Glassnode Co-Founders Say Bitcoin Flashing Major Momentum Signal, Detail Timeline for Bull Market Top

The co-founders of the analytics firm Glassnode say the bull market top for Bitcoin ( BTC ) is in sight.

Jan Happel and Yann Alleman, who go by the pseudonym Negentropic, tell their 63,900 followers on X that traders shorting Bitcoin right now will likely absorb losses.

According to the Glassnode co-founders, BTC is flashing signals witnessed exactly a year ago that drove Bitcoin to breach $100,000 for the first time ever.

“Our major momentum signal is in and accelerating deployment.

Last time this happened was October 2024, things about to heat up.

Bottom Confirmation with aggregated impulse.

BTC Trend and reversal confirmation with systematic strategies.

ETH systematic signals will be next, once BTC goes over all-time highs (ATHs).

If you are shorting this move, you are out of your mind.”

While the pair is bullish on Bitcoin and altcoins, they warn that the end of crypto’s bullish phase is on the horizon.

“There is a good chance BTC tops out in 4-5 weeks, and alts in 6-8 weeks.”

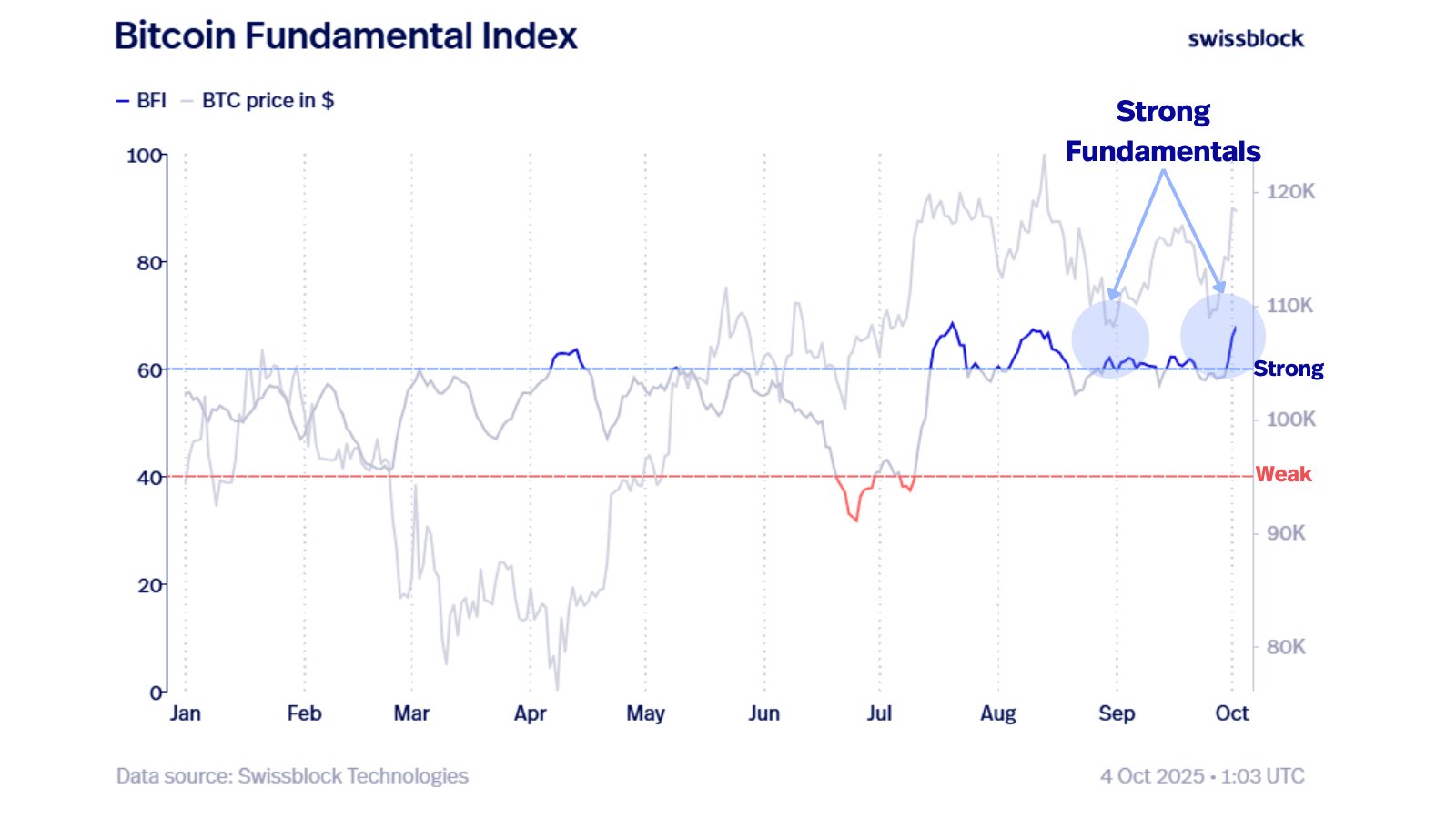

Meanwhile, analytics firm Swissblock says strong fundamentals are carrying BTC to new all-time high levels.

“Now, with Bitcoin trending into the ATH zone, it’s clear: fundamentals were the launchpad. Liquidity and network growth built the base, turning a bearish setup into the foundation of the current bullish trend. The lesson: when price and sentiment diverge from fundamentals, it often marks structural inflection points.”

Source: Swissblock/X

Source: Swissblock/X

At time of writing, Bitcoin is trading at $124,144, very close to its all-time high of $125,782.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: S&P Rating Drop Highlights Tether’s Risky Asset Holdings and Lack of Transparency

- S&P downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% BTC exposure exceeds overcollateralization margins, risking undercollateralization if prices drop. - CEO dismisses critique as traditional finance bias, claiming no "toxic" assets in reserves. - Regulators intensify scrutiny as stablecoin centralization risks emerge amid $184B USDT circulation. - S&P urges Tether to reduce risky assets and enhance reserve disclosure to rebuild trust.

Dogecoin Latest Updates: Is a Repeat Performance on the Horizon? Holding $0.15 May Signal a 611% Rally for Dogecoin

- Dogecoin (DOGE) stabilized near $0.15 support, triggering historical 611% rally potential to $1 by 2026. - Grayscale's GDOG ETF and pending Bitwise BWOW ETF mark institutional adoption, though initial inflows remain muted. - Technical indicators show mixed momentum with RSI near oversold levels and key resistance at $0.16. - Market remains divided as ETF-driven liquidity and on-chain infrastructure contrast with macroeconomic and regulatory risks.

Turkmenistan’s Approach to Cryptocurrency: Centralized Oversight Amidst a Decentralized Age

- Turkmenistan legalizes crypto trading under strict 2026 regulations, granting state control over exchanges, mining , and custodial services. - Law mandates KYC/AML compliance, bans traditional banks from crypto services, and classifies digital assets into "backed" and "unbacked" categories. - Central bank gains authority to operate state-monitored distributed ledgers, contrasting with decentralized approaches in South Korea and Bhutan. - Framework aims to balance innovation with oversight, testing Turkme

Bitcoin News Update: Has $162 Billion Left Crypto Due to Institutional Buying or a Broader Market Pullback?

- BlackRock deposited 4,198 BTC and 43,237 ETH into Coinbase amid crypto sell-offs, despite $355.5M Bitcoin ETF outflows. - A 1.8M BTC ($162B) overnight exchange withdrawal sparks speculation about institutional accumulation or portfolio rebalancing. - $40B in BTC/ETH exchange inflows and record $51.1B Binance stablecoin reserves highlight institutional demand for regulated crypto products. - On-chain data shows 45% of large deposits (≥100 BTC) and 1.8M BTC withdrawals, indicating mixed market sentiment ah