3 Altcoins To Watch In The Second Week Of October 2025

SPX, Optimism, and Aptos are key altcoins to watch in mid-October. Each faces crucial support and resistance levels as token unlocks add volatility.

The crypto market is looking green for the coming few days as the US Government Shutdown is expected to continue. This could continue driving Bitcoin and altcoins’ prices up, which in turn could draw fresh capital from new investors.

BeInCrypto has analysed three such altcoins that show potential to make gains in the coming few days.

SPX6900 (SPX)

SPX is trading at $1.62, maintaining its position above the crucial $1.58 support level. The altcoin has surged nearly 62% over the past week, hitting a two-month high. This sharp rally reflects renewed investor interest.

Currently, SPX is about 41% away from retesting its all-time high of $2.29, achieved in late July. Technical indicators, particularly the exponential moving averages (EMAs), highlight sustained bullish momentum. If this strength continues, SPX could break through the $1.74 resistance level and potentially climb toward $2.00 in the coming sessions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SPX Price Analysis. Source:

SPX Price Analysis. Source:

However, market sentiment remains crucial to sustaining this rally. Should investors begin taking profits, SPX could fall below the $1.58 support. A deeper correction might push the price down to $1.39 or lower, undermining bullish momentum and signaling a temporary reversal in the altcoin’s upward trend.

Optimism (OP)

Optimism is preparing for a major token unlock this week, with 4.47 million OP tokens worth more than $3.28 million entering circulation. Historically, such events often trigger selling pressure, leading to potential short-term downside. Traders are watching closely as the increase in supply could temporarily weigh on OP’s price.

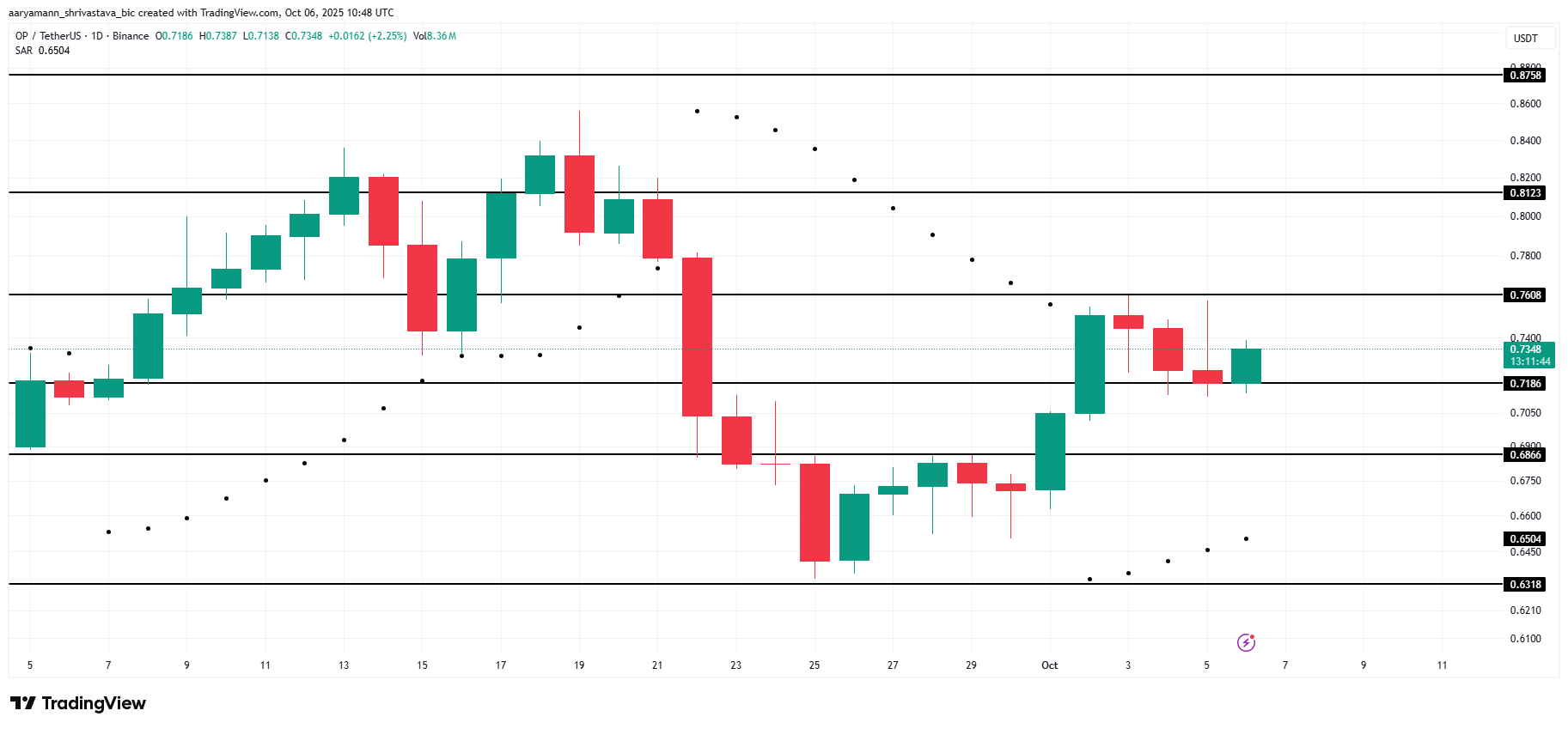

Despite the potential sell-off, technical indicators offer mixed signals. The Parabolic SAR positioned below the candlesticks indicates that OP may maintain its consolidation between $0.76 and $0.71. This pattern suggests that buyers still hold some control, keeping volatility limited as the market absorbs the new token influx.

OP Price Analysis. Source:

OP Price Analysis. Source:

However, if bearish sentiment strengthens after the unlock, Optimism’s price could break below the $0.71 support level. A deeper correction might drive OP down to $0.68 or even lower. Such movement would invalidate the short-term bullish outlook and highlight the token’s sensitivity to market supply dynamics.

Aptos (APT)

Aptos is set for a significant token unlock this week, with 11.31 million APT worth nearly $60 million entering circulation. Such events often introduce short-term volatility as supply increases, which could slow APT’s upward momentum and trigger selling pressure.

Despite this, Aptos has delivered strong performance, rising 24% in the past week to reach $5.31 — its highest level in two months. The Chaikin Money Flow (CMF) indicates growing capital inflows, signaling investor confidence. If buying continues, APT could push past $5.50 and $5.73 despite the unlock event.

APT Price Analysis. Source:

APT Price Analysis. Source:

However, the bullish outlook depends on sustained investor participation. If inflows diminish, APT could face challenges maintaining its current strength. A drop below $5.06 might lead to a deeper correction toward $4.79, effectively invalidating the bullish scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.