Federal Reserve's Schmid: Interest rates are "appropriately adjusted," focus should be on inflation risks

Jinse Finance reported that Kansas City Federal Reserve President Schmid said on Monday that he is inclined not to cut interest rates further, stating that when the Federal Reserve seeks a balance between the dual risks of overly tight and overly loose policy, it should continue to focus on the risk of excessively high inflation. Schmid supported the Federal Reserve's decision to lower interest rates by 25 basis points in September, calling it appropriate risk management against the backdrop of a cooling labor market. However, he pointed out that various indicators show the overall job market remains healthy, while inflation is still too high, with service sector inflation stabilizing at around 3.5% in recent months, far above the Federal Reserve's 2% inflation target. "A worrying sign is that the range of price increases is also expanding," Schmid said, noting that as of August, nearly 80% of categories in official inflation statistics saw price increases, up from 70% at the beginning of the year. He added, "Overall, I expect the impact of tariffs on inflation to be relatively moderate, but I believe this indicates that policy has been appropriately calibrated, rather than suggesting a significant reduction in policy rates is warranted." (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik: We need an on-chain gas futures market

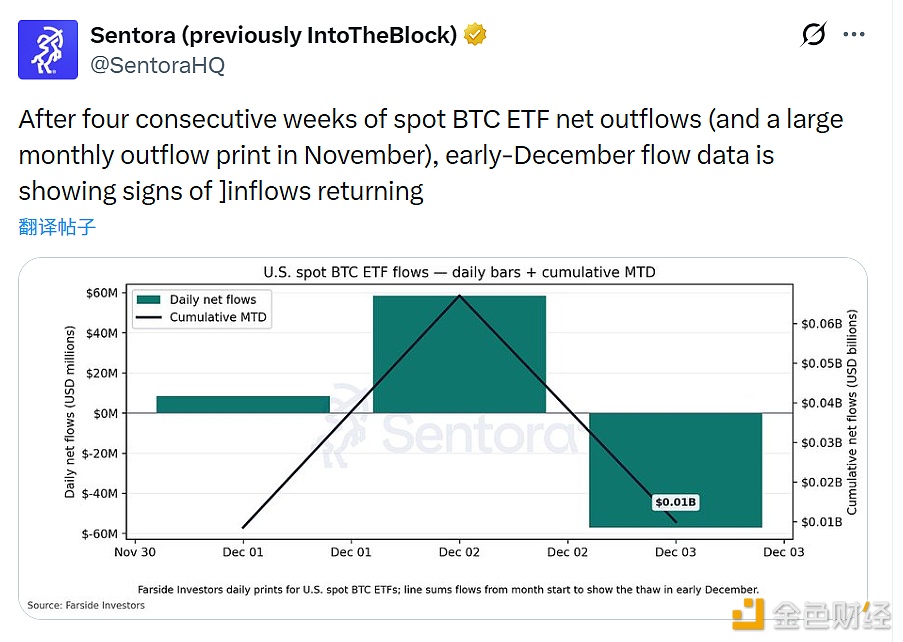

Bitcoin spot ETF fund flows in early December show signs of inflows recovering