Vitalik Buterin Backs ZK Secret Voting as $10 Billion Market Looms

Ethereum co-founder Vitalik Buterin has called for zero-knowledge (ZK)–based secret-ballot voting to shield judges and officials from retaliation after a U.S. court fire case drew attention to rising political threats. Analysts project the ZK proving market to reach $10.2B by 2030, as privacy-first governance gains traction worldwide.

Ethereum co-founder Vitalik Buterin has called for the use of zero-knowledge (ZK) cryptography to enable secret-ballot voting in governance and judicial systems. He said anonymity can help protect judges and lawmakers from retaliation.

His comments came after a tense case in South Carolina. Circuit Court Judge Diane Goodstein’s house burned down following weeks of threats linked to her election-related ruling. The incident reignited debate over public safety and judicial independence.

Vitalik Calls for Secret Governance Voting

Buterin argued that “in an era of easy physical retaliation,” anonymity should extend to judges, lawmakers, and international bodies such as the UN General Assembly.

Investigators have stated there is no sign of arson, according to a report. The investigation, however, remains active as authorities continue to gather evidence.

Statement of Vitalik | Farcaster

Statement of Vitalik | Farcaster

“One of my more radical beliefs is that many more classes of governance actions should be anonymous or secret ballot. I’ve advocated for secret-ballot UN General Assembly votes before.”

“This situation is a good argument for judges’ identities being hidden when they make their rulings. The function of a judge is to rule according to the facts as interpreted through their conscience, not to be ‘accountable’ to violent mobs.”

— Vitalik Buterin

Market Growth and Ethical Debate

Zero-knowledge proofs—cryptographic systems that prove a statement without revealing the underlying data—first gained widespread use in blockchain applications, particularly for enhancing privacy and scalability. Today, they are moving into governance. ZK proofs can verify voter eligibility and audit results without exposing identities. This “verify without trust” concept now supports digital identity, finance, and even regulatory compliance.

Aligned.co has forecast that the ZK proving market could reach $10.2 billion annually by 2030. The firm projects roughly 87–90 billion proofs per year, with an average cost per proof of $0.12. As computing hardware improves, ZK systems may process 83,000 transactions per second—nearly matching Visa’s speed. This growth shows ZK’s potential to become enterprise-grade infrastructure.

BeInCrypto has reported on the fundamentals of ZK technology, reported Buterin’s criticism of misleading “ZK-washing,” and reported on new ZK-based voting tools that preserve anonymity while proving eligibility.

Supporters say anonymous voting could discourage intimidation and protect judicial independence. They note that secrecy already exists in jury deliberations and papal elections. However, critics warn that too much anonymity could weaken oversight and reduce public trust in institutions. Therefore, the challenge is finding a balance between safety and transparency.

Buterin has also cautioned that “one-person-one-ID” systems—though ZK-protected—might still enable coercion if centralized. He instead promotes “pluralistic identity” models, where multiple decentralized issuers share verification authority to prevent abuse.

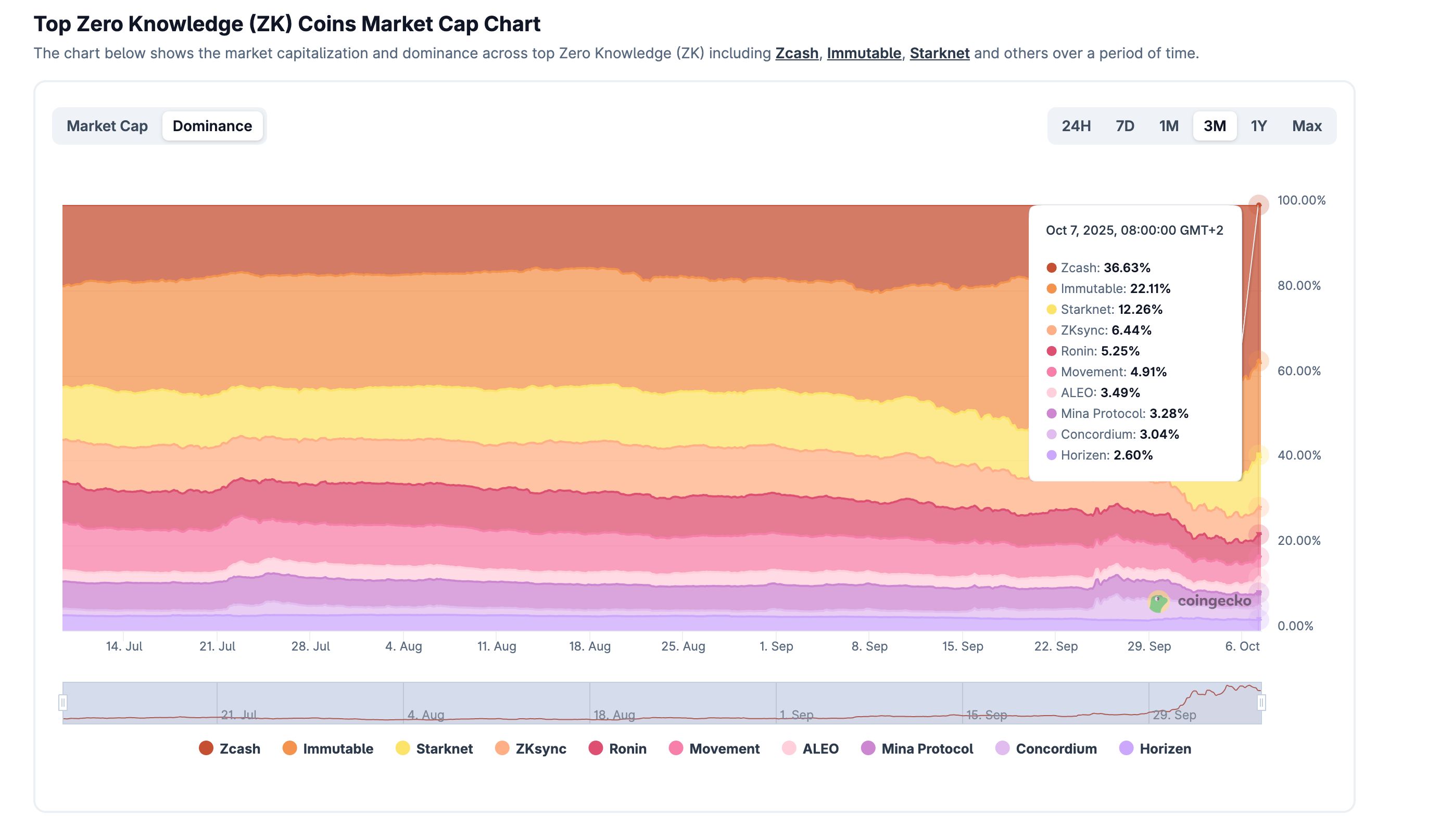

Top Zero Knowledge (ZK) Coins Market Cap Chart | CoinGecko

Top Zero Knowledge (ZK) Coins Market Cap Chart | CoinGecko

The broader Zero Knowledge (ZK) sector currently holds a market capitalization of $8.45 billion, reflecting a slight 0.2% decline in the past 24 hours, according to CoinGecko data. Despite the marginal drop, the segment remains one of the fastest-growing niches in blockchain infrastructure, driven by demand for privacy-preserving and scalable computation.

Overall, the debate shows how ZK cryptography is evolving from a blockchain scaling tool to a civic safeguard. As policymakers and developers explore these systems, stronger transitions from privacy to accountability will define the next phase of digital governance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Record Outflow on Solana ETFs, 21Shares' TSOL Crypto ETF Loses $42M in Record Time

$93.5K Rejection Adds To Bitcoin's Technical Woes

MSCI Exclusion Shock: JP Morgan Reveals Why Strategy’s Downside is Now Limited