BlackRock Makes Massive $969.7M Bitcoin Purchase

BlackRock created headlines when it went out and purchased a whopping $969.7 million worth of Bitcoin. This was another institutional boost for crypto and investors and market watchers alike are calling it a semi-seismic event that has partially aligned with other recent large purchases by whale Bitcoin holders.

This purchase is significant not only because BlackRock has confidence in the future of Bitcoin, but because it is a continuation institutional interest in crypto. The market may be about to shift, with whales still buying, and retail traders beginning to notice.

The scale of this purchase emphasizes that major institutions now view Bitcoin as a key portfolio asset. The move also underlines the importance of understanding market patterns and whale behavior, as these signals can affect Bitcoin’s price trajectory significantly.

🚨 BREAKING:

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) October 7, 2025

BLACKROCK BOUGHT $969.7 MILLION WORTH OF $BTC TODAY

WHALES KEEPS BUYING! 👀 pic.twitter.com/vuynZmwM6t

Why BlackRock Bitcoin Purchase Matters Now

BlackRock’s acquisition of Bitcoin is not merely a headline, it is a strong indicator of institutions’ renewed confidence in the crypto market. The purchase of approximately $970 million worth of Bitcoin in one day shows how strongly institutions are supporting the asset class and their rated confidence of the future of that asset class.

When companies like BlackRock make moves into Bitcoin as an asset class, they lend credibility and liquidity to the market. Their actions initiate engagement and movement among other institutions and retail traders that can have ripple effects through crypto exchanges.

Equally important, BlackRock’s acquisition highlights how we have moved from entities and institutional investors simply wanting to speculate with Bitcoin, to now adding Bitcoin as an asset class into traditional institutional portfolios as a mainstream investment investment.

The Role of Bitcoin Whales in Market Trends

When substantial purchasers or organizations acquire considerable amounts of bitcoin, this is typically referred to as whale buying. Purchases of this size can greatly influence price movements and market sentiment. BlackRock’s purchase could have brought other whales out of hiding, resulting the observation of whale buying in a wave-like fashion in the exchanges. This type of activity can create pressure on upward price movements of bitcoin, forward buyers hoping to ride the whale momentum and traders can interpret these actions as favorable signals. Moreover, following whale activity is useful when considering the potential behavior of the markets in the future. Any time there is institutional activity like when BlackRock purchased bitcoin, there is effectively a show of institutional confidence in the long-term potential of growth in bitcoin.

Institutional Crypto Investment is Reshaping the Market

Institutional cryptocurrency investment has transitioned from tentative exploration to real allocation within portfolios. Today, companies view Bitcoin as a hedge against inflation and volatility in markets.

Furthermore, institutions bring more advanced risk management and trading principles. Even an investor’s interpretation of inflated price increases can be advantageous when considering the context of circumstances that may see price deterioration. Institutions and fund managers can withstand volatility in a manner that retail traders can not, and can have the capacity to make calculated investment ideas that can endure over time.

Future Implications for Bitcoin and the Market

The BlackRock bitcoin purchase is likely to spur a domino effect in the crypto realm (more institutional interest greatly stabilizes Bitcoin’s market and lowers extreme volatility over time). As institutional interest in bitcoin and crypto increases, we could see a rise in trading volume and a more robust ecosystem with a higher level of investor confidence, helping move other cryptocurrencies to extremely mainstream investment portfolios.

The impact that whale buying (large bitcoin purchases) has already caused is inflection point (a point that we could suggest Bitcoin has entered a more matured stage in the cryptocurrency ecosystem); bitcoin investors should expect to see bitcoin continue to grow larger strategic purchases made by firms such as BlackRock.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation Spike: Systemic Threats and Institutional Investor Responses in 2025

- 2025 Bitcoin leverage liquidations exposed systemic risks across DeFi, institutional portfolios, and traditional markets, triggered by macroeconomic tightening and regulatory uncertainty. - Institutions accelerated adoption of AI-driven risk frameworks, with 72% implementing crypto-specific strategies post-crisis to mitigate cascading losses. - MicroStrategy's 60% stock collapse and $3.5B Bitcoin ETF outflow highlighted cross-market contagion, while hedging tools helped institutions navigate volatility.

Bitcoin Price Fluctuations and Institutional Involvement in Late 2025: Optimal Timing for Long-Term Investment

- Bitcoin's 2025 volatility dropped to 43% amid $732B inflows and institutional-grade infrastructure maturing. - Regulatory clarity (MiCA/GENIUS Act) and $115B ETF assets (BlackRock/Fidelity) normalized crypto in institutional portfolios. - $90K price near Fibonacci support zones reflects technical strength and improved liquidity from tokenized assets. - Vanguard's $9T Bitcoin access and Fed policy shifts reinforced crypto's transition from niche to $4T mainstream asset class.

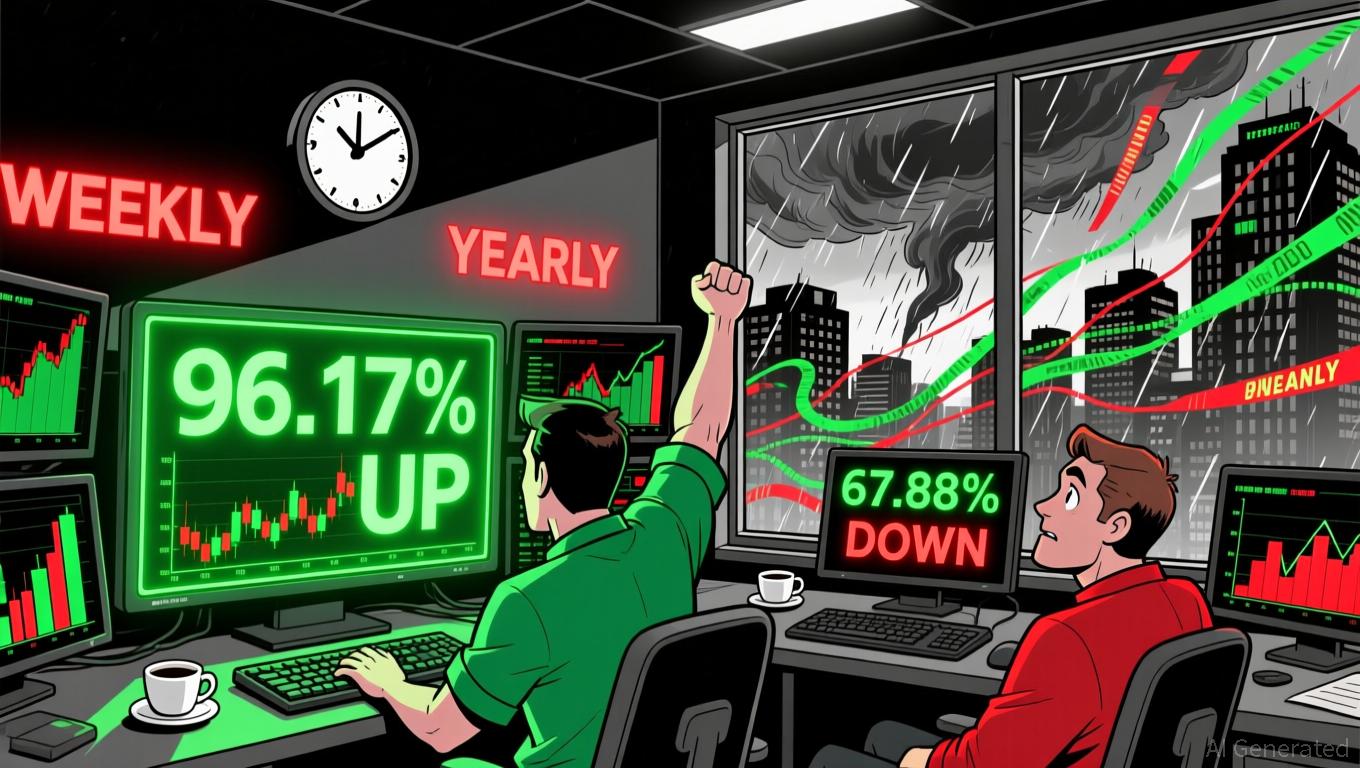

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to