What’s Next for STX?

If bulls manage to push STX above the wedge resistance and reclaim the 200-day moving average (MA) at $0.7108, it would likely confirm a bullish breakout. A successful breakout could open the door for a rally toward the next key target near $0.8941, aligning with the wedge’s measured move projection.

On the other hand, if the breakout attempt fails, the token could once again revisit its wedge support before making another push higher.

For now, the setup suggests that STX is at a critical juncture — either preparing for a bullish breakout or heading for one final retest of its lower support zone.